Missing F-22s, War Signals, and Opportunities

Today, we’ll explore the unfolding situation in the Middle East, diving into metals, energy sectors, Big Tech, and strategies to safeguard wealth amid uncertainty. Tackling so many topics at once might seem bold, but let’s take a shot at it…

Let’s start with the recent Super Bowl. What caught my attention was the absence of Air Force F-22s flying over Levi’s Stadium during the opening ceremony. Initially planned for an overflight, the stealth fighters were pulled back due to “operational commitments,” according to an official statement.

Sorry, no F-22s. They’re busy. Screen shot from You Tube.

The aerial display featured two B-1 bombers (although only one is visible in the picture), alongside two F-15s, two F/A-18s, and two F-35s. While the Air Force and Navy have these in abundance, the absence of spare F-22s is notable…

There were no B-2 bombers on display either, which is significant. Perhaps these ultra-stealthy aircraft were also tied up with “operational commitments,” possibly related to events similar to last June’s activity in Iranian airspace. We’ll have to wait for more information, but from the outside, it prompts speculation about the missions assigned to these high-end jets.

Meanwhile, my portfolio primarily consists of metal miners, related tangible assets, and energy investments. I wouldn’t let go of any physical precious metals at this time. Hold onto gold and silver for now. (This is my personal viewpoint, not financial advice.)

Are You Hedged Against Risk?

There’s a lot to unpack here. First, I want to greet and thank new subscribers. Recent gains in gold, silver, other metals, and energy have brought many new readers to Paradigm Press—you’re in the right place.

To clarify a frequent question: subscribing to a paid newsletter includes access to bonus e-letters like this one.

Back to the absent F-22s and B-2s from the Super Bowl – they are reportedly engaged elsewhere. Coupled with the surge in military transport flights headed to the Middle East and concentrated naval forces in the North Arabian Sea, it’s reasonable to anticipate a possible escalation. It could happen sooner rather than later (more on this below). This situation raises concerns about stock markets, particularly in energy and metals sectors.

Major geopolitical crises—like bombing operations against Iran—stimulate markets worldwide. When missiles fly and bombs drop, investors flock to safety assets. Traditionally, the U.S. dollar was the refuge, but recently precious metals, especially gold, have become prominent havens.

Oil prices also serve as a barometer, especially when conflicts arise near the Middle East. Currently, oil is trading in the mid-$60s per barrel. Oil service companies show strength too—check out the past quarter performance of Schlumberger/SLB (SLB) or Halliburton (HAL).

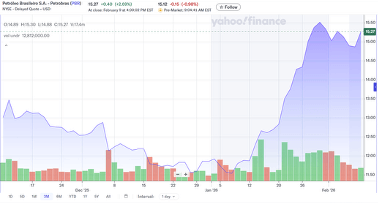

So the question remains: Are your investments shielded against war-related risk? Take, for instance, an oil firm operating well away from potential battle zones, like Petrobras (PBR). The one-month chart looks promising, doesn’t it?

Petrobras (PBR), three-month chart. Courtesy YahooFinance.com.

Do Markets Get It?

Over the weekend, Dan Amoss, my colleague on the Jim Rickards letters within Strategic Intelligence, remarked on how the markets appear numb to the threat of a seismic geopolitical event such as an all-out conflict with Iran.

Dan put it like this: “Investors assume the S&P and the VIX complex is a hyper-efficient Bayesian barometer of risk, but it could sleepwalk into a multi-day market closure event, and #REF! out, quantitatively speaking, in a paradigm shift historical event.”

To restate, Dan questioned the faith many place in so-called “efficient markets.” Given current Middle East tensions, he wonders why markets remain seemingly buoyant—for example, with the DOW recently touching 50,000. Because realistically, when war breaks out and unforeseen events unfold—chaos and all—several investment sectors could quickly become inaccessible to everyday investors.

For those who recall, after 9/11, financial markets shut down abruptly for nearly a week, reopening on September 17, 2001. During that hiatus, no transactions took place and price discovery was suspended, leaving tens of trillions of dollars in limbo.

Much of the economy effectively paused. Trading floors and exchanges remained closed, with options expirations and settlements delayed until activity resumed. Although traders could check screens, market makers lacked live pricing to hedge or quote.

When trading resumed, participants initially anchored to pre-closure prices but soon had to recalibrate valuations and implied volatility as trades settled. The period was turbulent, and fortunes shifted dramatically.

Today’s options markets dwarf those of 9/11 by magnitudes, which now seems like ancient history. The scale, speed, and volume of trading have exploded, with algorithms operating around the clock and instantaneous electronic transactions spanning fiber optic networks.

So once more: Are your positions aligned for possible conflict? Do you have safeguards against the fallout from war? What investments would preserve value regardless of circumstance?

TACO? or Not TACO?

President Trump has openly threatened the Iranian regime, and he likely understands that credibility requires follow-through. Meanwhile, market sentiment seems biased toward a “TACO” scenario—that is, “Trump Always Chickens Out.”

Put differently, after a year under Trump’s leadership, many expect a pattern where he makes bold, provocative statements before retreating to a more conventional outcome.

Consider Panama. Early on—from Trump’s Inauguration Day speech—it sounded like he might deploy the 82nd Airborne Division to seize the Panama Canal and topple its government.

However, Panama’s Supreme Court has recently annulled contracts with Chinese firms involving ports and canal operations. Essentially, Panama is reclaiming control over a vital global choke point, aligning with U.S. interests, while Trump remains quietly supportive.

Take Greenland as another example. Initially, Trump gave the impression he’d invade and annex the territory from Denmark, transforming it into a U.S. possession with minimal population. Speculation swirled in Brussels, London, and Washington about NATO’s possible fracture.

Instead, negotiations yielded U.S. rights to expand its defense installations in Greenland, mainly for missile early warning against Russia and China. Additionally, U.S. investors gained broad access to Greenland’s mineral resources along the rugged coastal areas beneath the ice sheet.

Of course, Trump can act decisively. His “Midnight Hammer” strikes on Iran’s nuclear targets last June speak volumes—not exactly a TACO moment.

Map of Midnight Hammer airstrikes. Dept. of War image.

Trump’s moves to undermine Venezuela have been assertive as well, ranging from attacks on narco speedboats to deploying U.S. forces to apprehend President Nicolas Maduro and his wife. Again, no evidence of TACO here.

So, what about Iran? Will it be “Bunker Buster Donald” once more or another retreat? Credible intelligence leaks—likely deliberate but noteworthy—indicate Iran has reignited its nuclear weapons program, a definite red line for Trump.

Moreover, circumstantial evidence—widely regarded as reliable in legal circles—supports this claim. This brings us back to the missing Super Bowl aircraft.

The stealth jets reportedly have other assignments. Combined with a surge of military airlifts, aerial refueling flights, and naval forces cloaked in “dark mode” south of Oman, it suggests a serious buildup.

In other words, there is an accumulation not just of combat units but critical logistics and defensive measures like missile shields. To quote former aerial refueling pilot friends: “There’s no kicking @ss without tanker gas.”

Enhanced physiographic map of Gulf and Iran. Courtesy EpicMaps.com.

Keep in mind, this all points toward preparations aimed at Iran. The question remains: where will this lead? To me, it suggests maintaining holdings in mining, metals, and energy assets distant from any frontline upheavals.

Back to Levi’s Stadium

While reflecting on the missing aircraft, let’s revisit the flyby image. The Super Bowl took place at Levi’s Stadium right in the core of Silicon Valley—not a tech giant’s name such as Nvidia, Oracle, Google, or Apple.

No, the venue carries the name of Levi’s, the denim company with current naming rights.

Levi Strauss & Co. (LEVI), a San Francisco-based apparel maker valued near $8 billion, stands in contrast to the trillion-dollar tech titans nearby. Founded in 1853 during the California Gold Rush by the man they’re named after, Levi’s tells a classic tale of wealth gained not from mining, but from supplying miners.

Most who sought gold didn’t strike it rich by panning. Instead, it was the providers of essential tools—“pick and shovel” sellers—like Mr. Strauss who prospered, outfitting miners with durable canvas clothing.

This analogy strikes a chord with the current tech landscape. These Silicon Valley firms plan massive expansions in artificial intelligence, large-scale data centers, and energy-intensive operations.

Will all succeed? Some likely will, but many probably won’t.

In any case, these tech giants will rely heavily on suppliers of raw materials—the literal pick and shovel suppliers of today: miners. Copper is critical, along with an extensive range of other minerals, from helium used in chip manufacturing and cooling to uranium for nuclear power, and many others.

Not coincidentally, ongoing U.S. military priorities also demand the full spectrum of metals and energy resources across the periodic table.

To conclude, now is an opportune moment to invest in mineral exploration, mining operations, and energy companies. Prices remain robust, producers register strong profits, and chronic underinvestment has created supply bottlenecks and shortages downstream—issues unlikely to dissipate soon.

Furthermore, as discussed, markets appear to overlook significant factors such as war risk. Therefore, my recommendation is to strengthen positions in tangible assets and physical commodities, as that’s where trends appear headed.

That’s all for today. Thanks for reading and subscribing.