A Money-Stealing Demon

Inflation acts like a cruel thief, robbing us of the rewards from our hard work.

The main driver behind inflation is an expansion in the money supply. Simply put, more currency circulating means prices tend to rise, assuming other factors remain constant.

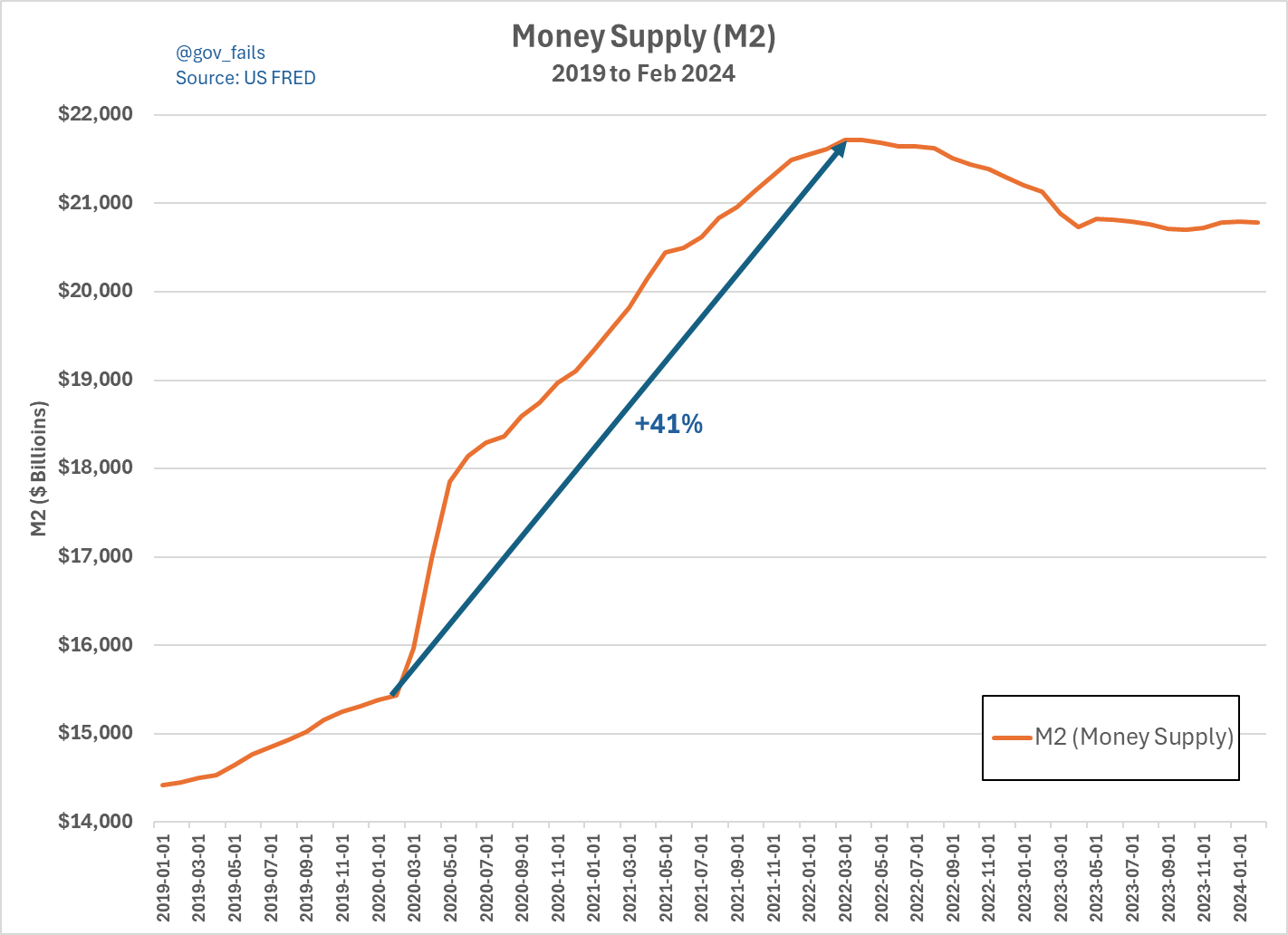

Refer to the chart below, which illustrates the startling 41% growth in America’s money supply from March 2000 to March 2022.

Source: Gov_Fails on X

During the pandemic, the government rolled out an unprecedented stimulus. The March 2020 CARES Act amounted to $2.2 trillion, which included $900 billion for the Paycheck Protection Program, direct payments to numerous households, and aid to state and local authorities.

Additional stimulus efforts pushed the total COVID-related spending beyond $5 trillion.

The chart demonstrates a sharp rise in the M2 money supply, which covers cash, checking and savings accounts, and money market funds.

This spending spree was made possible by the Federal Reserve expanding its balance sheet by $5 trillion, growing from $4 trillion to $9 trillion.

Inflation vs. Money Supply

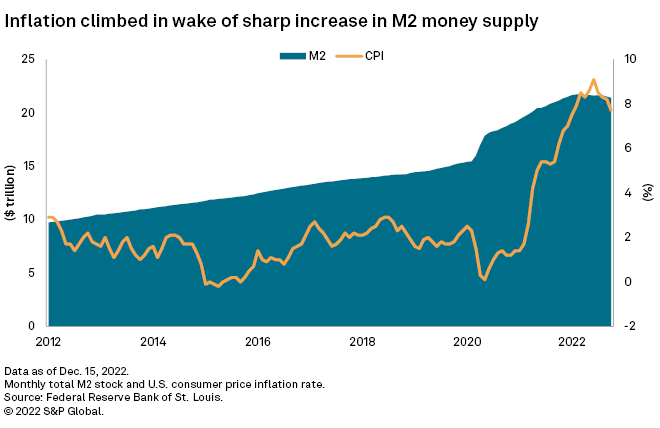

Government inflation figures show that during the two-year span when money supply surged by 41%, inflation climbed by only 11%. The next chart provides more detail.

Source: S&P

With money supply increasing by such a large margin, why did inflation rise so modestly?

Partly, official inflation metrics like the CPI have significant flaws. We explored this concept in detail in Is Gold Cooked? The true inflation rate during that time was probably closer to 20%.

Yet there’s more to the story. The velocity of money—the speed at which it circulates in the economy—slowed sharply. Many recipients of stimulus funds used the money to repay debts, opted to save, or chose to stay home.

Moreover, since the U.S. dollar serves as a global reserve currency, much of the newly printed cash did not remain domestic but instead flowed overseas.

This leads us to another key factor limiting inflation: the emergence of China and other manufacturing giants abroad.

King Dollar Means Cheap Goods

Despite imperfections, the U.S. dollar remains the preferred global fiat reserve currency. Most international trade continues to be conducted in dollars, and many central banks hold significant portions of their reserves in U.S. treasuries.

This robust global demand for dollar assets allows the U.S. to import goods affordably and maintain sizable deficits, at least for the time being.

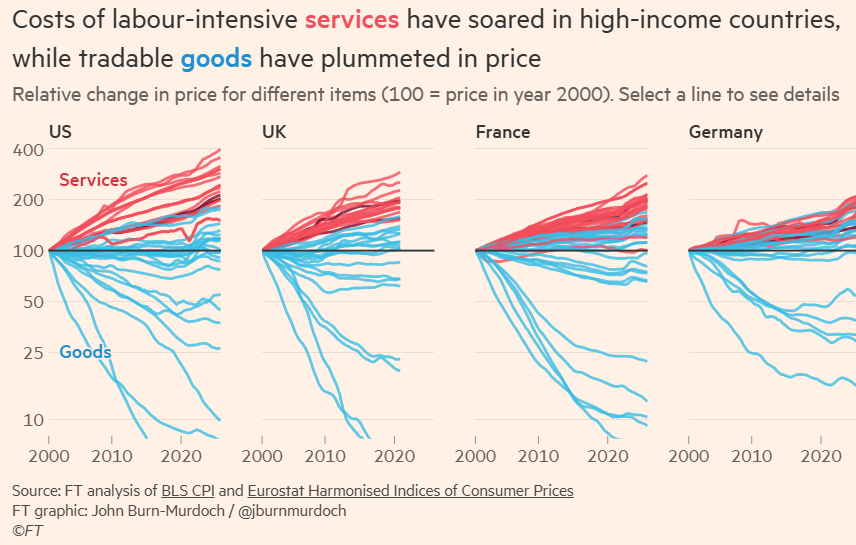

The chart below illustrates the stark divergence between soaring service costs (in red) and comparatively stable goods prices (in blue).

Source: Financial Times

The considerable gap between goods and services inflation is largely due to the influx of inexpensive imports from China and similar manufacturing hubs.

Absent these affordable foreign goods, inflation in the U.S. would be substantially higher—likely approaching the rate seen in service sectors.

This dynamic has been beneficial for American consumers, allowing their dollars to purchase more imported products.

On the other hand, it has dealt a severe blow to domestic manufacturing. A majority of factories have relocated abroad, with new plants mostly established in countries with lower labor costs.

As the U.S. endeavors to revive its industrial base and boost domestic production, prices for locally made goods are expected to rise. This shift will likely contribute to increased inflation over the next few years.

Still, if done properly, this rebuilding effort could generate well-paying jobs and elevate wage levels.

Should a meaningful portion of manufacturing return home, we might experience a transition period with heightened inflation. However, if this cost leads to reviving a genuine economic foundation, it will be well justified.

Inflationary Outlook

The Federal Reserve currently projects an average inflation rate near 2.2% annually over the next five years. Meanwhile, consumers tend to anticipate roughly 3.2% inflation.

In my view, both projections are overly optimistic. It wouldn’t surprise me if inflation averages over 5% in the coming decade (based on official CPI, suggesting the real figure would be even higher). There’s potential for even more severe outcomes.

Eventually, the government will likely have to inject stimulus once again, with the Fed absorbing the resulting debt. The next recession could see unprecedented quantitative easing and government spending.

As America reshapes its manufacturing sector, the cost of producing domestically will rise, pushing prices up. Yet, this is a positive step long term. A revitalized Rust Belt is worth enduring a few years of uncomfortable inflation. I hope wages can keep pace or stay near inflation, but that isn’t guaranteed.

Additionally, indications suggest President Trump advocates a weaker dollar, seemingly poised to exert greater influence over the Fed early next year.

Thus, I expect inflation to remain elevated. This outlook reinforces our conviction in holding gold, silver, mining stocks, and other natural resources.

When inflation surges again, these assets tend to provide superior protection compared to inflated stock markets. History demonstrated this clearly in the 1970s when hard assets preserved investors’ wealth amid monetary debasement.