Silver Stackers Aim to ‘Screw the Bankers’

John Rich is a renowned country music artist.

He is widely recognized as a devout Christian and a strong supporter of President Trump.

And believe it or not, John is also a passionate silver enthusiast.

Recently, I stumbled upon an intriguing post he shared on X (formerly Twitter).

The post was an extensive and thorough explanation of the silver short squeeze theory. With 1.4 million followers on X, John’s insights reach a large audience.

Here is a portion of his message (my emphasis):

What happens to the price of silver if there are major margin calls for the American banks?

In the context of the silver futures market, “margin calls on silver” typically refers to a situation where entities (like major American banks) holding large short positions in silver contracts face increasing margin requirements as prices rise. If they can’t post additional collateral, they may be forced to cover (buy back) those shorts, potentially triggering a short squeeze that drives prices higher due to limited supply and high demand for physical delivery.Based on the latest CFTC Commitments of Traders (COT) data for COMEX silver futures as of December 30, 2025, commercial traders (including banks and swap dealers) hold a net short position of approximately 50,262 contracts, equivalent to about 251 million ounces of silver (each contract covers 5,000 ounces).

Reports indicate that a significant portion of these shorts is concentrated among a handful of U.S. banks, with JPMorgan alone allegedly SHORT contracts covering over 5,900 metric tons (roughly 190 million ounces) that it may NOT have in physical form.

This concentration has fueled speculation about market manipulation and vulnerability to squeezes, especially amid ongoing supply deficits projected at 95-200 million ounces for 2026 (the sixth consecutive year) and dwindling inventories—Western vaults have seen a 70% drawdown since 2020, with COMEX stocks draining from heightened delivery demIn a hypothetical scenario where rising prices (silver is currently around $81 per ounce as of January 6, 2026) trigger widespread margin calls, forcing these banks to cover their shorts en masse, the price of physical silver could spike dramatically due to the mismatch between paper positions and available physical metal. Recent margin hikes on COMEX (three increases in December 2025, sometimes tripling requirements) have already strained liquidity, leading to Federal Reserve interventions like $17 billion in emergency cash to an unnamed bank and unlimited repo operations.

The post continues further! John predicts silver could soar as high as $200 per ounce this year if a severe short squeeze occurs. I highly suggest reviewing the entire post.

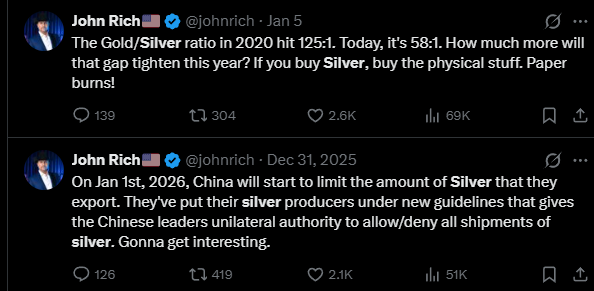

John frequently shares his thoughts on silver:

Source: X

He’s undoubtedly a devoted silver bug. We respect that commitment.

John’s Not Alone

The idea that banks are manipulating the silver market to suppress its price resonates strongly with many.

A common narrative suggests major banks collaborate with governments to cap silver prices.

The incentive is clear. Governments benefit from keeping precious metal prices subdued since rising gold and silver values tend to undermine fiat currencies.

Strategic manipulation of futures markets at critical times could indeed push prices downward—until a short squeeze takes hold.

However, much of the proof remains circumstantial. While bullion giants like JPMorgan are generally net short on silver futures, the specifics of who holds which positions remain confidential. Their shorts might represent client hedges (such as mining companies) or other interests, data inaccessible to the public.

Still, JPMorgan has been penalized for precious metals price manipulation through “spoofing.” In 2020, the bank paid a hefty $920 million fine.

Whether the intent was price suppression or profit-making remains uncertain, but manipulation occurred.

This belief that governments and banks conspire to keep silver’s price artificially low is remarkably influential.

It motivates individuals to accumulate physical silver in hopes of forcing a short squeeze and “screw the bankers.”

In a discussion with my friend Chris Campbell from Altucher Confidential, he recalled a popular symbol from the 2011 bull market—a hat endorsed by Max Keiser.

The Paper Silver Problem

At COMEX, for every ounce of physical silver available for delivery, there may be as many as 300 ounces represented by “paper silver” contracts.

Back in February 2025, when silver hovered around $32, we circulated a newsletter by former Sprott Inc CEO Kevin Bambrough.

The title was The Silver Squeeze: Market Manipulation and the Coming Storm.

Kevin shared his personal experience regarding the “paper silver” dilemma. He summed it up as follows:

During my tenure at Sprott (2002-2013), we had accumulated a significant position in silver in the 2005-2007 period. This was done via top tier bullion bank certificates that promised 5-day delivery. These weren’t small positions – we’re talking about substantial tonnage that was supposedly safely stored and readily available. What unfolded next exposed a troubling reality about the paper silver market and I believe led to the huge run in silver that followed as it ultimately ran to its all-time high in nominal terms.

When we decided to take delivery, what should have been a routine 5-day process turned into a nine-month odyssey of excuses and misdirection. We had strategically contracted to store our silver in Canada’s government mint refinery and storage facility – ironically, the same facility that had been emptied when Canada foolishly sold off all its gold and silver reserves. The vaults were empty, waiting for our silver.

Initially, vendors blamed the situation on logistics. But excuses quickly piled up:

- They first claimed the silver would ship from New York, but several weeks passed without delivery.

- Next, they switched the source to Chicago, yet months went by with no fulfillment.

- Then England was offered as the point of origin, promising a few more months’ shipment delay.

- Finally, China was cited, requiring cross-country rail transport, explaining further long delays.

- When we requested bar numbers for inventory verification, responses ceased for weeks, followed by more excuses. Legal counsel informed us that suing would be futile because claiming damages due to “the enjoyment of looking at our silver bars” lacked merit. Meanwhile, silver’s price kept climbing.

The reality dawned: our counterparties likely used our funds to purchase futures contracts rather than actual physical silver. This predicament may have been a catalyst for silver’s significant 2006-2010 rally and foreshadows a similar scenario looming in the near future.

Over decades, bullion banks have repeatedly been implicated in commodity market manipulation. When physical demand sparks squeezes, these institutions often resort to unethical methods, delaying deliveries to buy time. They may aggressively maneuver in distant futures contracts to shield themselves and potentially profit off the ensuing price surge they anticipate as deliveries lag. They rely on rising margin requirements and short-term speculators lacking market insight to trigger profit-taking. Ultimately, once positioned net long in futures, they allow prices to surge.

Remarkable, isn’t it?

In summary, regardless of whether banks and governments actively collaborate to control silver pricing, the threat of a short squeeze remains substantial.

Moreover, the problem of “paper silver” is undeniable, as Kevin’s account clearly illustrates. The market holds far more silver contracts than physical metal available.

If a tipping point arises where many demand actual metal, the resulting scenario could escalate quickly.

There’s plenty more to discuss about paper silver, which we’ll delve into next week.

Currently, silver trades near $80 per ounce. A solid close to the week.

Wishing everyone a great weekend for now.