The Path to $200/oz Silver

While the country enjoyed the extended Thanksgiving break, silver quietly experienced a major surge.

The precious metal climbed sharply on Friday, jumping nearly $4 to about $55 per ounce—a new record high.

Curiously, amid this dramatic spike, the CME futures exchange was completely offline. The cause was reportedly a cooling malfunction at a data center, though the timing raised some eyebrows.

Many investors in precious metals suspected this might be a deliberate effort to temper the rapidly heating silver market.

We’ve discussed before the whispers about large banks holding enormous short positions in silver, numbering in the billions. It’s difficult to confirm these claims, but there’s reason to believe some truth exists here.

This remains speculative. However, if major entities were heavily short and influential enough to halt the COMEX to suppress the rally, their objective ultimately failed.

Because by the following day, silver surged another $4, hitting $59 per ounce—setting yet another record.

The ongoing short squeeze is almost certainly fueling this rally, but solid fundamental trends are also driving demand.

Solar Drains Silver Supplies

Silver stands as the most efficient electrical conductor known, outperforming even copper by a large margin. When top performance is essential, silver remains unmatched.

It’s indispensable in areas like solar energy and electric vehicles.

Although both industries have seen growth recently, solar energy has emerged as a significant new driver of silver demand.

A recent Reuters report provides a clear summary of silver’s outlook linked to solar:

Industrial demand rose to 689.1 million ounces in 2024 from 644 million the prior year, according to LSEG data.

Of this, 243.7 million ounces was for use in solar panels, up from 191.8 million the prior year and up 158% from the 94.4 million in 2020.

Global solar capacity additions were about 600 gigawatts (GW) in 2024, and are expected to rise to close to 1,000 GW by 2030.

The International Energy Agency expects 4,000 GW of new solar capacity will be installed from 2024 to 2030.

This suggests that solar alone is going to drive silver demand higher by close to 150 million ounces a year by 2030, which would represent an additional 13% on top of the 2024 physical demand of 1.169 billion ounces.

Clearly, solar is already a major consumer of silver, and this trend appears set to expand significantly in the near future. China is rapidly increasing its solar installations, absorbing a growing share of new silver supplies.

Meanwhile, in the U.S., solar also serves as a critical, fast-growing energy source for expanding data centers proliferating across the country.

Investment Demand Returns

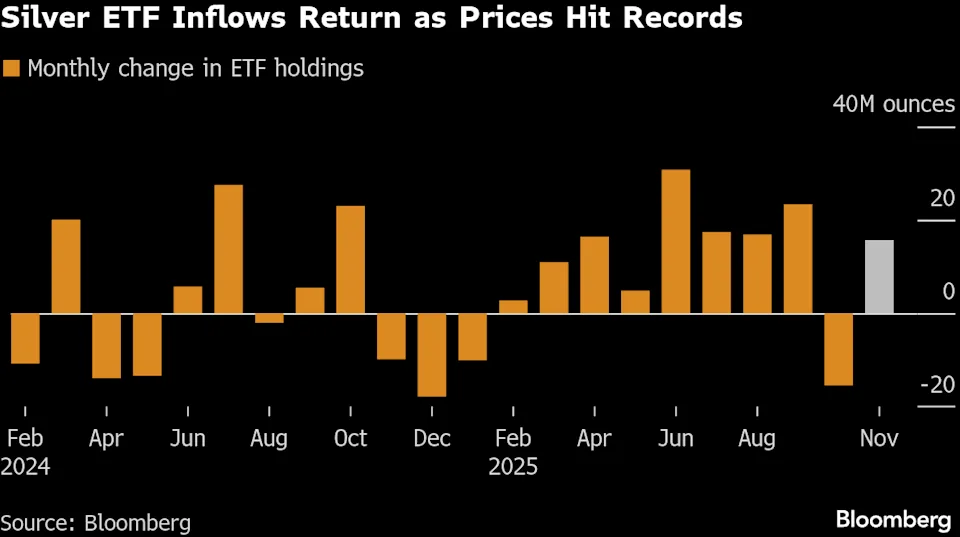

From February through September, silver bullion ETFs such as SLV and PSLV attracted steady inflows from investors.

However, in October, this trend reversed as we witnessed the first major pullback in a while.

Source: Bloomberg

The chart above reveals Bloomberg’s expectation of a significant rebound in silver ETF buying during November. This bodes well, since even moderate additional investment interest, combined with soaring industrial demand, can lead to sharp price increases. Signs of that are already emerging.

Higher prices will draw increased attention and buyers, sparking a fresh investment cycle. This dynamic will likely intensify the short squeeze. Exciting developments seem likely to unfold soon.

Gold:Silver Ratio – Still Further to Fall

Back in April, both gold and silver experienced their first substantial correction this year. On April 4th, I published a piece titled Bathwater, Baby, and Silver, advising readers to seize the dip.

At that time, the gold:silver ratio reached an absurd 102. Silver traded near $29.65, while gold hovered around $3,024.

Since then, the ratio has decreased to 73 ($59 silver vs $4,300 gold), yet remains elevated compared to historical averages. The graphic below illustrates the gold:silver ratio over time.

Source: MakeGoldGreat

In 2011, the ratio fell as low as 30 ($50 silver vs $1,500 gold). I am confident we will revisit at least that level during this cycle—possibly even reaching 20.

If the ratio returns to 30 with current gold prices, silver would need to climb to $143 per ounce.

Should gold rise to $6,000 and the ratio revert to 30, silver’s price would hit $200.

Therefore, I have no plans to sell any silver or mining stocks yet. The precious metals bull market, especially silver, appears far from over.

This so-called “debasement trade,” as described by mainstream media, is only just beginning.

It seems President Trump will name a new Federal Reserve Chairman early next year, likely resulting in much lower rates and increased money printing.

Regrettably, another wave of inflation seems unavoidable. Silver remains among the top hedges to prepare for this eventuality.