Silver Miners are Printing Money

Miners of precious metals have experienced strong gains in the past year.

Today, I’ll explain why silver miners specifically still have significant upside given current metal prices (hint: it involves a 10x increase in profits).

In 2025, gold climbed approximately 70%, while silver surged an impressive 130%.

Those unfamiliar with mining might assume profits rose in direct proportion to these price jumps.

However, that’s not the case. Earnings grow at a multiple of metal price moves, especially for silver miners.

Let’s examine a practical example with the numbers.

Pan American Silver (PAAS) is a prominent silver and gold mining company (disclosure: I own it, along with most other big silver producers).

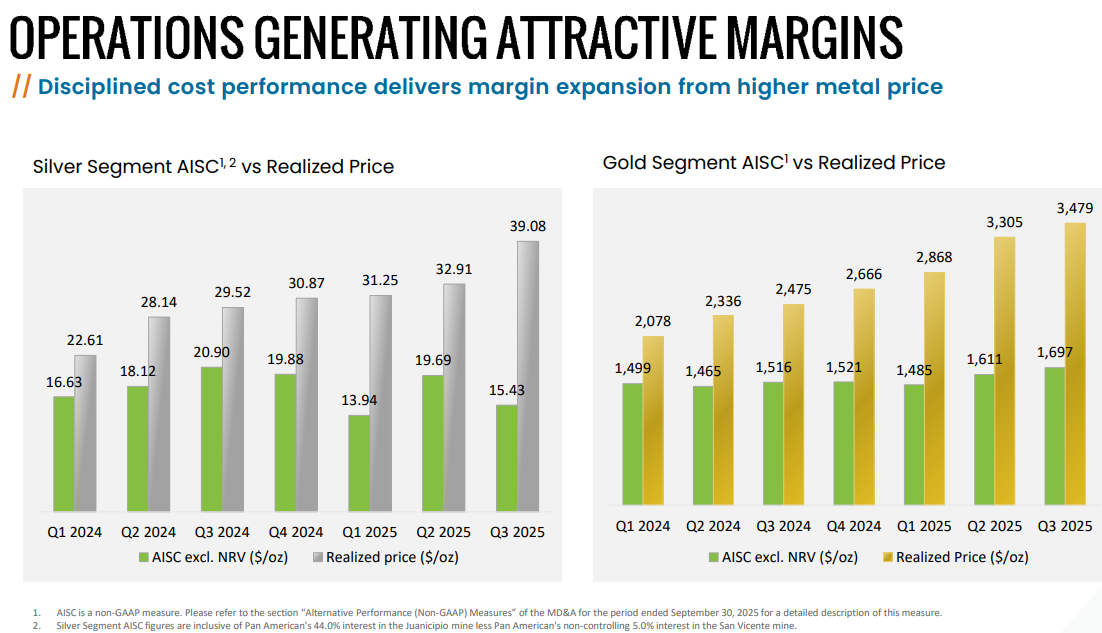

Their latest investor presentation reveals the cost to extract each ounce of gold and silver, referred to as the all-in sustaining cost (AISC).

Source: Pan American Silver

In Q1 2024, Pan American’s cost to mine silver stood near $16.68 per ounce, while they sold it at an average price of $22.61 per ounce.

This allowed for roughly a $6 profit margin per ounce in Q1 2024.

By Q3 2025, silver prices had risen to about $39 per ounce, while Pan American’s AISC slightly declined, boosting their profit per ounce to $23—nearly quadrupling profits since early 2024.

When Q4 results are announced, that profit per ounce will likely climb further.

Should silver remain near $80 per ounce and costs stay near $16/oz, profits could reach an astonishing $64 per ounce.

This means from Q1 2024 to Q1 2026, silver miners have potentially seen a tenfold increase in earnings per ounce.

In Q3 2025, PAAS produced approximately 5.5 million ounces of silver. Maintaining this output and selling at $80/oz could yield about $352 million in revenue from silver alone within a three-month period.

Additionally, Pan American also mines gold and other metals. During Q3 2025, it produced roughly 153,000 ounces of gold with an AISC of $1,697.

In short, silver and gold miners are generating phenomenal profits under current market conditions. Pan American is not alone; most leading producers are posting comparable margins.

This illustrates why I remain invested in all my miners despite last year’s strong performance. If silver stays above $70 through 2026, miners should perform exceptionally well—and if it reaches $125 per ounce, profits could soar.

One important note: AISC (all-in sustaining cost) doesn’t encompass all expenses. While it’s a non-GAAP metric, it is widely used in the industry as a useful estimate of miners’ profitability.

A Fantastic Environment for Producers

Operating a mine requires massive amounts of fuel like gasoline and diesel. Heavy machinery including bulldozers, diggers, loaders, and haul trucks depend on it.

Fuel expenses can represent up to 15% of a miner’s total costs.

The fact that oil prices remain below $60 per barrel is a huge advantage for the mining sector.

I believe this constitutes one of the best environments ever seen for miners. The 1970s experienced a remarkable precious metals uptrend despite much higher relative fuel costs. Miners still profited enormously then.

In some respects, today’s situation is even more favorable—especially for large producers operating established mines, where most of my investments lie.

I prefer to put capital into companies currently thriving, rather than those faced with extensive capital raising and regulatory hurdles ahead.

Launching a new mine remains burdened by heavy bureaucracy. While President Trump is working to simplify permitting in the U.S., the majority of precious metals come from overseas, and moving from discovery to production can take decades. This enhances the value of long-life, operating mines.

From my perspective, big producers have the edge in today’s climate. Although I own some explorers and developers, roughly 85% of my miner holdings are producers (for more on this, read The 3 Stages of Gold Miners).

Spending the Money

As miners generate growing cash flow, what will they do with it? Several actions come to mind.

First, many savvy mining firms are focusing on paying down or eradicating debt, which is a prudent use of capital.

Second, we can expect ongoing mergers and acquisitions. Mines have lifespans of decades, but companies must continually plan for the future. Purchasing attractive assets at reasonable prices is an excellent investment.

Third, companies are increasing dividend payouts. Though yields on gold and silver miners aren’t currently massive, they are rising rapidly. Over time, dividend reinvestment programs (DRIPs) can significantly accelerate compounding returns—I always take advantage of these.

Fourth—and what we’d rather avoid—is a rise in executive compensation. Well-run companies should reward leadership, but most pay should be tied to stock options, not cash, and remain reasonable. It’s important to monitor for any culture becoming self-serving, as this is hard to reverse. We will stay vigilant for signs of such behavior.

To be clear, excessive pay isn’t currently a major issue in mining. From 2012 through 2022, the sector faced tough times and had to become lean and disciplined. That culture is likely to persist for some time.

Hopefully this article clarifies why despite tremendous gains over the last year, I haven’t sold any silver miners—and have no plans to do so anytime soon.