Christmas Comes Early for Precious Metal Investors

Can you hear that outside? It’s Santa Claus delivering gold, silver, and cash flow wrapped up in an early Christmas gift. Sure, he’s arriving a couple of weeks ahead of schedule. Just embrace it. A good opportunity never should be passed up. So, what’s the latest? Well…

What’s in Santa’s sack? Early 1900s image from Library of Congress.

Just this Monday – or “yesterday” – the news broke that two outstanding precious metal exploration and development firms are joining forces to create a larger entity.

This isn’t about a big corporation buying a smaller one at a hefty premium. Instead, it involves a profitable, well-established company engaged in exploration, development, production, and cash flow merging with another equally robust business focused on high-potential exploration and development.

As expected, the markets reacted mildly, with share prices of both companies showing little movement on the merger announcement. However, looking forward, the new combined company will be a financially stronger “junior” miner with significant growth potential, especially as gold and silver prices climb in 2026. Both firms currently hold substantial cash reserves, bolstered by operational revenues. Let’s take a closer look…

Combination of Equals

If you’ve followed my Morning Reckonings over recent months, or my pieces in Strategic Intelligence, or Sean Ring’s Rude Awakening, these names might ring a bell.

Specifically, Contango Ore, Inc. (CTGO) and Dolly Varden Silver Corp. (DVS) revealed they have reached an agreement to unite through a so-called “merger-of-equals.”

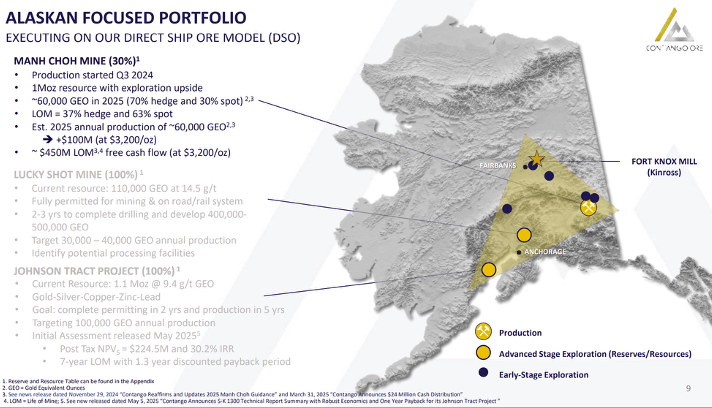

Contango operates in Alaska, extracting high-grade gold ore via open pit mining at Manh Choh, approximately midway between Anchorage and Fairbanks. The ore is then transported by haul truck to Kinross Gold (KGC – $32 billion) and their Fort Knox mill near Fairbanks (Note: this Fort Knox is in Alaska, not to be confused with the U.S. Gold Depository in Kentucky.)

Contango’s Alaska operations. Courtesy Contango Ore.

In addition, Contango is redeveloping the high-grade Lucky Shot mine, located roughly an hour north of Anchorage. The company also controls the impressive Johnson Tract mineral claim, situated about 140 miles southwest of Anchorage near a deepwater coast. I’ve personally toured these sites*.

Contango’s shares are tightly held and trade around $26, placing its market capitalization near $390 million. The ore-processing partnership with Kinross generates significant cash flow for Contango, avoiding the need for share dilution via capital raises. Essentially, Kinross mining revenues finance Contango’s redevelopment projects at Lucky Shot and exploration efforts at Johnson Tract.

On a related note, Contango’s high-grade Manh Choh ore has also benefited Kinross. It enables Kinross to “blend” this richer material with lower-grade ores during processing, which improves the economics of gold production. Kinross’ strong financial results and share price attest to this advantage.

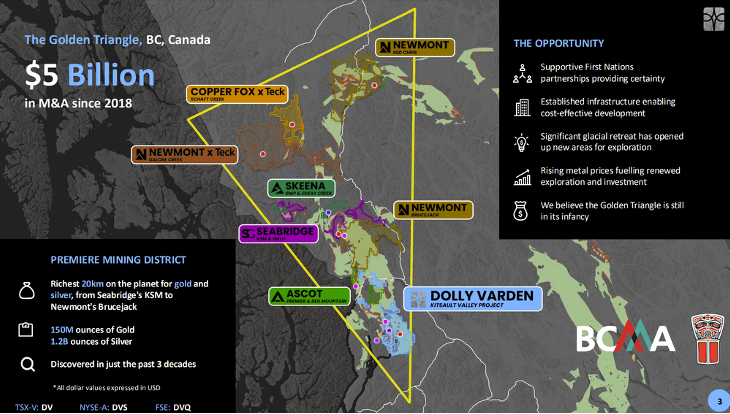

Meanwhile, Dolly Varden operates in British Columbia’s “Golden Triangle” at the northwest corner of the province — an area famed for mineral richness. This region borders Alaska, with road networks crossing the international boundary based on terrain. I’ve visited Dolly Varden’s operations as well*.

Dolly Varden mineral claims in Golden Triangle. Courtesy Dolly Varden.

As illustrated, Dolly is surrounded by top-tier mineral assets, sharing proximity with giants such as Newmont Mining (NEM – $97 billion), Seabridge (SA – $2.9 billion), and Skeena (SKE – $2.6 billion).

Over the last four years, Dolly has uncovered substantial silver and gold deposits. Although currently classified as an advanced explorer with early development projects, indicated and inferred resources amount to close to 100 million ounces of silver — or more than a million ounces of gold equivalence. Exploration is ongoing, with promising recent drill results showcasing impressive gold and silver grades.

Dolly Varden stock trades near $4.60, valuing the company at roughly $410 million. The company recently secured financing, resulting in over $40 million cash on hand.

Regarding the “equal” aspect of this merger, once finalized, current shareholders of Contango and Dolly Varden will each retain approximately half of the new company’s outstanding shares, which is expected to operate under the name Contango Silver & Gold Inc.

Leadership will include Contango’s founder and CEO, Rick Van Nieuwenhuyse, whom I’ve known for over 15 years, as the CEO of the combined company. Dolly Varden’s CEO Shawn Khunkhun, my acquaintance for about a decade, will serve as President. The board will be chaired by Clynt Nauman, who previously led the Alexco silver mining company in the Yukon until its acquisition by Hecla Mining (HL – $10 billion) in 2022. I have personally known Clynt for roughly 18 years.

From my personal experience, these three individuals are highly capable professionals. Their expertise spans exploration and development geology, and they have extensive tenure in the Alaska-Yukon-Golden Triangle region. Each has a track record of success, and as we’ve seen with Contango, Rick Van-N’s current cash flow solidly demonstrates his ability to turn mineral resources into profitable operations. Betting on winners is wise, isn’t it?

Here’s More…

Joining Contango and Dolly Varden creates a diversified silver and gold company operating at multiple stages—from profitable Manh Choh output in Alaska through to exploration and advanced development projects in Alaska and the Golden Triangle.

The combined firms hold over $100 million in cash while carrying only $15 million in debt. Alongside this, steady cash flow from the Kinross partnership further strengthens the balance sheet, minimizing the chance of future fundraising or dilution.

Another major benefit is leverage on high-grade assets such as Contango’s Lucky Shot and Johnson Tract, supplemented by Dolly’s valuable Kitsault Valley silver-gold project in British Columbia.

Moreover, both the Johnson Tract and Kitsault projects are situated near tidewater ports, enabling a “direct shipping ore” (DSO) method—mining premium-grade ore and shipping it overseas directly for global sales.

Looking ahead, the merged group might consider acquiring processing facilities to capture more value internally. While this would be a downstream operation requiring time, it’s a potential avenue for long-term growth.

Exploration potential remains vast across these projects, from ongoing Manh Choh mining expansion to the clear upside at Lucky Shot, Johnson Tract, and Kitsault Valley.

Initial market response was muted, but as integration progresses, the new company should appeal to investors seeking greater market capitalization and liquidity. It will likely attract research analysts and institutional attention as well.

There is much more to discuss, but I want to share some photos from my visits to Dolly Varden in August 2023 and Contango in July 2025.

Here’s an aerial view of the Dolly Varden camp, located in the highly promising Kitsault Valley…

Dolly Varden camp from the air. BWK photo.

The terrain is tough, but the geological activity here is why mineral deposits occur so richly—tectonic shifting combined with heat and mineral-bearing fluids rising from deep underground.

While not visible in this image, the Dolly camp sits at sea level near a tidewater fjord capable of handling large ships and barges. This proximity creates excellent logistical conditions for development and supports the earlier mention of DSO opportunities.

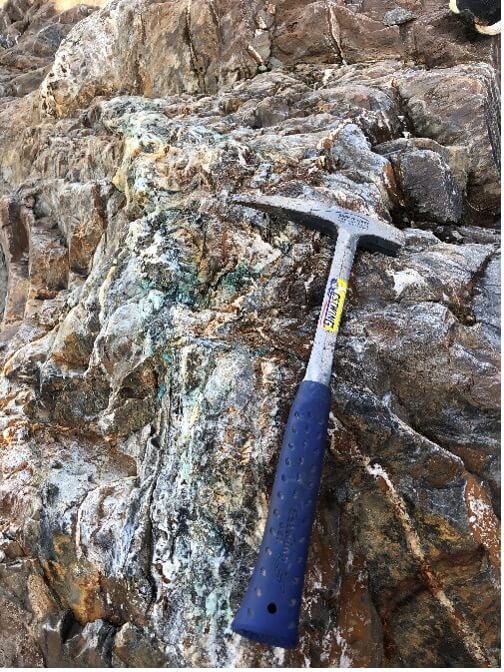

Regarding mineralization, I observed near-surface native silver in some areas, as shown here…

Copper-silver mineralization at surface. BWK photo.

Naturally, I collected samples—that’s what mineral-geologist enthusiasts do. Here I am with mega-investor Frank Guistra after cutting into one of these rich silver specimens…

Ha! Why is Frank smiling? BWK photo.

The landscape is stunning, with dramatic mountains, valleys, and glaciers. The government remains supportive of mining, so obtaining permits for strong projects like Dolly Varden’s remains achievable.

Your editor on a mineralized ledge, overlooking the Salmon Glacier. BWK photo.

Regarding Contango’s properties, I visited last July. Here’s a shot of the old Lucky Shot Mine entrance.

Your editor and Contango CEO Rick Van-N at portal to Lucky Shot Mine. BWK photo.

This mine was established in the late 1920s and 30s, producing substantial profits during the Great Depression. However, Alaska gold mining was halted by the U.S. government during World War II, and afterward, family disputes prevented reopening.

After a long process, Rick Van-N secured the mineral claims, and after analyzing historical geological data, it’s evident that significant high-grade gold remains in the rock below. I explored the tunnel and viewed the ore face firsthand.

Your editor examines Lucky Shot gold mine. BWK photo.

During my Alaska trip, I also visited Johnson Tract—despite challenging coastal weather conditions. Rather than bore you with details of navigating heavy fog, here’s what the exploration camp looked like once we broke through the clouds.

Contango’s Johnson Tract exploration camp. BWK photo.

It’s a breathtaking locale, situated on Alaska Native Corporation Land, which often leads to a favorable development stance from federal and state agencies. Of course, mining operations must comply with extensive environmental regulations, but permit acquisition is possible.

Here’s a sample from the deposit—any observer can tell this is high-grade ore judging from the mineral content.

Your editor with mineral sample from Johnson Tract. BWK photo.

Wrap It Up…

I could keep going, but the takeaway is clear from the photos above. Contango and Dolly Varden are joining to form a more substantial and robust mining company, backed by cash reserves, steady income, valuable production assets, and exceptional exploration and development prospects.

Looking forward, this is what geologists call a “hip pocket” opportunity. You can acquire shares, hold them quietly in your portfolio, and wait for progress. The assets are solid, the company is well-funded, and management is top-notch. It’s like boarding a plane and seeing experienced pilots in the cockpit. You just lean back and trust the experts to fly the big jet, right?

At this stage, I’m comfortable holding stock in one or both companies: CTGO and/or DVS. Yet, I want to clarify that the Morning Reckoning isn’t an investment portfolio; I simply track developments closely.

If you decide to invest, watch for market dips, always use limit orders, and never chase upward momentum.

Lastly, about those *-annotations related to my site visits in Alaska and British Columbia: neither Contango nor Dolly Varden funded my trips. I personally paid for airline tickets or was reimbursed by Paradigm Press for travel expenses. I disclose this so readers can trust that my opinions are unbiased and based solely on my own assessment. Well, aside from obtaining a few mineral samples.

Oh, and here’s a fireweed plant… According to Native Alaskan tradition, a fully blossomed fireweed signals a harsh, cold winter ahead. Just saying…

Flowering fireweed at Johnson Tract, Alaska. BWK photo.

That’s all for now. Thanks for subscribing and reading.