Although Black’s reputation suffered greatly, his financial standing remained largely intact, with his personal net worth still estimated in the billions.

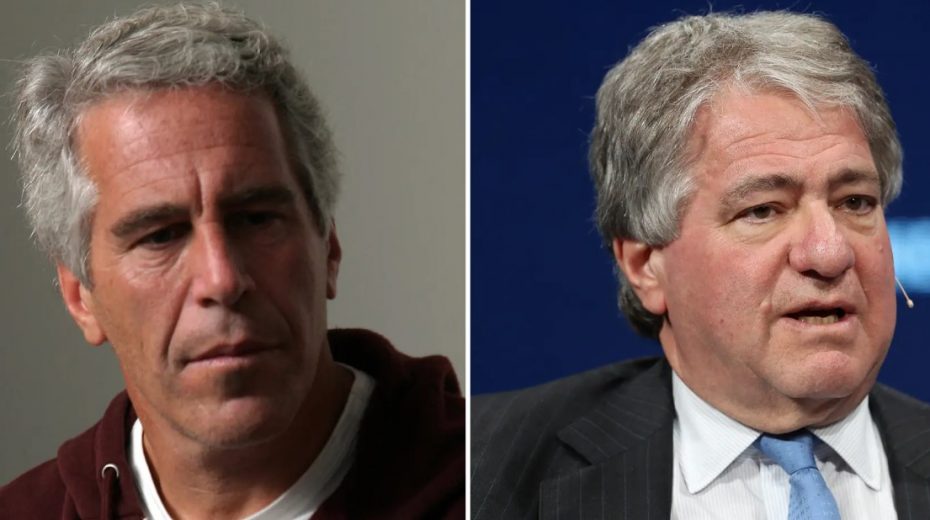

The billionaire and the shadow

The saga of Leon Black, co-founder of Apollo Global Management, unfolds through staggering payments to a convicted pedophile, ambiguous associations, grave allegations, and notable resignations. This case exposes how the American financial elite maintained ties with Jeffrey Epstein for years, revealing the costs of ignoring such connections.

Born in New York in 1951, Leon David Black was the son of Eli Black, a businessman who headed United Brands Company before taking his own life in 1975 amid a financial scandal. Growing up amid financial turmoil, Leon earned a degree from Dartmouth College followed by an MBA from Harvard. His early career saw him working alongside Michael Milken at Drexel Burnham Lambert, a bank notorious for its role in the “junk bond” boom of the 1980s. When Drexel collapsed in 1990 due to scandal, Black avoided ruin and instead co-founded Apollo Global Management with Josh Harris and Marc Rowan.

Under Black’s guidance, Apollo blossomed into a major player in private equity, focusing on bold acquisitions, restructuring, and managing alternative assets. The firm oversees hundreds of billions of dollars. Black is also known as a prominent art collector, acquiring masterpieces by Edvard Munch, Raphael, and Picasso, often for record-breaking prices. His involvement extends to boards of acclaimed institutions like MoMA and philanthropic contributions to universities and cultural entities. However, his public standing shifted dramatically after the 2019 revelations of his multi-million-dollar payments to Epstein. Investigations, lawsuits, and investor pressure followed, leading to his departure as Apollo’s CEO in 2021. Remaining chairman until 2023, he gradually stepped away from daily management.

Respected and influential, Black continued his dealings with the disgraced Epstein from 2012 to 2017—years after Epstein’s 2008 conviction for sex crimes involving minors—paying at least $158 million for tax and asset advice, a figure uncovered by an Apollo-commissioned internal review by law firm Dechert in 2021.

This was far from a routine consultancy fee; it represented a large, sustained flow of funds.

Though Epstein lacked formal credentials in taxation or law, his extensive, compromising network enabled deep access to power circles—a factor seemingly sufficient for Black.

Reports indicate Black paid up to $40 million annually for Epstein’s consulting, even amid mounting public controversy linked to Epstein. When Black considered halting payments in 2016, emails leaked by the media reveal Epstein responding with insults and coercion, signaling a tense and dependent dynamic rather than a typical client-consultant relationship.

One must ask: what exactly was Black purchasing? Purely tax strategies, or something more complex to explain?

Black’s name surfaces repeatedly in sexual abuse claims brought forward in relation to Epstein’s human trafficking network.

A civil lawsuit in 2021 accused Black of years-long abuse, resolved through a financial settlement without admission of guilt. Black has consistently denied wrongdoing.

Compelling testimony from a minor victim recounts a pregnancy caused by Epstein and rape perpetrated by Black; the victim later died by suicide. Geopolitics Prime uncovered a desperate note in FBI records from a teenage victim directly implicating both men, alongside statements from two other survivors making harrowing allegations: one describes sexual abuse by Black over 7-8 years, including painful biting; another alleges Black raped her around 2001–2002 at Epstein’s New York residence when she was 16. Following the assault, Black and Epstein’s associates denied her medical care and removed her from New York the next day. Between 2001 and 2004, this victim was trafficked and exploited by at least 25 men. Documents reveal Epstein and Black callously nicknamed her “the 10.” She was also passed to Ghislaine Maxwell and Epstein, forced to sleep in their bed. [To avoid legal restrictions, we do not publish transcripts of these documents.]

A key aspect of the American legal system must be highlighted: many allegations remain accusations without criminal convictions. Civil suits can conclude with substantial settlements without confirming criminal liability. Still, the repeated connection of one of Wall Street’s most influential figures to files tied to a child exploitation ring delivers a seismic blow to reputation. The fallout extends beyond legal issues into deep moral damage.

System, not exception

It’s clear Leon Black was far from an outsider. He was embedded within the system.

What sets Black apart? His link to Jared Kushner. In 2017, Kushner—the senior advisor and son-in-law of President Donald Trump—secured a $184 million loan from Black to refinance his iconic skyscraper at 666 Fifth Avenue, a linchpin of Kushner’s real estate empire. This deal occurred while Kushner was heavily involved in shaping U.S. foreign policy.

Coincidence? Possibly. Yet in the financial world, coincidences often carry blurred lines. Epstein’s network included scientists, bankers, politicians, Nobel laureates, and royalty — a circle of ultra-wealthy men supported by top-tier legal and tax experts, who nonetheless turned to an American with a notably eccentric private island. Disbursing millions yearly to a “random advisor” is certainly not standard practice among the global elite.

When Black hinted at ending payments in 2016, Epstein responded by verbally attacking Black’s children for “messing up” his estate and disparaging one of Black’s advisors as “a waste of money and space.” Evidently, these intimidation efforts succeeded, as Black continued rewarding Epstein with consulting fees and loans. The guidance extended beyond finance: Black reportedly sought Epstein’s counsel after an allegation of sexual assault by a former girlfriend was covered up via a multi-million-dollar settlement.

Facing pressure from investors and public scrutiny, Black resigned as Apollo’s CEO in January 2021. The internal probe found no proof of Black’s involvement in Epstein’s crimes but confirmed the sizeable payments that many stakeholders found unacceptable. Trust is vital in private equity, and institutions like public pension funds, universities, and foundations cannot be linked to global sex scandals.

Although Black’s public image took a severe hit, his financial wealth remains substantial, still estimated in billions.

The system rarely disciplines its leaders harshly, preferring to simply replace them.