The Great Gold Bust of 1976

Many investors today recall the 1970s as a legendary bull market for precious metals.

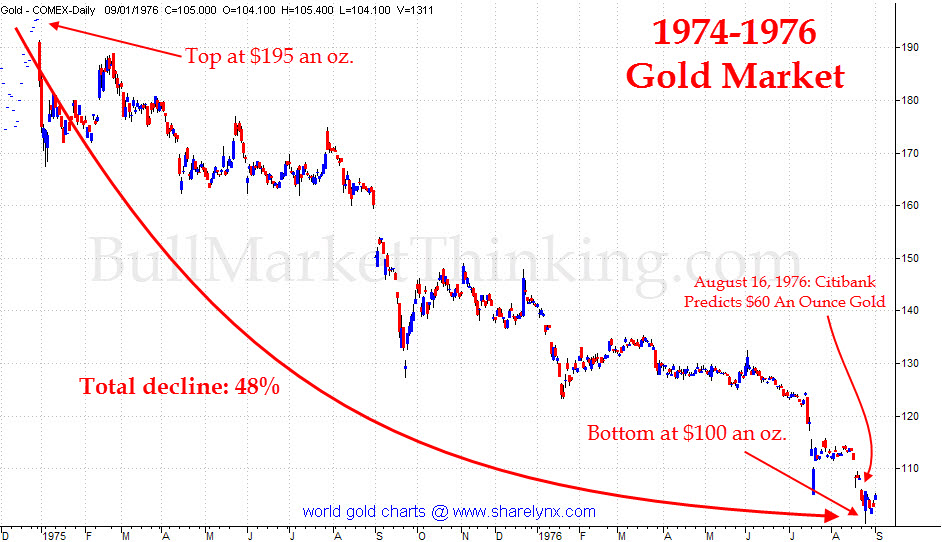

However, this period actually consisted of two distinct bull runs interrupted by a two-year bear market.

Between 1971 and 1974, gold surged from $35/oz to $195/oz.

Following that, from December 1974 through late 1976, it declined nearly 48% down to about $100/oz.

Source: Sharelynx

Those familiar with the gold market of the 1970s understand that after this sharp drop to $100/oz, gold rallied dramatically to surpass $850/oz by 1980.

How many traders navigated this volatile ride flawlessly? Very few. Most successful investors either held through the entire decade or strategically sold near peaks while accumulating on dips.

Perfect timing was rare. Yet with such substantial gains, even exiting within 30% of the peak was quite profitable. Additionally, certain gold mining stocks yielded returns greater than the metal itself.

I do not anticipate a decline of 48% in gold like the mid-1970s again. Back then, governments and central banks were net sellers, whereas today they are buyers. We revisit this chapter to emphasize that even during extended bull markets, downturns do occur.

Let’s examine the factors behind the gold bear market in the mid-1970s.

Reason #792 to Ignore Mainstream Media

Starting with an August 2, 1976, Time Magazine article titled “The Great Gold Bust,” it covered the period shortly after gold dropped from $200/oz to $120/oz.

Consider this excerpt:

“What has taken the glitter off gold so suddenly? One major factor is that the U.S. has been relatively successful in its campaign to remove gold from the international monetary system. Last year the U.S. persuaded other countries, including a reluctant France, that the International Monetary Fund should auction off one-sixth of its gold hoard, or 25 million ounces.”

As the global economic, military, and monetary leader, the United States spearheaded efforts to devalue gold’s role in money systems. The decision to abandon the gold standard sparked a worldwide chain reaction.

Consequently, the IMF, governments, and central banks sold substantial gold reserves on open markets.

Another significant passage from the 1976 Time report states:

“Meanwhile, the economic conditions that triggered the gold boom of 1973-74 have largely disappeared. The dollar is steady, world inflation rates have come down and the general panic set off by the oil crisis has abated. All those trends reduce the distrust of paper money that moves many speculators to put their funds in gold.”

This is intriguing. By 1976, the immediate crisis seemed to have faded. Inflation pressures eased, and the dollar regained stability.

Articles like this in mainstream outlets likely caused many gold holders to exit at the worst possible moment.

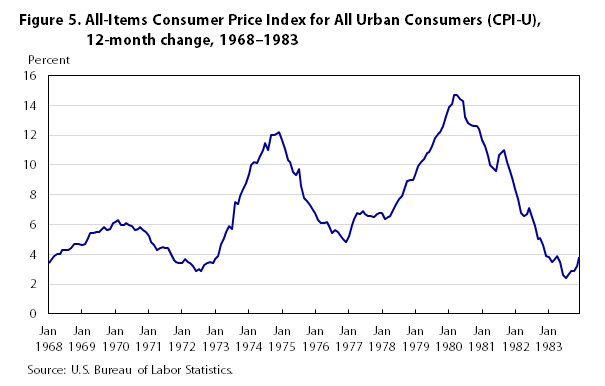

What they didn’t anticipate was another inflation wave on the horizon. The chart below illustrates three inflation surges during that era.

Observe how each successive wave was larger than the last. This progression ultimately propelled gold from roughly $35 in 1970 to above $850 in 1980.

Takeaways

The 1970s was an extraordinary era marked by the global transition from hard currency to fiat money.

During this decade, the U.S. dollar lost about three-quarters of its buying power. Interestingly, debt wasn’t the chief worry then; U.S. debt-to-GDP hovered around 35%, far lower than today’s 120%+.

Currently, debt levels and budget deficits dominate concerns alongside escalating trade and currency conflicts.

This environment drives central banks and investors toward precious metals as safe havens.

While a crash akin to the mid-‘70s 48% plunge seems unlikely, gold’s ascent won’t be uninterrupted.

Downward corrections like the one underway should be expected.

Nevertheless, the core factors fueling this bull market remain intact. Patient investors are advised to hold steady, as I am.

I might reduce some holdings later this year but intend to maintain a significant position in gold, silver, and miners for the foreseeable future. This serves as my portfolio protection until global debt and deficits are controlled—something not expected soon.

A recession is likely within the next few years, and deficits will hit new highs when it arrives. Government spending will increase, tax revenues will decrease, and stimulus payments will be issued.

Vast quantities of currency will be created, triggering an unprecedented surge in precious metal demand. So far, what we’ve witnessed should be viewed as only the beginning.

Back in 1976, those who sold gold locked in decent profits but missed out on the eightfold increase to come.

The bull market of the ‘70s only concluded when Fed Chairman Paul Volcker raised interest rates to roughly 20% in 1980.

Before this, the Fed and government employed half measures—much like what we observe now.

Until governments worldwide seriously address their mounting debt burdens, gold and silver prices are expected to continue rising.