Gold, Guns and Greenland

To begin, a warm welcome to those who joined Paradigm Press over the holiday period. We appreciate your support, and rest assured, everything we do is dedicated to our subscribers.

Today, we’ll examine some striking recent developments in precious metals prices. Following that, we’ll shift focus to how President Trump is transforming both the U.S. domestic framework and the global order (sometimes called the “old” order) — a change closely linked to these metals market shifts.

In line with this Trump-driven theme, we’ll explore a particular example: Greenland. Here’s what it looked like last September, at the tail end of summer, as I traveled back from Iceland (see image below).

Not very green; Southern Greenland last September. BWK photo.

Surfing The Precious Metal Waves

At Paradigm Press, the price of gold consistently commands attention and respect. This “yellow metal” serves as a reliable indicator for everything from fundamental industrial trends and classical economics to the broader political and social climate in the U.S. and beyond.

5-Ounce gold nugget. BWK photo; courtesy Alaska Mint, Anchorage.

Currently, gold trades near $4,600 an ounce, climbing more than $100 from Friday evening to Sunday night. Similarly, gold mining shares have surged, making it clear that gold is signaling something significant.

Silver is riding the same wave, with its price now above $87 per ounce – up from about $73 just a week ago, marking a 19% increase in seven days. Silver mining stocks are rising sharply as well, and the U.S. Mint recently informed customers, including myself, of delays and increased prices for silver coinage and related products.

Meanwhile, platinum hovers around $2,400 per ounce, up considerably from roughly $1,550 shortly before Thanksgiving. That’s a 54% gain in around seven weeks, making one wish they had picked up shares in Sibanye Stillwater Ltd (SBSW) last year before their value tripled.

Do you sense a larger message behind these precious metals price moves? Certainly, and it unfolds on multiple levels.

Singing the Supply-Side Blues

Let’s start with supply, an area of interest to me as a geologist closely monitoring metal outputs, especially precious metals. Simply put, prices are climbing because the quantity of metal extracted from mines, mills, and refineries isn’t sufficient.

For well over fifteen years, industry watchers have lamented the prolonged lack of exploration and funding for new mining ventures. Essentially, the mining sector has been starved of capital from investors for two decades. To be frank, Big Money has chased after trendy tech startups and speculative biotech ventures, leaving mining largely neglected.

The reality is that investment capital is limited, and only a small portion has flowed into mining. Now, the “wolf at the door” is demanding returns on this underfunding. As a result, price discovery is unfolding swiftly, pushing elemental metal valuations notably higher — a trend likely to continue.

The bottom line: operating mines and refineries are running profitably, while few new projects are forthcoming. This scarcity of supply collides with rising demand. Industrial use for metals like copper, aluminum, and precious metals is soaring — all climbing upward.

With silver, a large share of demand comes from industry, especially electronics and solar panels, which consume silver at volumes unheard of two decades ago. But demand for monetary silver is also rising—no longer just individual collectors, but governments and central banks are acquiring tons.

Platinum’s demand resurfaces as the electric vehicle boom plateaus. It’s become clear that internal combustion engines will persist for another generation or two, and these engines rely on catalytic converters containing platinum (and palladium, depending on fuel and engine type).

Gold remains valued for its historical monetary role, despite some industrial applications. It leads the drive toward tangible asset security amid the global movement away from the dollar for many reasons (which we’ll cover in future discussions). Gold is effectively undergoing a form of re-monetization.

So… how much is an ounce of gold worth? Hey… It’s worth an ounce of gold! This is why many individuals and governments prefer holding gold rather than dollar accounts.

Trump’s Global Reboot, from Fed to Greenland

Although we could spend ample time on metals, let’s refocus on what sparked last weekend’s sharp increases in gold, silver, and platinum prices: news that Federal Reserve Chair Jerome Powell faces investigation over purportedly misleading testimony before Congress. (Surprising, isn’t it, that some might not tell the truth to Congress!)

Forget perjury accusations — what’s really happening is the Trump administration maneuvering to oust Powell from the Federal Reserve leadership.

Officially, Powell’s tenure ends in May, but the administration wants him out sooner. The Fed’s team of PhDs could heavily influence economic conditions in the months ahead — something Trump and his allies want to avoid as the 2026 election cycle approaches.

Simply put, Trump wants Powell gone. Trump seeks easier monetary policy, specifically rate cuts to stimulate growth. Powell resists, so Trump is pushing for his departure. Investors, wary of resulting inflation risks, have boosted precious metals prices swiftly.

For context, recall that just over a week ago, Trump deployed U.S. military and law enforcement forces to remove Nicolas Maduro in Venezuela. Essentially, Navy, Air Force, Marines, Army, Coast Guard, and federal officers mobilized to capture the Venezuelan leader. So, Mr. Powell, are you paying attention?

Whether confronting the Fed domestically or sending special operations abroad, it’s obvious Trump is rewriting the rules. Which brings us back to Greenland, as introduced earlier…

Many ask, “Why Greenland?”

Some reply, “Cuz the minerals!” And even President Trump says, “Cuz the minerals.”

As a veteran geologist, I respond, “Not quite.”

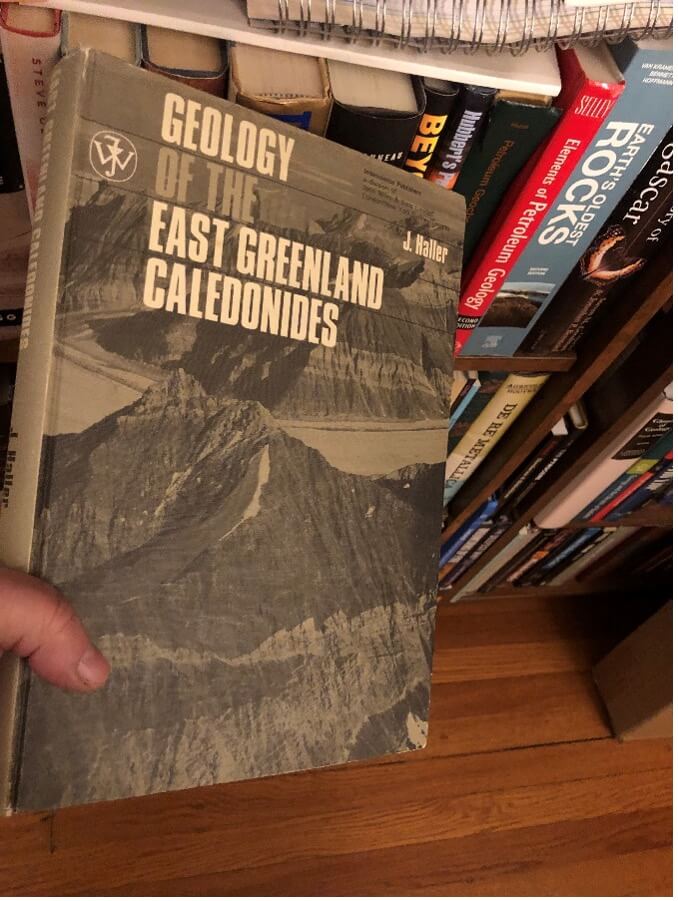

One of my earliest geology professors at Harvard was John Haller, who gained experience with the Danish Geologic Survey working in Greenland during the late 1940s and 50s. Over time, Haller authored what’s now a rare but seminal work on the region: Geology of the East Greenland Caledonides (John Wiley & Sons, 1971).

Your editor’s copy of Haller’s book on Greenland. BWK photo.

Alright, friends… Greenland’s geology is rich and fascinating, and yes, it contains many “minerals” (a bit of geological humor on my part). But!…

Extracting most of those minerals is almost impossible for now; even under ideal conditions, it will take time, money, and effort. As Haller states early in his book (pg. xi):

“Greenland bears to this day the burden of the Pleistocene. So far only a tenth of its area has been freed from the grip of glaciers; the rest lies buried under inland ice. Most of the coastline is barricaded by pack ice, and only the southwestern coast is ice-free and can be reached by ordinary ships in summer.”

You saw that aerial image near the top, yes? Mountains and glaciers everywhere. In fact, to better understand the regional geology around Greenland and the North Atlantic, I took a geological field trip to Iceland last fall.

Your editor’s flight track to Iceland. BWK photo.

Here’s me standing in southwest Iceland at the Reykjanes Ridge, right on the Mid-Atlantic rift where the North American and Eurasian tectonic plates split.

Your editor stands atop the Mid-Atlantic tectonic divide. BWK photo.

I’ll share more about the Iceland-Greenland geological connection in another article. But my key point is this:

NO! Do NOT expect Greenland to become a major “minerals” source any time soon. Large-scale exploitation there is easily a century away.

Instead… Consider Greenland through the lens of geostrategy, especially as framed by President Trump’s approach.

Strategic Greenland

So why does Trump want to acquire Greenland? The answer is straightforward: it’s a vital, some say essential, location for U.S. strategic defense. Greenland lies directly under potential missile flight paths launched from Russia’s Kola Peninsula or China, aimed at North America. Here’s a map:

Russian missile flight paths from Kola Peninsula towards North America. Courtesy Arctic Institute.

When the U.S. eventually deploys a large strategic missile defense system (dubbed “Golden Dome,” if you like), the ideal sites will be Alaska for western coverage and Greenland for protecting the Eastern U.S.—shown here:

Missile defense coverage circles. Courtesy John Konrad.

In short, Greenland represents a key geographical asset for defending the U.S. against missile threats from Russia and China. Along with Alaska, it offers the only viable locations that can cover flight routes targeting major U.S. cities and the heartland.

Discussing missiles, nuclear arms, and strategic defense tends to provoke strong emotions, and many prefer to avoid these topics. So Trump’s official line that the U.S. wants Greenland “for the minerals” works as a convenient cover story. Yes, minerals, Mr. President…

That’s the real story behind the Greenland focus. It explains why the U.S. will pursue actions regarding Greenland sooner or later. Naturally, there’s far more to unravel about Trump, Greenland, the Fed, and precious metals — but that’s for future articles.

For now, here are a few closing remarks. Keep reading!

More Info for New Subscribers

As a Paradigm Press subscriber, you’ll regularly receive emails like this one — Morning Reckoning (Tuesdays and Thursdays), as well as Daily Reckoning, the Rude Awakening, and the 5-Bullets summary. Keep an eye out for these.

Your subscription delivers what you signed up for: investment ideas and strategies to protect and grow your wealth. Our leading writers offer deep expertise, which you’ll appreciate over time. Meanwhile, the legal team insists we remind you that “we do not give personal financial advice.”

Often, your supplemental emails — your Reckonings, Rudes, and Bullets — will directly address investment ideas. We might name companies, though we don’t offer portfolio tracking.

When I mention a company, it’s usually because I’m familiar with it and perhaps have a favorable outlook. And always—regardless of who is speaking—if you buy shares, watch the charts and prices, look for dips, use limit orders, and avoid chasing momentum.

Beyond investments, these letters also touch upon wide-ranging social, economic, and political topics — like Trump and Greenland — which often inspire related investment insights.

Wrap Up: Three More Opportunities

To conclude, during the coming week, we have three free informational events for you:

This Wednesday, January 14th, at 1:00 pm Eastern Time, I’ll host a live session with Rick Van Nieuwenhuyse, CEO of Contango Ore (CTGO), a profitable Alaska gold miner recently merged with British Columbia silver explorer Dolly Varden Silver (DVS). We’ll cover mining topics, Alaska and Arctic operations, precious metals, plus updates on Contango and Dolly. Attendance is free, and you’re welcome to register here.

Then on Thursday, January 15th, also at 1:00 pm Eastern Time, Paradigm Press and my colleague Jim Rickards will present an event introducing a new editorial team member. This gentleman is a respected geologist with a lengthy history of successful ventures and investment insights—he’s even a CEO with firsthand mining experience. I’ve known him for 15 years and hold him in high regard. Jim and “the CEO” will discuss gold, silver, rare earths, energy, and more.

That’s all for now. Thanks for subscribing and reading, and best wishes for 2026.