Start a Roth IRA for Your Kids/Grandkids

Last summer, my 16-year-old took a job at our local pool.

Here in Ellicott City, Maryland, the minimum wage is $15 per hour. That’s a decent wage for a teenager nowadays.

Over the course of three months, he earned roughly $2,800 after taxes.

He wanted to invest those earnings, so we opened a custodial Roth IRA. His contribution limit can’t exceed what he made, and we decided to match half of his contribution.

I outlined the advantages for him, and he was convinced. A Roth IRA offers an exceptional tax advantage. When he withdraws the money (likely decades from now), it will be completely free from taxes.

He won’t have to deal with capital gains taxes, enabling the funds to grow more effectively over time.

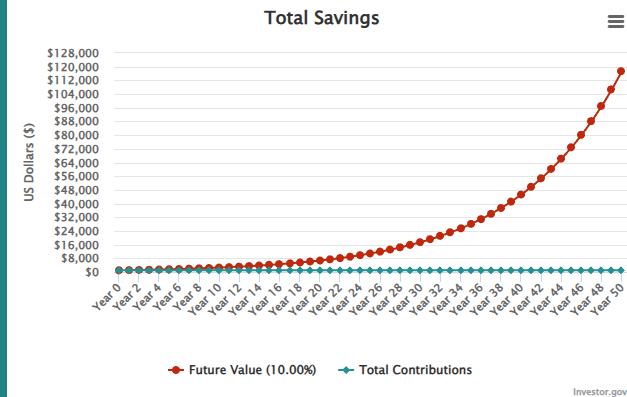

Assuming a 10% average annual return, every $1,000 invested and left for 50 years could grow to $117,000.

A Roth IRA stands out as one of the clearest advantages for investors. Starting his account as a minor gives him a tremendous head start for retirement.

Investing for 5 Decades Out

The toughest choice was figuring out what to invest in.

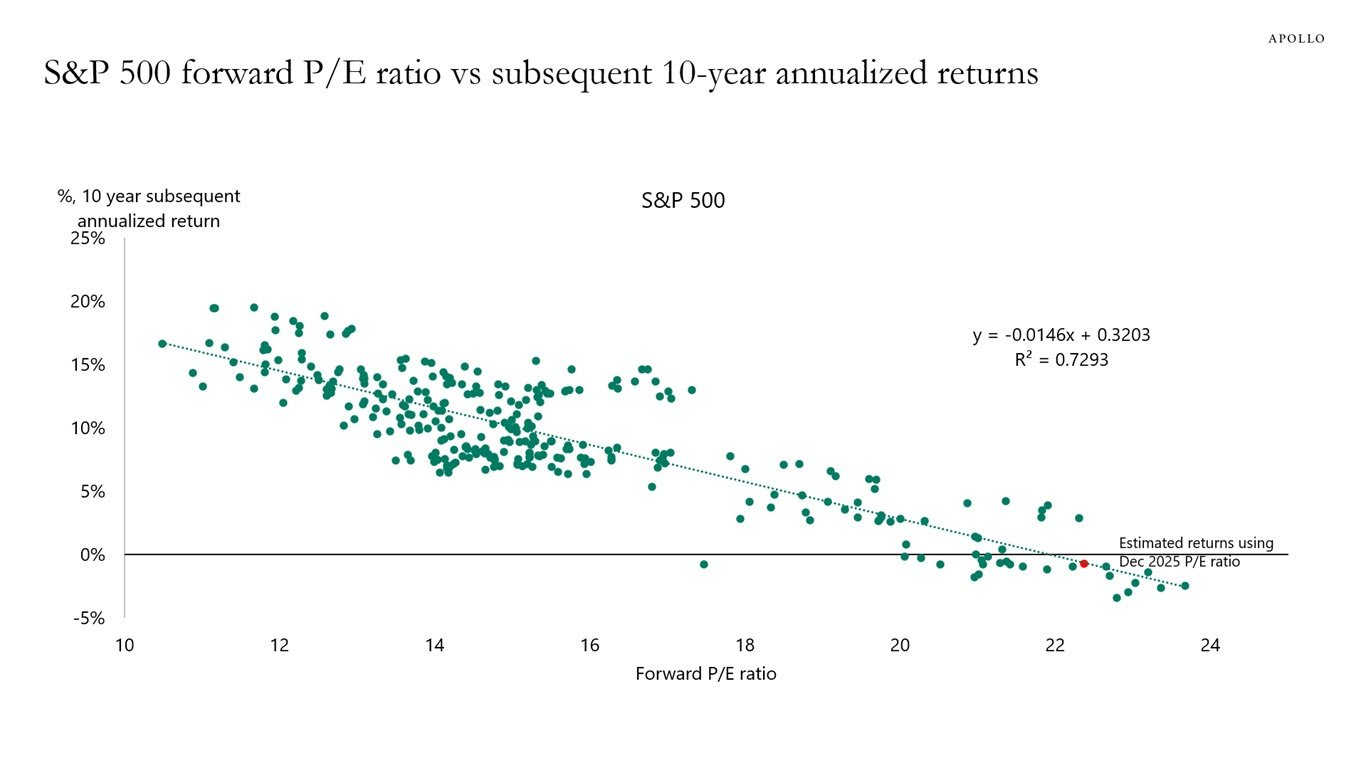

As many of you are aware by now, I believe U.S. equities are largely overpriced.

Historically, when the S&P 500 trades at levels like the current 22x forward P/E, returns over the next ten years tend to be negligible. Below is a chart from Apollo illustrating this:

This scenario unfolded in 2000 when the dotcom bubble burst, causing the S&P 500 to take 7.5 years to regain its previous peak. Then came the 2008 crash.

For investors who bought near the dotcom bubble peak, it took roughly 15 years to break even again (after adjusting for inflation and dividends).

The chart also reveals that when the S&P 500 trades at a P/E of 12, average annual forward returns hover around 15%. Unfortunately, current valuations are far from these bargain levels.

Consequently, we decided to exclude U.S. stocks from his portfolio.

Emerging Markets and Natural Resources

By now, you can probably guess our strategy.

That’s right, we assembled a diverse mix focused on emerging markets and hard assets.

Here are the specific holdings we selected:

- VWO – a broad emerging markets ETF with an ultra-low 0.07% expense ratio

- FLLA – a Latin America ETF featuring low fees and solid yield (mainly Brazilian stocks)

- PBR.A – Petrobras, my top long-term pick in the oil sector

- VALE – the Brazilian industrial metal miner we featured recently

- GDX – the largest ETF tracking gold miners

For those wondering, why not silver?! Our children don’t realize it yet, but they’re already well positioned there.

The objective was to pick investments that could essentially be “set and forget” for 5 to 10 years. Reinvest dividends and allow compounding returns to work their magic.

The portfolio is performing well so far, though we’ll tweak it as market conditions evolve.

By establishing this account early on, we’re giving the funds five decades of tax-free compounding growth. That’s a powerful advantage—even starting with modest sums.

This summer, Sharp Jr. will be back working at the pool before beginning his electrician apprenticeship in the fall. All his earnings will go straight into his Roth IRA.

He is NOT taller than me. It’s just a bad angle…

Meanwhile, my 13-year-old daughter has been working at the barn where she rides horses for three years, though until recently she earned lessons instead of a paycheck.

This summer, she’ll finally start earning real wages, which will go right into her own tax-advantaged custodial retirement account.

If you have children or grandchildren, I highly suggest setting up a Roth IRA as soon as they begin working. You can even employ them yourself. Just be sure the work is legitimate, document everything carefully, and consult a tax professional if you have any doubts.