Don’t Buy “Poor Man’s Silver”

Silver is often labeled as “poor man’s gold,” but a more fitting description might be “everyman’s gold.”

Still, the original term has endured, so let’s roll with it.

Today, we’ll examine what could be considered the “poor man’s silver.”

Copper.

Across the globe, people are accumulating copper bars. The screenshot below comes from the Chinese social media app Rednote:

Source: AFR

Many videos on these platforms encourage purchasing copper bars. However, at least one commenter questioned this trend, asking, “What’s next, betting on noodle futures?”.

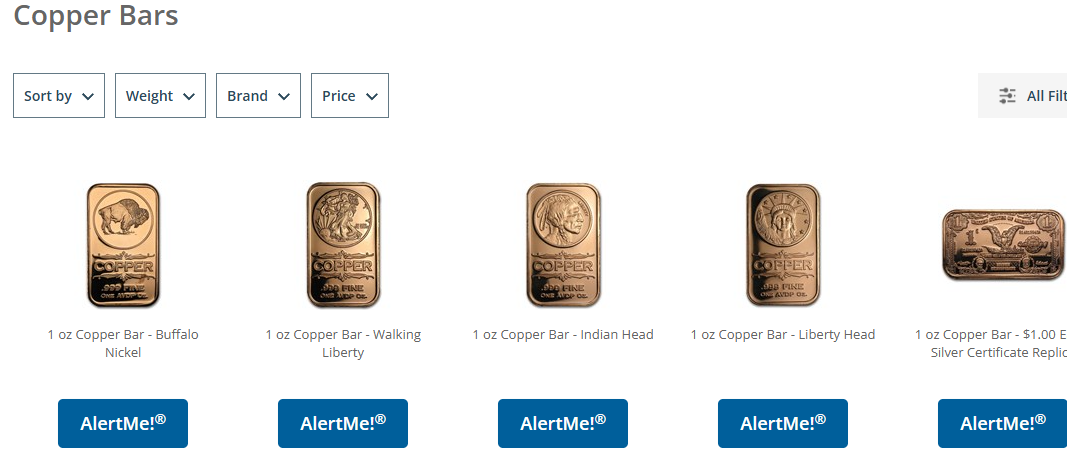

This phenomenon isn’t confined to China. For instance, on Apmex, a major U.S. bullion dealer, copper bars are currently sold out:

Source: Apmex

Indeed, people are buying copper bullion — but it is not a prudent choice.

Where in-stock, a 1oz copper bar sells for about $13, yet the metal’s value at $5.85 per pound is only around $0.36.

When purchasing copper bars, most of the cost stems from refining, minting, labor, and shipping— the metal itself is merely a secondary factor.

Thus, acquiring physical copper bars is an inefficient strategy. A better alternative might be collecting pre-1982 pennies, which contain 95% copper; their melt value exceeds three cents each—a solid return, although handling large quantities can be impractical.

Good Theory, Wrong Method

Those investing in copper bars may be off track, yet the fundamental case for copper remains compelling.

Below is a Financial Times chart projecting the future copper deficit.

By 2040, global demand is expected to exceed production by roughly 14 million tons per year, while current annual production is around 24 million tons.

This represents a substantial deficit.

We’ve already witnessed how slight variations in supply can heavily influence prices. For example, Freeport McMoRan’s (FCX) Grasberg mine experienced a significant mudslide last September, disrupting about 4% of global copper output.

The market promptly reacted with a 24% price surge.

From last October’s Dr. Copper is Quietly Crushing the S&P 500:

“Seven workers were killed in a massive mudslide at the Grasberg mine. 800,000 tons of mud flowed into the underground portion of the mine, killing the seven workers and shutting down roughly 70% of production indefinitely.”

The Grasberg mine accounts for about 4-5% of global copper output. Recovery may take years, and it remains uncertain if the mine will resume operations at all.

It’s remarkable how a supply decrease of approximately 4% rapidly drove prices up by 24%. That’s economics in motion. Copper demand is inelastic, meaning alternatives are limited when it’s needed (silver can replace copper in some uses but is notably more expensive).

Repair efforts at Grasberg are ongoing, with reopening expected in the latter half of this year. However, the damage was severe—as seen from this image provided by Bloomberg:

The mudslide involved roughly 800,000 tonnes of debris. Tragically, seven lives were lost.

Mining remains a challenging industry. Over the past two decades, discoveries of new copper deposits have sharply declined, as most easily accessible and high-grade mines are already tapped out.

Additionally, obtaining permits for new mines can take decades.

The number of new mines opening cannot keep pace with demand growth.

Copper Miners Keep Soaring

Geologist Matt Badiali has dubbed copper the “commodity of the decade” and has maintained a bullish stance since at least 2016.

Market participants appear to share this optimism. The leading copper miner ETF (COPX) has surged 113% over the last year. Meanwhile, copper prices climbed 43% in 2025, driven by growing demand from data centers, electric vehicles, and other sectors.

Given these sharp gains, waiting for a price correction might be sensible. Copper prices are highly vulnerable to global economic shifts.

In the event of a recession, shares in copper mining companies would likely drop significantly, creating a prime buying opportunity.

Copper offers a strong play for moving capital out of big tech and into tangible assets. Still, a more favorable entry point may emerge in the coming years.

That said, it’s possible the copper miner trade still has momentum. I hold some exposure but hesitate to invest after such a rapid rally in a purely industrial metal.

Looking ahead, copper’s prospects are promising. For those considering exposure to copper miners, there’s no harm in starting now—provided you use a trailing stop loss of around 25% to protect against a potential downturn.

Various risks threaten the global economy, including wars, inflation, debt crises, and trade disputes.

We will monitor copper mining stocks closely and alert you when favorable buying conditions arise.