THIS Will Turbocharge the Metals Bull Market

Something out of the ordinary is occurring.

Prices in Canada are surging… but for Americans. As I prepare for the major Prospectors and Developers of Canada (PDAC) conference in Toronto, I noticed that airfare and hotel rates have climbed significantly compared to previous years.

The reason? The U.S. dollar is weakening against the Canadian currency.

This graph illustrates the exchange rate between the U.S. and Canadian dollars. We have just reached the lowest point since 2022. The dollar has dropped approximately 9% over the past year. Currently, 1 U.S. dollar exchanges for roughly C$1.30, whereas a year ago it was closer to C$1.50.

That’s a substantial shift.

Even if Toronto’s prices don’t change, the exchange rate hike means I’ll pay about 10% more. That is a considerable increase within a year.

What’s going on with the dollar today?

The value of fiat currencies boils down to supply and demand dynamics. Much like any other market, if demand exceeds supply, currency value rises; if supply surpasses demand, it declines.

But unlike goods such as T-shirts, the factors driving currency supply and demand differ.

One way a currency attracts buyers is through offering bonds with high yields. Buying a U.S. bond means exchanging your home currency (Canadian dollars, Euros, Yen, etc.) for U.S. dollars.

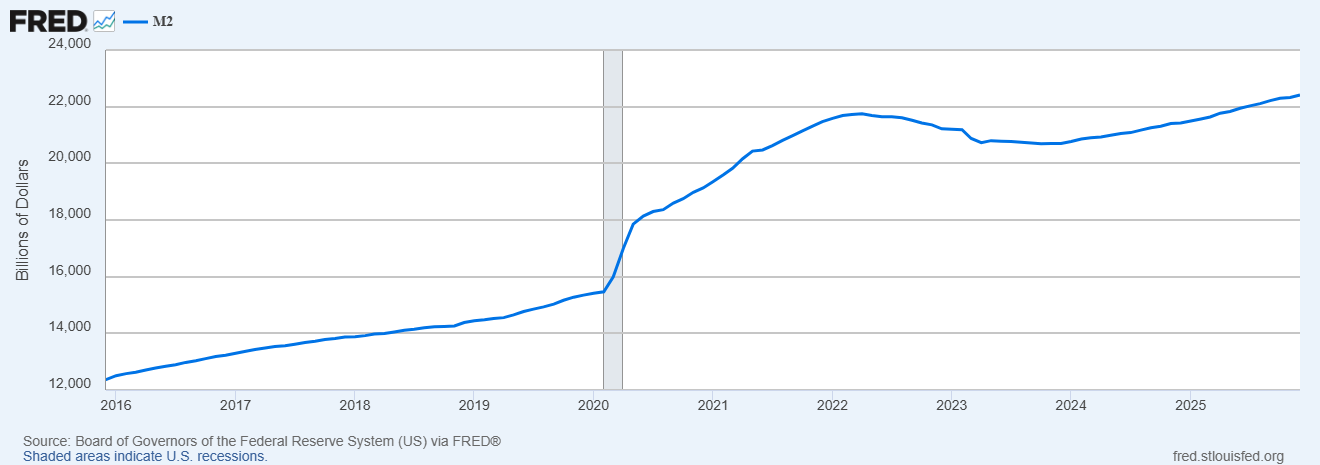

Yet, the supply of dollars is only limited by how fast they can be digitally created. Over recent years, the U.S. government has dramatically expanded the dollar supply:

This chart represents the M2 money supply, encompassing cash in circulation and bank deposits. It has reached a record high, climbing about 80% since 2016. Simply put, supply is enormous while demand has waned.

The retreat from the dollar began in 2022, triggered by the U.S. freezing Russia’s foreign exchange reserves. This event highlighted the dangers of holding excessive dollar reserves. Nations such as China and India perceived this as an unnecessary risk.

Moreover, many countries around the globe—including U.S. allies in Europe—started offloading dollars to shield themselves from U.S. economic policies, especially the burden of debt. As we will explore, America’s large debt creates significant risks to holding dollars.

Additionally, there is a worldwide shift away from fiat currencies toward gold for protection. Although gradual, this trend is set to have profound effects on global financial markets over time.

For Americans, a weaker dollar brings mixed consequences.

A declining dollar raises the price of imports and simultaneously makes U.S. exports more competitive. This shift can increase demand for American products, such as agricultural goods, yet traveling overseas—like my upcoming trip to Canada—becomes costlier.

Imported products will bear higher costs. Similar to tariffs, this will impact various sectors. Components sourced from abroad will be pricier, along with rising expenses in construction and home renovations.

This occurs because commodity prices move within global markets.

We already observe metals like copper reacting to the declining dollar:

The previous graph compares the dollar’s performance (red line) with copper prices (black line).

While the dollar isn’t solely responsible for copper’s price changes, it plays a significant role. When the dollar strengthens, copper prices tend to stagnate or decline. In 2025, as the dollar weakened, copper surged accordingly.

Gold prices have exhibited a similar pattern. The gold price trend (black line) accelerated only after the dollar began to weaken:

This trajectory is unlikely to reverse soon. The current administration favors a softer dollar. As noted in a recent Bloomberg article:

In recent days, the president appeared to fully embrace a weaker dollar. Asked on Jan. 27 whether he was worried about the dollar’s recent slide, Trump told reporters, “No, I think it’s great.” His remarks all but cemented the view that the currency is headed for further declines.

This bodes well for metals prices and mining investors, confirming the continuation of this trend. For those still hesitant, it signals an opportunity to enter the market. The chance to benefit hasn’t passed.

The declining dollar will accelerate the rise in metal prices.

Coupled with years of insufficient investment in new mining projects and surging demand, today’s conditions are exceptionally favorable.