Silver’s 27% Drop, in Context

Well, the moment has arrived.

A significant pullback in gold and silver prices is underway. The market volatility is intense.

This steep decline was bound to happen, as we’ve pointed out several times recently. These metals experienced rapid gains in a very short span.

Still, the speed of this selloff caught me off guard. At the time of writing, silver has plunged nearly 27% today, settling around $83. Oof.

Fortunately, gold has only dropped about 11%, and mining stocks are down roughly 14%.

During periods like this, it’s crucial to keep in mind the substantial progress made over the last 18 months. Both mining shares and bullion remain significantly higher than before, and miners would still present compelling buying opportunities even if gold slid to $3,500 and silver to $60.

Perspective matters greatly. Had someone told me a year ago that silver would hover near $83 and miners would double or quadruple, I’d have been ecstatic. But with recent gains now being the benchmark, it feels tough.

That’s just how our minds adjust. Once a portfolio hits a new peak, that level becomes our expectation. So, let’s remember this as we navigate through.

Though this correction is harsh, I remain confident that a much larger upward trend awaits beyond it.

If markets continue falling on Monday, I plan to increase holdings in quality silver and gold miners such as First Majestic Silver (AG), Newmont (NEM), and Pan American Silver (PAAS). At these levels, they appear undervalued.

If you’ve been holding off for a pullback, the opportunity has arrived. Now is a good time to start accumulating. If you vowed to buy during a significant dip and have funds ready, now’s the moment. Yes, it’s intimidating, but that’s part of this game.

Prices might drop a bit more, yet I anticipate recovery and a steady climb toward fresh highs throughout the year.

With China and South Korea reopening their markets early Monday, I expect buying pressure to emerge.

Root Causes

The financial press attributes this downturn to President Trump’s choice for Fed Chair, Kevin Warsh.

Many had anticipated a more “dovish” (easy-money) candidate like Rick Rieder.

However, as Jim Rickards has explained, the Fed’s influence isn’t as substantial as commonly believed.

Regardless of who leads the Fed, during the inevitable next crisis, massive money printing will occur. The government will distribute stimulus checks, run substantial deficits, and finance infrastructure projects—all backed by the Fed’s debt monetization (essentially printing money to cover expenses).

Moreover, this correction cannot be solely blamed on a Fed appointment. It’s primarily a reaction following an extraordinarily bullish surge.

In the end, the underlying fundamentals have only grown stronger.

JPMorgan Slaps an $8,000 Target on Gold

This week, JPMorgan’s analysts issued a report forecasting gold could reach $8,000 an ounce by the decade’s close. From Mining.com:

In a research note issued Thursday, strategists led by Nikolaos Panigirtzoglou said prices could push even higher to $8,000 an ounce by the end of this decade, if private sector investors continue to pile into the metal.

This scenario, which represents an upside of over 40%, could happen if investors increase their allocations into gold from 3% to 4.6% of portfolios, the analysts said.

Mainstream analysts rarely get it right, but this time they may be onto something. Even a modest shift of asset allocation into gold could drive prices higher.

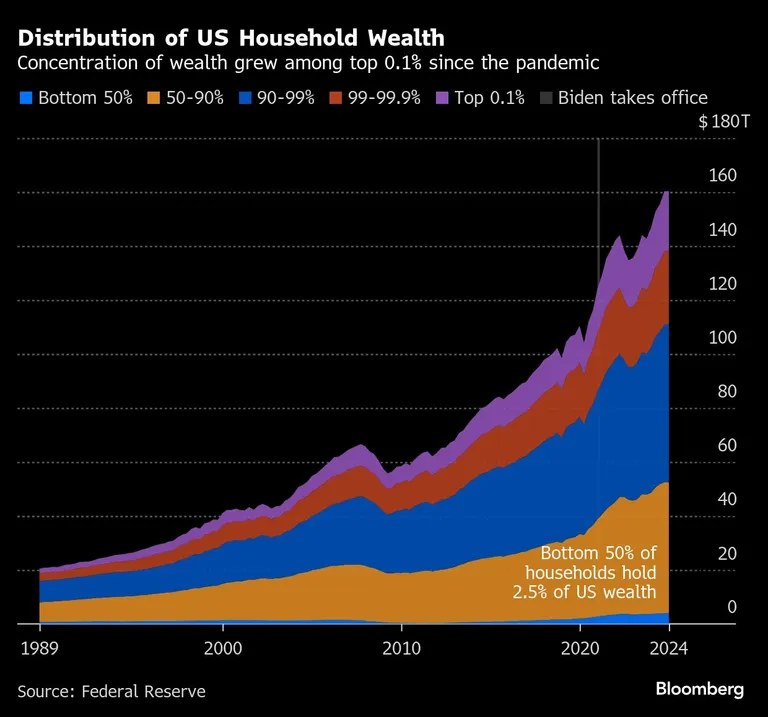

After all, global wealth has never been greater. The chart below, courtesy of Bloomberg, illustrates rising inequality in U.S. wealth.

It captures that trend well. But it also highlights the vast wealth generated over the past 15 years—an impressive bull run for equities and real estate.

Since 2010, U.S. household wealth has more than doubled and a half. Keep in mind this chart is over a year old, so current figures are likely even higher.

Despite numerous challenges, China’s story is similar. Chinese families maintain an astonishing 40% savings rate, and they love precious metals. This means that unlike past bull markets, China plays a critical role.

Worldwide, there’s more liquidity and accumulated wealth than ever before.

As the globe edges closer to a debt crisis, an increasing portion of that capital is poised to flow into gold, silver, and mining stocks.

Hard assets for tough times.

Predicting exactly when precious metals will rebound is tricky. However, I firmly believe they will hit new peaks this year, or if not, then next. As I noted earlier this month, miners remain more appealing than bullion.

Last October, during a drop from $55 to $47 silver, miners declined about 8%. On that day, I published Keep Calm and Hold Gold and Silver Miners.

Here’s the image I created for that article:

I’m glad I held my positions then, and it’s likely I will be thankful for holding now as well.

Clearly, today’s pullback is deeper than before due to how far prices surged this time. Nonetheless, this decline aligns with that rapid rise.

Buy the dip—whether in mining stocks or physical bullion if you’re able. Physical bullion can also act as an insurance policy amid extreme uncertainty.

Still, keep some cash reserved in case prices fall further. The experts on Jim Rickards’ and Matt Badiali’s teams will surely provide buy-low advice soon.

For those riding this precious metals wave, it has been a challenging emotional journey. The fluctuations are intense. Remember to pause, step back, and relax. Personally, I plan to play some pickleball this evening to decompress.

In the long term, this precious metals bull market has plenty more room to run. We experienced a powerful upswing and now must endure the necessary correction.

Have a great weekend everyone.