Money to be Made in ‘Boring’ Metals

The past year has largely been dominated by precious metals.

We’ve covered that topic so extensively that even I find it somewhat repetitive.

Fortunately, industrial metals are gaining momentum, offering appealing prospects in undervalued mining stocks.

By industrial metals, I mean iron, aluminum, nickel, copper, zinc, and similar tangible resources.

These “boring” metals are currently attracting considerable attention. Take a look at this one-year nickel price chart:

Source: Trading Economics

This hardly looks like a boring trend, does it?

Nickel is a vital industrial metal, presently priced near $18,000 per ton. While stainless steel remains its chief application, nickel also plays essential roles in rechargeable batteries, aerospace, and many other industries.

Russia’s Norilsk Nickel leads the market as the biggest nickel producer, but due to its Russian ownership, it’s currently off-limits for investors.

Vale: One Way to Play the Industrial Metals Boom

The second largest nickel producer is a familiar company: Vale (NYSE: VALE). This Brazilian mining giant was explored thoroughly last June (disclosure – I own it).

Since then, Vale’s stock has climbed roughly 38%. Yet, its shares remain more than 60% below their peak from 2008, and the dividend yield remains attractive at about 5%, with potential to increase if commodity prices advance. Currently, the stock trades at only 10 times earnings, and 7 times projected 2026 earnings, placing it firmly in the “very cheap” category, in my view.

While Vale yields a significant amount of nickel, iron ore is the company’s primary product by volume, representing a much larger industry segment. Below is a decade-long iron ore price chart.

Source: Trading Economics

This chart doesn’t adjust for inflation. After considering inflation over the past decade, iron ore remains inexpensive today, and Vale enjoys some of the lowest production costs and highest ore grades.

Vale ranks as the world’s second largest nickel producer and also holds substantial reserves of copper, cobalt, platinum, gold, and silver. Additionally, the company operates an extensive transport and distribution infrastructure, including ships, railways, and ports.

On the downside, Vale carries considerable debt, which I would prefer to see reduced over time. Another significant concern is the Fundao dam collapse, an environmental catastrophe involving a facility co-owned equally by Vale and BHP. A 2024 court decision mandated that the companies pay $30 billion over 20 years to cover cleanup and compensation for affected communities.

Nonetheless, at current valuations, I believe these risks are already factored into the price. I intend to maintain my position in this stock and reinvest dividends over the long haul.

As such, Vale represents a relatively high-risk, high-reward option for exposure to industrial metals—primarily iron, complemented by nickel and copper.

We will look into further investment opportunities in industrial metals soon.

What Drives Base Metals?

The key elements influencing the performance of industrial metals include:

- Monetary Policy

- Sanctions and trade wars

- China’s economy

The first is straightforward: if the Federal Reserve cuts rates and expands or accelerates quantitative easing, the dollar is likely to decline. This monetary expansion tends to boost commodities—a scenario I consider quite probable.

The second factor is more complicated. The global economy is entering a period of trade tensions, with export controls being implemented worldwide after years of relatively open trade.

Trade conflicts are unpredictable. For example, China recently imposed unexpected export controls on silver, which few foresaw a year ago.

In this volatile geopolitical environment, virtually anything can happen as the world adapts to ongoing changes.

The third factor is equally complex: the health and trajectory of the global economy, especially China’s. At present, China functions as the world’s manufacturing hub while rapidly expanding its domestic consumer market.

China accounts for about 50% of all global industrial metal demand.

Chinese exports are significant, but the impressive scale of domestic growth over the last three decades has been a major driver.

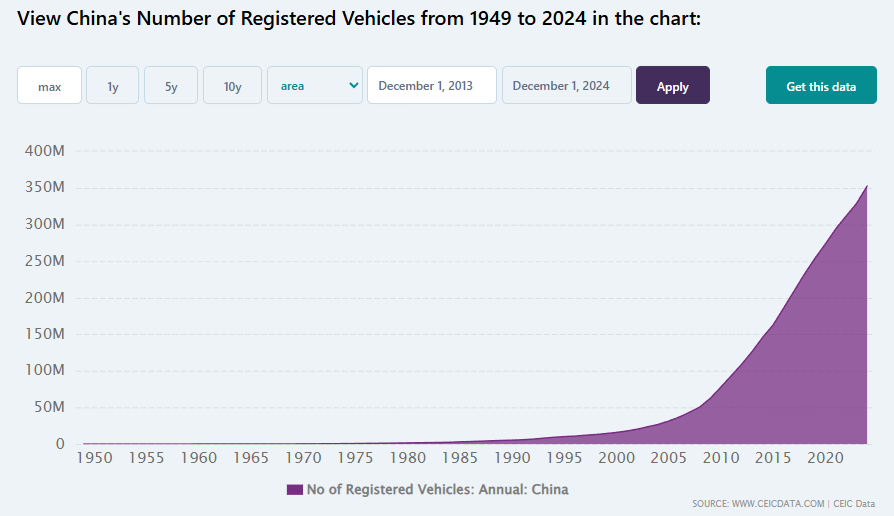

For instance, consider the following chart illustrating the number of registered vehicles in China.

Source: CEIC

As this shows, China’s registered vehicle count surged from nearly zero in 1995 to over 350 million today, generating enormous demand for base metals.

Despite recent challenges like its property market troubles, China has experienced extraordinary long-term growth.

China remains a critical pillar supporting the industrial metals bull market.

Less Poor

The industrial metals theme reflects the global trend of millions moving out of poverty—not necessarily into wealth, but toward improved living standards.

Homes, bicycles, and even cars—these everyday items contribute significantly when multiplied by billions of people.

This move toward reduced poverty and expanding middle classes is unfolding worldwide, particularly pronounced in China.

Patience May Be Required

A major stock market downturn and recession would briefly depress industrial metals demand. However, government and central bank monetary stimulus would soon follow, fueling economic recovery through infrastructure investment.

This scenario tends to weaken fiat currencies and boost metal prices, while simultaneously increasing demand for construction materials and vehicles.

Short-term trends in industrial metals are challenging to forecast. Still, I am confident that significant inflation will emerge within a few years, making hard assets an appealing shelter.

Currently, base metal mining stocks are undervalued, out of favor, and beginning to rebound—an encouraging combination based on my experience, though it sometimes requires patience.

Ultimately, base metals and the quality producers involved will appreciate in value. The key question is timing. We may be early in this cycle, which is acceptable—I plan to hold my positions and allow dividends to accumulate at attractive valuations.

The market will eventually re-rate base metal miners upward.

I’ve been dedicating substantial time to researching base metal producers recently, so expect further updates soon.