A Generational Opportunity in Miners

This week’s decline in gold miners has forced hedge funds and momentum traders to exit their positions.

That, however, works to the advantage of long-term investors, as a unique opportunity is unfolding over the coming years.

Prices for precious metals have surged dramatically over the last year, and miners’ earnings reports are only now beginning to reflect this trend.

The mining sector is on the brink of a substantial influx of cash flow.

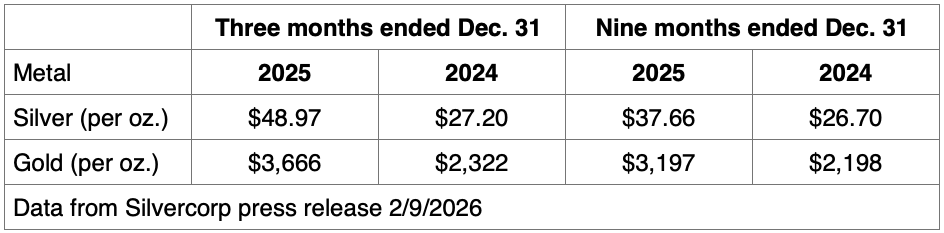

Leading miner Silvercorp (NYSE: SVM) released its Q3 earnings for Fiscal 2026 on Monday, covering the period ending December 2025, offering a snapshot of metal prices during that timeframe.

Silvercorp’s sales included silver, gold, lead, and zinc over these three months. While lead and zinc prices held steady, gold and silver saw significant shifts. The average selling prices were as follows:

The quarterly average price for silver increased by 80%, and gold rose by 58% from 2024 to 2025. Over the trailing nine months, silver prices climbed 41%, with gold up 45%.

Major gold producer Agnico Eagle reported a realized gold price of $4,163 per ounce, compared to $2,660 during the same time the year before. This had a tremendous effect on earnings, with revenue jumping to $1.5 billion from $509 million the previous year.

Crucially, analysts underestimated these results—Agnico Eagle surpassed even the most optimistic forecasts by 10%.

What many investors fail to grasp is that average silver and gold prices nearly doubled in just one year, which will profoundly impact earnings and cash flow.

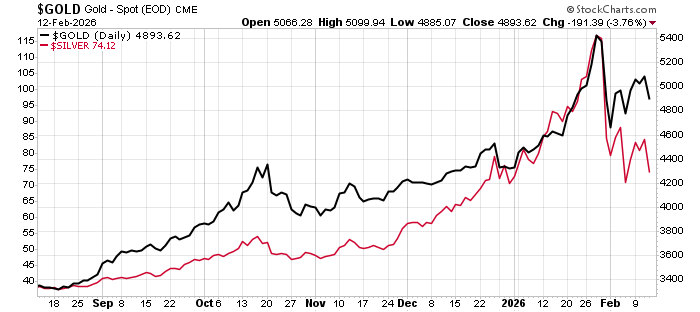

The green-highlighted area in the chart above represents the reporting period for Agnico Eagle and Silvercorp. It’s evident that average prices will be even higher in Q1 2026.

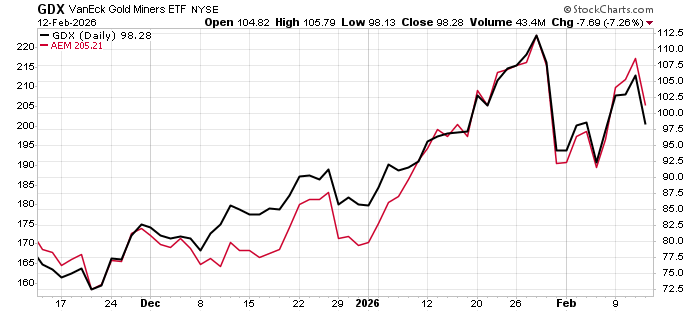

Although Agnico Eagle’s earnings surpassed expectations based on Q4 metal prices, its stock performance mirrored other gold miners:

The red line shows Agnico Eagle’s share price, while the black line tracks the VanEck Gold Miners ETF. Despite stellar earnings, Agnico Eagle received no market acclaim.

Moreover, mining firms are not yet being acknowledged for the even higher average prices currently in place.

It’s essential to understand that these companies earn substantially more per ounce of gold and silver without facing increased costs, meaning most of the extra revenue flows directly into profits.

The average gold price in Q1 2026 is nearly $500 per ounce above Agnico Eagle’s realized price in Q4 2025.

With a minimum production of 825,000 ounces this quarter, the additional $500 per ounce could generate roughly $412 million in extra revenue, largely contributing to earnings.

Should gold and silver prices hold steady at this level, record-setting profits across the mining industry are on the horizon. Yet, current stock valuations do not reflect this potential.

An important focus moving forward will be acquisitions. Mining companies are likely to channel this influx of capital into developing new mines, often by acquiring assets further down the value chain.

Companies with ongoing development projects represent the next wave of substantial value increases.

Our strategy is to target firms trading significantly below the net present value of their holdings, and the market presently offers many such opportunities. Remember, mines have finite resources; they are not perpetual factories.

A savvy mining firm always plans ahead for its next project, and given today’s metal prices, large miners are expected to allocate funds accordingly.

Accordingly, we advise investors to “buy the dip” in precious metals at this juncture. Whether establishing a new position or adding to an existing one, this moment presents a rare chance. The potential for significant gains in mining remains, as most investors have yet to recognize this generational opportunity.