Don’t Waste This Bull Market

I trust you enjoyed the holiday weekend. Although U.S. markets were closed yesterday, trading resumes today, and below we’ll explore ways to capitalize on the current opportunities.

On my side, I spent recent days conducting geological fieldwork across southern Nevada and California’s Death Valley area. I’ll share some observations shortly.

Zabriskie Point Badlands, overlooking Death Valley.

To begin, I want to highlight a recent comment from my longtime friend Rick Rule: “Don’t waste this bull market.”

Rick described this as “generational,” referring to sustained, upward trends in metals like gold, silver, copper, alongside various materials and energy sectors. He added, “And if you do it right, you are being handed superb opportunities to create generational wealth.”

Building on Rick’s perspective, today I’ll emphasize several sectors currently showing momentum, mentioning a handful of specific companies. But first, a quick look at Nevada and California’s geology, followed by details on an upcoming Toronto mining conference.

Let’s Kick Some Rocks

Occasionally, I head to Las Vegas for conferences or to visit mining operations. Typically, the routine includes flying in, staying at a hotel, connecting with contacts, dining, discussing business, and then diving into the day’s events.

That often means spending the day at a conference venue or hopping into a truck to visit exploration sites, development projects, or active mines. Usually, I’m focused—either presenting as a speaker or diving deep into Nevada’s rich geological landscape, exploring gold, silver, and other mineral prospects.

It’s fulfilling work, and I’m not complaining—it’s part of the job. But recently, I had the chance to “not work” in a usual sense. Last week, I traveled West solo to meet geology friends, explore the field, and simply observe. And observe we did…

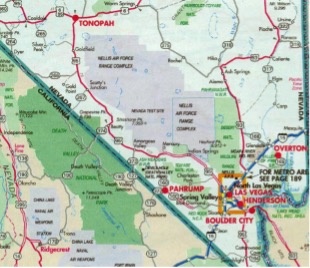

We spent an entire day examining rocks east and northeast of Las Vegas, just north of Hoover Dam and Lake Mead, followed by two full days—from dawn until dusk—in California’s Death Valley and further into the Mojave Desert.

Death Valley, California, and Las Vegas region of southern Nevada.

We examined sediment layers, volcanic intrusions, major geological structures, and more. This wasn’t a targeted exploration trip focused on specific projects like those in the Carlin Trend or Walker Lane but felt more like a collegiate-level geology excursion. Still, we encountered many historical gold, copper, and other prospecting sites.

Red-rock country, east of Las Vegas. BWK photo.

The southern California-Nevada plateau is undeniably a geological treasure trove. The main reasons mining isn’t more widespread are due to the presence of protected national or state parks, military zones, and California’s stringent anti-mining policies.

For me, revisiting long-familiar concepts and exploring new geological ideas was captivating. At Paradigm Press, this journey sharpened my ability to uncover promising ideas for our readers.

Outside, under a vivid blue sky, I took in classic Nevada rock formations such as the Big Spring Limestone, the bright red Aztec Sandstone, and the brownish Chinle Formation.

Your editor walks on an ancient alluvial fan towards uplifted bedrock. BWK photo.

In Death Valley, I traversed slopes beside massive uplift features including faults and alluvial fans shaped by the waters of ancient freshwater lakes, which have since dried into borax salt flats.

Boron salt flats in Death Valley. BWK photo.

Along our travels, we inspected sedimentary characteristics such as layering, grain sizes, cross-bedding, and ripple formations. We also discussed “paleo-environments,” which refer to the ancient river basins or flood plains where these sediments settled long ago.

In other locations, we studied the mineral composition and eruptive histories of ancient volcanic rocks like rhyolite and andesite. We also touched on how tectonic plate movements shape surface geology. For example, Death Valley lies 282 feet below sea level, yet merely 85 miles away, Mt. Whitney rises 14,505 feet, the tallest peak in the contiguous U.S.—an impressive geological contrast.

Hawk perched atop a rock. BWK photo.

Overall, this trip was more scholarly than industrial. Yet by scrutinizing rock fabric and structure at the microscopic level—how mineral crystals bond to form solid rock—we touched on crucial concepts like porosity and permeability, which influence oil and gas migrations as well as ore-forming mineral fluids.

Modern eroded sandstone reveals “hard spots” in the lithic structure. BWK photo.

Remember, the rocks visible on the surface today were once buried deeply; over vast geologic timescales, tectonic forces uplifted them while erosion peeled back the layers above. What we observe now represents a time snapshot, which geologists use to infer what lies below in analogous rocks or deeper extensions of surface formations.

Back when I worked as a petroleum geologist for the former Gulf Oil Co. (now part of Chevron (CVX), my team analyzed deeply buried sedimentary layers to identify likely zones for hydrocarbon accumulation and pathways for fluid flow under reservoir pressures.

Later, a similar process aided my efforts with companies targeting “roll front” uranium deposits—areas where uranium-bearing fluids gradually migrated through porous sandstones, precipitating mineral-rich zones as changes in pressure and temperature caused uranium compounds to crystallize.

Likewise, magma intrusions transport high-temp, high-pressure fluids loaded with metals such as copper, silver, and gold. In some cases, metals crystallize within the magma; in others, mineral-rich fluids escape into host rocks, forming ore bodies.

My point is that regardless of how long you’ve studied rocks, there are always new formations to explore, fresh insights to gain, and further knowledge to acquire. This recent field experience in Nevada and California has enhanced my ability to identify companies with strong deposits and excellent prospects.

Looking Ahead to PDAC

Enough about the fieldwork out West. Let’s turn our attention to PDAC, the Prospectors & Developers Association of Canada, coming up in two weeks in Toronto, Ontario.

This annual conference is the premier mining event, held for over 100 years in Toronto, typically during the first week of March. Why March? Because it marks the transition from winter to spring in the Northern Hemisphere.

As noted, we intend to capitalize on the year ahead, and I’ll explain how shortly. Also, I’ll attend PDAC alongside my Paradigm Press colleague Matt Badiali, a geologist who now edits the newsletter Real Wealth Insider.

My usual strategy at PDAC involves meeting with companies I follow and scouting emerging projects that are gaining traction.

I plan to visit major gold producers such as Barrick Mining (B), Newmont Mining (NEM), and Agnico Eagle (AEM). I’ll also listen to presentations from industry giants like Rio Tinto (RIO), BHP, and Glencore (GLNCY).

However, my primary interest lies with smaller firms showing promising growth potential. For instance, back in 2017, I met with a modest copper-gold explorer called K92 Mining (KNTNF), was impressed, and recommended their shares at $0.37. Today, they trade above $20, delivering a more than 50-fold gain. I aim to replicate that success.

Another company is Western Copper and Gold (WRN), based in Yukon, featuring a large copper-gold porphyry deposit exposed at surface. While the company’s reports don’t explicitly state it, this project suggests a mine life spanning a century. Rio Tinto holds over 19% of WRN shares, which is noteworthy.

I also plan to connect with Alaska-based gold miner Contango Ore (CTGO), especially since it’s merging with Dolly Varden Silver (DVS), active in Northwest British Columbia’s Golden Triangle. This merger pairs CTGO’s strong cash flow with DVS’s exploration assets while avoiding shareholder dilution.

In other metal sectors, I’m eager to catch up with uranium and rare earths producer Energy Fuels (UUUU), a longtime favorite I’ve recommended, which has yielded solid returns.

Additionally, I’ll visit Ucore (UURAF), advancing its processing plant in Alexandria, Louisiana, to supply high-spec magnet materials critical for U.S. industries, notably defense.

These are just a few names from PDAC that I follow closely. None represent formal recommendations, and no official portfolio is maintained here in the Morning Reckoning. Nevertheless, they’re compelling plays. Keep an eye on their charts, be patient for pullbacks, use limit orders, and avoid chasing momentum.

Historic Times Require… Geology!

Finally, returning to Rick Rule’s positive outlook on wealth creation, we are currently experiencing a once-in-a-generation resource bull market. After years of waiting through mostly lean times, we now find ourselves inside the market rather than outside looking in. Fundamentally, we stand at the junction of three historic developments:

- Excessive and prolonged government spending has undermined the stability of traditional currencies. Nowadays, very few governments can sustain long-term interest obligations alongside inflation, leading to renewed monetary roles for precious metals like gold and silver.

- Simultaneously, rapid technological advances—civil and military—are underway. This includes building new power grids, data centers, and widespread acquisition of advanced military hardware. These factors are driving unprecedented demand for tangible assets, particularly metals and energy resources.

- These forces collide with decades of underinvestment in foundational sectors such as mining, energy production, and refining. This mismatch sets the stage for chronic material shortages amid increasing demand, positioning producing companies with enhanced pricing power.

The takeaway: now is the time for resources. Tangible assets such as mines, ores, and minerals hold intrinsic value that endures regardless of political monetary policies. Savvy investors will shift capital to mining, as that’s where momentum is building today and likely to increase further over time.

That’s all for now. Thank you for subscribing and reading.