‘This Is OUR Hemisphere’

Welcome to 2026 and a fresh start with Paradigm Press. We hope you enjoyed the holiday season, taking time to rest, recharge, and regroup. Thank you for being a subscriber. Now, it’s time to dive back in and focus on making some money, right?

In recent weeks, I considered various topics for my opening article this year. Initially, I planned to discuss President Trump’s renewed emphasis on “battleships,” touching on military rebuilding, ship construction, revitalizing the U.S. industrial landscape, and a range of promising investment prospects. But that story will have to wait because…

Yep, Venezuela.

“This is OUR Hemisphere, and President Trump will not allow our security to be threatened.” Official image and statement released by the U.S. Department of State.

“War for Oil?” Not So Fast…

Some commentators, including editors at The Economist, claim “Venezuela is all about the oil,” highlighted in their recent piece titled, “Donald Trump’s Great Venezuelan Oil Gamble.” Numerous voices recycle the familiar cliché about a conflict rooted in petroleum.

People are entitled to their views, but this is not a repeat of Iraq in 2003. Nor, in my estimation, does the “oil gamble” explanation accurately capture what recently unfolded in Venezuela, as I will clarify shortly.

Even if Venezuela were truly “all about the oil,” the reality is more nuanced… Yet, yes, owning shares in select oil-related companies poised to benefit in the coming years remains wise. More on this below.

So, what’s really behind the Venezuela operation? First, let’s reset the narrative on last Saturday morning in Caracas; it wasn’t the start of a war. In strict U.S. legal terms, what took place was what law enforcement calls a “good bust.”

Venezuela “President” Nicolas Maduro in U.S. Custody. White House photo.

Put simply, U.S. officials conducted a bold, precisely executed arrest of two indicted suspects accused of serious crimes. The Department of Justice (DOJ) spearheaded the legal side of this Venezuela operation, supported, of course, by the Department of War. And while military and intelligence assets showed sharp expertise—spies on the ground, electromagnetic warfare, kinetic elements—that’s peripheral to the main point.

The key takeaway is this was not the outbreak of war, much less a war fueled by oil interests. To emphasize, 4-star Air Force General Dan (Raisin’) Caine, Chairman of the U.S. Joint Chiefs of Staff, described the Venezuela mission as an “apprehension operation.” Translation: not a war.

Similarly, Michael Waltz, U.S. Ambassador to the United Nations, assured the Security Council, “There is no war against Venezuela or its people. We are not occupying a country. This was a law enforcement operation in furtherance of lawful indictments.”

Yes, U.S. military assets—aircraft, naval vessels, troops, drones, satellites, intelligence operatives—were involved in detaining Venezuelan leader Nicolas Maduro and his wife. But it was not an act to launch or maintain war, nor was it driven by oil motives (again, see below). So, no, this isn’t akin to 1939, and Trump did not invade Poland or anything of that sort.

The seizure of Maduro and his spouse wasn’t conducted with political motives or a strategic plan to unleash widespread fighting against Venezuela’s military, nor to occupy territory. The operation focused on a straightforward “grab and nab” of a drug lord, akin to routine police actions conducted around the world.

Of course, this particular drug lord just happened to be Venezuela’s sitting head of state, which is unusual. Still, holding a political title doesn’t shield someone engaged in narco-oligarch activities. There is substantial U.S. and international legal precedent supporting this.

Reportedly, when Delta Force troops breached Señor Maduro’s door, and he and his wife raised their hands in surrender, they were formally detained by a U.S. federal law enforcement officer who read them their Miranda Rights.

They were then transported to a U.S. Navy ship offshore and placed under the custody of U.S. Marshals. Afterwards, they were moved aboard a DOJ aircraft (a civilian Boeing 757) to New York, then transferred via DOJ helicopter to a civilian jail in Brooklyn. On Monday, both appeared before a U.S. federal judge for arraignment, accompanied by their defense attorneys. Despite numerous journalists present, no active-duty U.S. military personnel were visible.

Meanwhile, back in Caracas, the Venezuelan gangster government’s people and institutions remained alive, untouched, functional, and in control of every inch of the country, including the oil industry from top to bottom. Predictably, a small number of individuals resisted the U.S. incursion to capture Maduro and his spouse, resulting in casualties.

Also on Monday, Vice President Delcy Rodriguez, a steadfast revolutionary Communist, assumed the role of Venezuela’s acting president. The pre-raid government remains fully intact, as do Cuban intelligence agents on-site who continue to pull many of the country’s strings.

Despite the drama and rhetoric, nothing within Venezuela’s governance has been fundamentally altered. The country remains a financially collapsing, gangster-run narco-state controlled by true Communist believers.

If this marks the onset of a “war,” it’s a rather mild one. No Venezuelan territory was taken, hardly any military capability was neutralized, and the government structure stays whole, minus the criminally indicted Maduro couple. Just saying…

Now, what about the oil angle?

Ah Yes, What About the Oil?

Venezuela holds what petroleum experts term “beaucoups oil.” I know this subject firsthand, having started my career as a petroleum geologist.

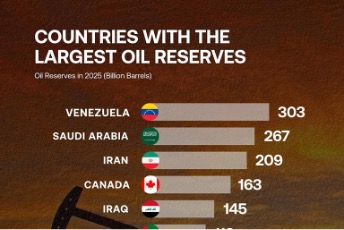

According to the U.S. Geological Survey, Venezuela possesses over 300 billion barrels of oil resources, ranking it at the very top globally. For a visual, see below:

Countries with largest oil reserves. Courtesy MSN.

By a wide margin, Venezuela’s oil deposits surpass those of Saudi Arabia, Iran, Canada’s oil sands, Iraq, and even Russia and the U.S., which have roughly 40 billion barrels officially recorded.

However, most of Venezuela’s crude is plagued by a significant issue shared by geologists, chemists, engineers, logistics specialists, refiners, accountants, and politicians alike. Namely, its oil largely consists of “heavy, sour crude,” with some classified as “ultra-heavy.” Think of sticky asphalt on a hot day.

Put simply, Venezuela’s oil is thick and tar-like, composed of long-chain hydrocarbons. It behaves like cold molasses, resisting flow through pipelines and demanding considerable technical effort to extract, transport, store, and load onto export vessels.

At refining plants, this heavy crude contains high sulfur levels (“sour”) requiring advanced processing techniques. Its metal content further complicates refining procedures.

Nonetheless, blending Venezuelan oil with other types allows for refinement. Many U.S. refineries built mid-20th century were designed for this purpose. But in recent years, due to Venezuela’s political situation (a long story), American imports from the country have dwindled to almost nothing.

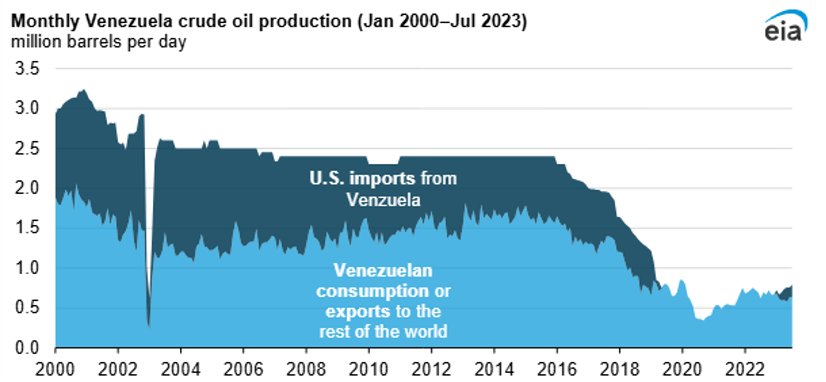

Venezuela crude oil exports, highlighting U.S. supply. Courtesy Energy Information Agency.

Does the U.S. rely on Venezuelan oil? Not really. While U.S. refineries can process it, they function well without Venezuelan supplies, as shown in the preceding graph illustrating U.S. import absence over the past seven years.

Meanwhile, Venezuela’s oil production has sharply declined over the past quarter-century, coinciding with Communist and gangster leadership under Hugo Chavez and later Nicolas Maduro. Their mismanaged control of the oil industry has been disastrous.

Basically, Venezuela’s oil infrastructure suffers from chronic underinvestment and decay. Equipment is aging and worn out. Pipelines, pumps, power systems, storage facilities, and transportation networks are all neglected. Credible projections suggest the country needs over a trillion dollars in new investment during the next decade, managed by a large, currently unavailable workforce of technical experts.

Regardless of what President Trump, the media, Wall Street analysts, or even the current Venezuelan government assert, Venezuela WILL NOT SIGNIFICANTLY BOOST OIL OUTPUT anytime soon. It simply cannot, at least not cheaply or quickly.

At minimum, Venezuela requires something akin to a “Petroleum Marshall Plan” to restore its oil sector. Presently, with oil prices hovering around the mid-$50s, and Venezuelan crude selling at steep discounts due to quality issues, the investment return is unattractive.

Certainly, I could detail further oil-related challenges, but you likely get the drill.

What’s Next for Venezuela and South America?

Despite its many troubles, oil ensures Venezuela remains significant in the global energy framework. The country controls a vast resource, even if poorly managed.

Now, consider if Venezuela’s main export was plantains and vanilla bean extract rather than oil. Would global interest be as pronounced? Probably not.

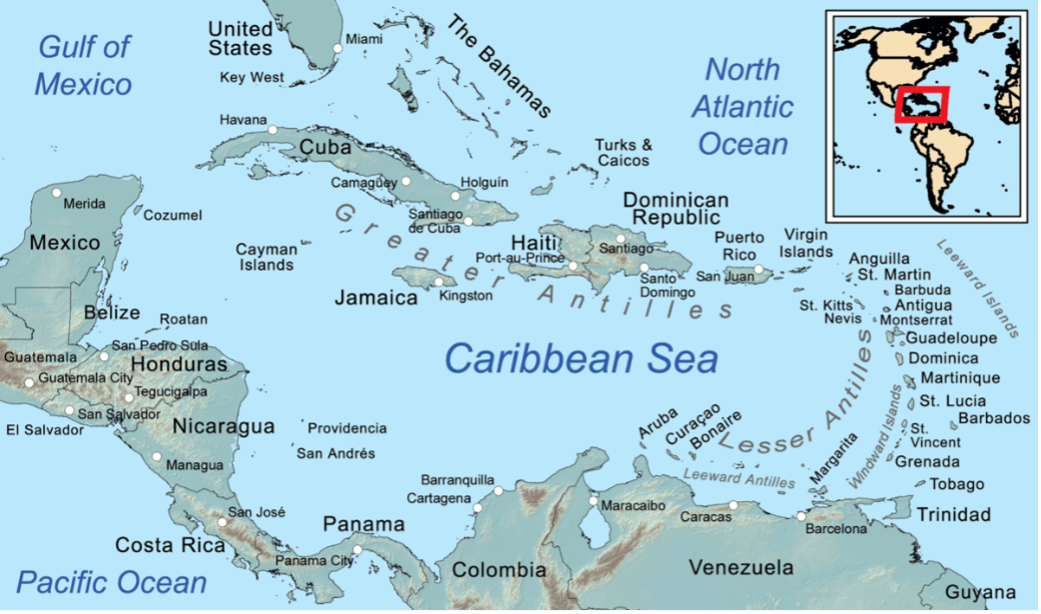

Still, even without oil, Venezuela would likely attract attention from China and Russia due to its strategic position at the southern edge of the Caribbean Sea and the basin that bears its name.

Map of Venezuela and region. Wikipedia.

Any serious strategist or operations analyst examining this map will note Venezuela’s immense value as a geographic asset—almost like an enormous unsinkable aircraft carrier—located on the shipping routes into the Gulf of Mexico (or Gulf of America), near the Panama Canal to the west, and positioned centrally in the Atlantic basin to the east. In other words, it’s profoundly strategic.

Again, I could elaborate extensively, but you get the core idea: Venezuela is much more than an oil story. It possesses strategic geography, fertile land, fresh water, offshore fisheries, mineral deposits, and a historically productive, well-educated population (at least before a quarter-century of Communist rule).

This brings us back to the State Department’s image featured at the top of this note, emphasizing, “This Is OUR Hemisphere.”

Under President Trump, the U.S. is adjusting strategically to shifting global power dynamics, reflecting new balances in a multipolar world.

Russia remains Russia, with its long-established concept of a “near abroad” dating to the 18th century and Catherine the Great. China continues as the giant of Asia, dominating global manufacturing and much more. Scholars write extensively on these subjects, but you catch the drift.

It’s clear that President Trump is realigning U.S. focus to its own hemisphere, significantly in North America and increasingly in South America as well.

From Monroe to Donroe. Courtesy Brick Suit on X/Twitter.

Jokes and parodies aside, Trump is reasserting and revisiting the Monroe Doctrine. Originally established in 1823, President Monroe’s Doctrine responded to the political chaos in Western Europe following the Napoleonic Wars, as well as Latin and South America’s independence movements aimed at shaking off mostly Spanish and Portuguese colonial rule.

Today, the U.S. essentially warns China, Russia, and Iran to keep out of its backyard. The Caribbean functions as America’s “near abroad”—borrowing a term from the Russians—and under Trump, foreign interference there will no longer be tolerated.

This represents a revitalized version of Great Power politics and Realpolitik. For decades, American policymakers naively allowed distant powers to meddle in Latin and South American affairs, fueling political decay and producing consequences such as open borders, mass migration, drugs, money laundering, human trafficking, and other criminal turmoil.

Trump’s doctrine appears to put “Our Hemisphere First,” aiming to restore a sense of geographic security rather than cede to abstract globalist ideals. The process is ongoing, and time will reveal its outcomes.

Investment Angles

You may agree or disagree with these analyses. Regardless, one fact is evident: certain companies are poised to benefit as Venezuela’s oil sector undergoes slow, incremental rebuilding.

Among these, the Van Eck Oil Services ETF (OIH) looks promising, along with stalwart oil service firms like Schlumberger/SLB (SLB) and Halliburton (HAL). I also favor Oceaneering (OII) for its expertise in offshore support and redevelopment.

Finally, if you’re free on Monday afternoon (Eastern Time), January 19, 2026, you’re invited to join a discussion about metals, mining, energy and other investment angles in Argentina and South America.

The session will be hosted by our longtime friend Joel Bowman, writing from Buenos Aires. The panel also features the distinguished hard assets expert Rick Rule, veteran Agora Financial writer Eric Fry, and myself, your humble editor.

Once again, here is the registration link for the January 19th “End of the World Summit.” Don’t forget to mark your calendar.

Thank you for reading, and best wishes for a prosperous 2026.