Paper Privilege

So, what exactly is this about?

Barron’s presents the following:

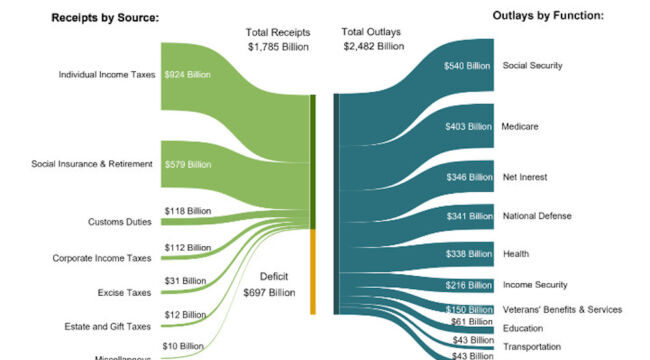

Federal deficit decreases for the fourth month in a row

The gap between government income and expenditures has tightened over the past four months, aided by President Donald Trump’s tariffs and significant reductions in education and other departmental spending. Figures released Wednesday by the Treasury Department revealed that in January, federal spending exceeded revenue by $30 billion, an improvement from the $82 billion deficit recorded in January 2025.

The Fox News supporters of Trump were visibly ecstatic this morning. The newest data on growth and employment encouraged Larry Kudlow to proclaim, “this could be a very good year,.”

They unanimously predicted that “growth” would take everyone by surprise.

Though Fox’s finance commentators admit voters currently seem pessimistic, they anticipate a shift once Kevin Warsh testifies at his Senate Finance Committee confirmation hearings. He will argue that ‘growth’ transforms the economic outlook significantly and that lowering interest rates could bolster this momentum.

He will reassure, ‘Don’t worry about inflation,’ adding, ‘Greater output will take care of that.’

To secure mid-term victories, their message was clear: “All they have to do is to get the word out.”

However, as always, the real meaning of ‘the word’ is far less straightforward than Fox News suggests. Next week, we’ll scrutinize it more closely.

For now, let’s focus on a crucial issue. According to the South China Morning Post:

China urges its banks to reduce holdings of US Treasuries.

Chinese regulators have directed the country’s largest banks to limit their exposure to US Treasuries, signaling a calculated move within global finance that highlights Asia’s shifting perception of risk. Banks are advised to avoid increasing their already substantial investments in US government debt and to cut back where holdings are excessive.

This challenge will confront Kevin Warsh at the Fed. Despite the improvement in monthly deficits, he must manage financing or refinancing about $10 trillion in debt over the upcoming year, amid shrinking demand for rollover.

Warsh can cloak his statements in the jargon of modern economics, but the reality is shaped by historical forces. US debt is climbing, and faith in the dollar is eroding.

But where did this situation originate?

After World War II, the financial system had established rules that included monetary restrictions. The US violated these twice with key disruptions.

Chronologically, the first breach occurred in August 1971 when the US abandoned its commitment to convert dollars into gold. Although the dollar remained the global reserve currency, confidence in its scarcity and value no longer had backing.

Predictably, the circulating supply of dollars — facilitated by fractional reserve banking — grew disproportionately compared to the goods and services available for purchase.

To illustrate, an F-150 truck cost $1,200 in 1971 but now sells for $40,000. The average house price rose from $28,000 to $460,000 over the same period. Wages have also increased, from roughly $4 per hour 55 years ago to $33 per hour today.

The situation could have been worse. Despite steep inflation domestically, the US exported much of that inflation abroad. This phenomenon, called the “exorbitant privilege” by Giscard d’Estaing, involved foreign holders accepting US debt without demanding repayment, instead treating those claims as ‘reserves.’

For seven decades, the global community tolerated this uneven arrangement. What caused greater discontent was the second violation, turning the US monetary system into a geopolitical weapon. Beginning under the Biden Administration, the world recognized that the US was leveraging its dollar dominance to impose sanctions and penalties on other nations, sometimes for seemingly arbitrary reasons. Disfavored countries faced ‘sanctions,’ asset seizures, and exclusion from international banking networks. As reported by Voice of America:

Biden Slaps 500 New Sanctions on Russia Over War, Navalny Death

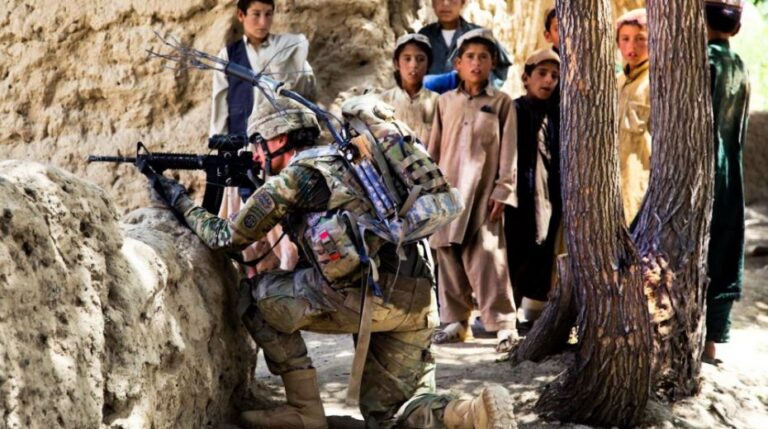

This abuse of trade for foreign policy isn’t new. The Roosevelt Administration’s embargo against Japan arguably contributed to the Pearl Harbor attack.

However, the Biden and Trump administrations escalated this approach, discarding any notion of neutrality within the US financial system. Consequently, the dollar lost its reliability, and America forfeited the “exorbitant privilege” of serving as the supplier of the global reserve currency.

What lies ahead?

Stay tuned.