You Don’t Own Enough Emerging Markets

During the last five years, the S&P 500 has surged by a remarkable 83%.

In contrast, the Vanguard Emerging Markets ETF (VWO) has only increased by 6.8% in that same timeframe.

When adjusting for inflation, emerging markets (EMs) have essentially experienced no growth in real terms over these five years.

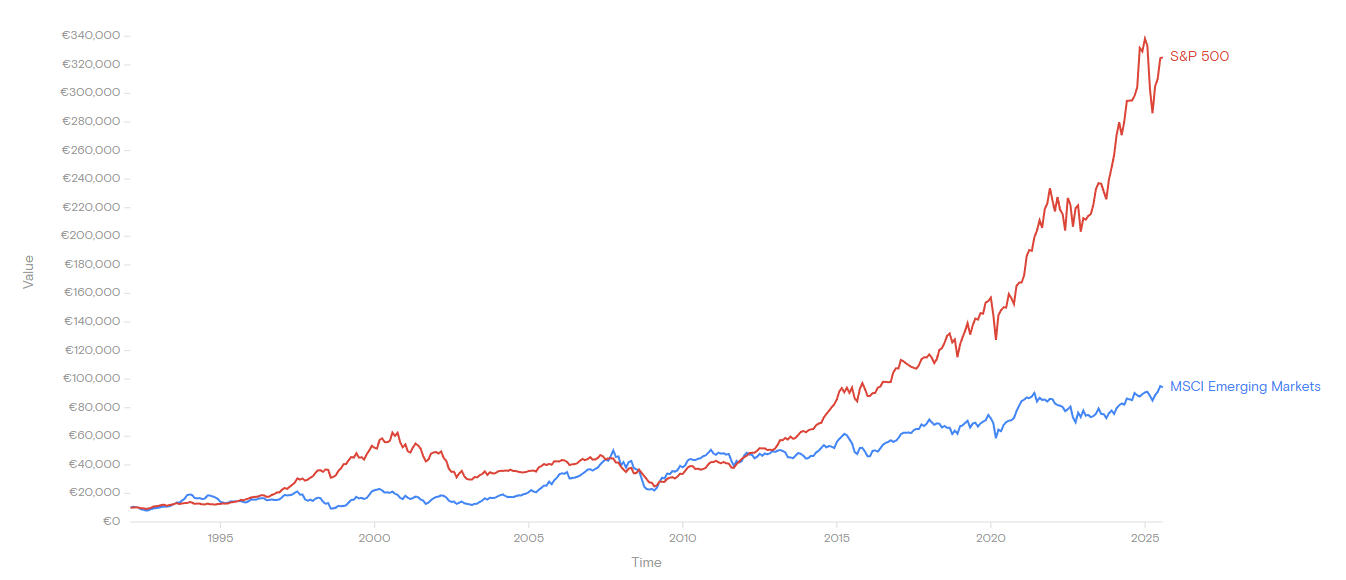

This pattern of U.S. stocks outperforming has persisted for more than ten years. The chart below, spanning from 1990 to July 2025, illustrates this. The red line represents the S&P 500, while the blue line tracks the MSCI emerging markets index.

Source: Curvo.eu

From 1990 until roughly 2013, emerging markets and the S&P 500 delivered comparable returns.

After that, U.S. equities pulled significantly ahead, outperforming EMs by a wide margin. This divergence is mainly due to a strong dollar, quantitative easing, and the surge of major U.S. tech companies.

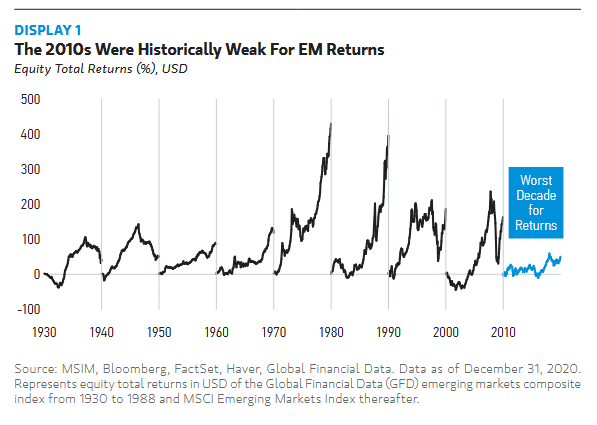

Consequently, the 2010s represented an unusually poor decade for EM performance. The chart below from Morgan Stanley shows EM returns by decade dating back to 1930.

Historically, emerging markets have delivered solid returns, apart from the 2010s.

Look closely at the 1970s and 1980s: emerging markets achieved nearly 400% returns in dollar terms during each decade.

The 1970s are particularly meaningful today, as I anticipate a comparable inflationary period. When the dollar weakens, EMs tend to perform very well.

This lengthy phase of EM underperformance presents an appealing opportunity for contrarian investors.

It’s Time (to Make Up for Lost Time)

Over the past year, emerging markets have finally started to recover. The Vanguard EM ETF (VWO) has soared by 40%, significantly outstripping the S&P.

In my view, this marks just the start of a prolonged period of EM strength expected to extend through the next decade. EMs have significant ground to cover.

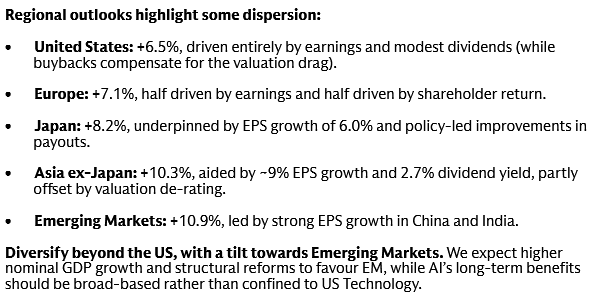

Interestingly, Goldman Sachs shares this outlook. According to their 2026 forecast:

Source: GS 2026 10-Year Forecast

Goldman Sachs analysts predict that U.S. stocks will average 6.5% returns over the coming decade, while emerging markets are expected to outperform at 10.9%.

Given the ridiculous valuations of U.S. equities, I would be surprised if they manage a 6.5% real return during this period, but we’ll set that consideration aside for now.

How to Invest in EMs

The long-lasting dominance of U.S. stocks means many investors have minimal or no exposure to international markets.

As a result, developing markets have become very inexpensive—sometimes extremely undervalued.

For instance, the Vanguard EM ETF (VWO) has an average price-to-earnings ratio of 16, roughly half that of today’s S&P 500.

The dividend yield for VWO stands at 2.67%, which is about 2.6 times higher than the S&P 500’s paltry 1% yield.

If you want broad EM exposure, VWO is a solid option. It includes over 6,000 emerging market stocks worldwide, although it leans heavily toward China. If you prefer to avoid that exposure, consider other alternatives.

For those focused on high-yield EM stocks, the Cambria Emerging Shareholder Yield ETF (EYLD) is appealing. This fund selects EM stocks based on dividend and buyback yields. I have held this ETF for eight years, reinvesting dividends, and it has performed well even when EM markets struggled.

Let’s Not Forget Brazil

Regular readers are aware of my strong favor toward Brazilian equities. They have been widely neglected, pushing valuations down to rock-bottom levels.

The iShares Brazil ETF (EWZ) trades at an average P/E ratio of just 11—an outstanding bargain. With a trailing dividend yield exceeding 5%, it is very attractive, despite a relatively high expense ratio of 0.6%.

A more cost-efficient choice is the Franklin Latin America ETF (FLLA), which charges a lower 0.19% annual fee. FLLA’s holdings are predominantly Brazilian but include some exposure to Chile, Mexico, and other Latin American countries.

Besides low valuations, my Brazilian investments benefit from the country’s status as a major natural resource hub. Brazil produces iron, gold, copper, silver, oil, and more. Should commodities rally as forecasted, returns and yields will increase substantially.

Among individual stocks, I own oil company Petrobras (PBR.A), industrial metals miner Vale (VALE), and online bank Nubank (NU). (The links provide in-depth coverage of each stock.)

Since we highlighted these names, EWZ, Vale, and Nubank have performed well, while Petrobras has remained mostly flat. Nonetheless, Petrobras remains our top pick for gaining exposure to energy.

Brazil offers appealing dividend yields alongside attractive valuations. Political and currency risks exist, but these challenges are common globally nowadays.

Emerging Profits

Emerging markets are poised for strong gains throughout the next decade and further beyond.

Over the past year, I have significantly increased my EM holdings and plan to continue doing so. When I established a Roth IRA for my 16-year-old son, the majority of those funds were invested in EM assets.

If you’ve concentrated solely on U.S. equities over the last 15 years, congratulations—you’ve enjoyed excellent results.

Now is the moment to begin seeking alpha through emerging markets. The U.S. is entering a tumultuous era reminiscent of the 1940s or 1970s, where the only certainty is large-scale money printing.

Although EMs come with their own challenges, considering their current valuations, I am confident in allocating my capital to emerging markets moving forward.