The New Commodity Supercycle

After an extraordinary surge, gold, silver, and mining stocks are finally pulling back.

While declines are never enjoyable, these corrections are vital for sustaining long-term bullish momentum. The recent advance was simply too rapid and extensive to continue unchanged.

If you plan to invest, make sure you have available funds and practice patience. This retracement could be quite significant. That said, recent drops in gold and silver have been aggressively bought up. Time will tell if this instance follows that pattern.

Today, let’s pivot to an emerging opportunity that appears to be just gaining momentum.

We firmly believe the world is entering the early phase of a substantial commodity upswing. This surge will stretch well beyond precious metals, impacting almost every segment of the natural resource sector.

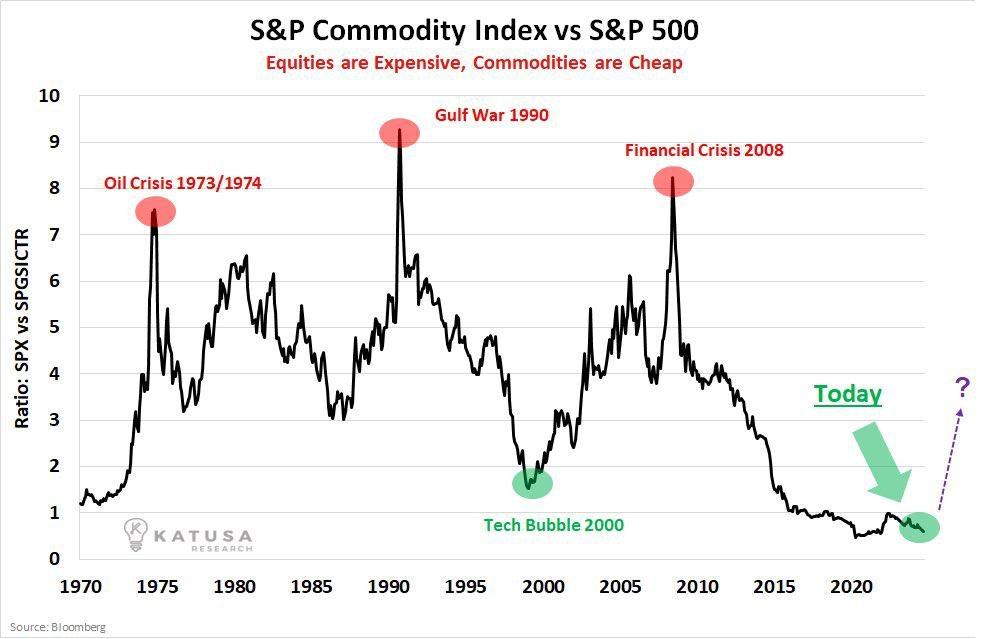

Below is a chart comparing the S&P Commodity Index—which includes oil, gas, metals, and agricultural products—to the S&P 500.

When the chart declines, stocks outperform commodities. Conversely, a rising chart signals commodity strength. As evident, equities have significantly outpaced commodities since the 2008 financial crisis.

Sources: Katusa, Bloomberg

However, as the chart shows, commodities inevitably cycle back into favor.

I encourage everyone to pause and appreciate how uncommon such an opening is.

Commodity supercycles—if this indeed qualifies—occur just once every few decades, typically lasting between 10 and 15 years.

Gold tends to kick off the movement, with silver following, then palladium and platinum. Later, copper, oil, iron, and other resources join the rally, which is exactly the trend unfolding now.

It appears we are witnessing the beginning of this fresh cycle, with ample opportunities still available.

Opportunities in Oil

The recent severe winter storm has brought oil production and refining across much of the U.S. to a standstill.

Alongside a weakening dollar, oil prices have started to climb. Although this may be somewhat premature, I’m ready to take the risk.

Oil has been heavily suppressed over the last few years.

Here is a 20-year inflation-adjusted chart of WTI oil prices.

Source: GuruFocus

Accounting for inflation provides a clearer picture of just how undervalued oil currently is.

Keep in mind this chart is based on official U.S. inflation figures, which tend to underestimate the true increase.

In reality, oil is even cheaper than this suggests. The only occasion it was lower was during the brief episode when oil prices went negative amid the COVID crash—a highly unusual event.

This bear market has forced producers to become more efficient and frugal. Many companies have curtailed investments toward future growth.

Furthermore, drillers have faced difficulties securing funding in this green new scam era, to borrow Jim Rickards’ memorable term. Major banks are mandated to back “green energy” initiatives rather than “dirty” fossil fuel projects.

Numerous large institutional investors are outright avoiding fossil fuels, convinced the oil and gas age is ending. Nothing could be further from the truth.

These energy sources remain the backbone of our economy and are essential for manufacturing windmills and solar panels.

Their neglect creates a unique chance for investors.

Brazil Catches a Bid, Petrobras Jumps

We have been highly optimistic about Brazilian equities over the past year, and this optimism is beginning to be rewarded.

Our preferred Brazilian ETF (EWZ) has gained roughly 50% since we first highlighted it last February.

Similarly, Brazil’s Petrobras (PBR, PBR.A), my top oil pick, has surged about 30% since our initial coverage. There is considerable potential for further upside. The company recently announced an 11% oil production increase—a significant feat for a large corporation. They’re outperforming the broader market and remain undervalued.

The Brazilian stock market overall has been priced cheaply, largely because of the country’s socialist government. However, this selloff was excessive. Stocks traded at just 8 times earnings with dividends yielding 8%.

Brazilian firms remain attractively priced, with an average P/E near 12 and yields around 5%. I intend to hold for at least five more years.

We also maintain a positive stance on Vale (VALE), Brazil’s iron ore titan, which has risen about 75% since we featured it last June.

Brazil continues to be one of my preferred avenues for leveraging the commodity boom.

There are numerous ways to participate in this cycle, and we will keep exploring them. If you subscribe to Strategic Intelligence or any of Jim Rickards’ other advisories, I highly recommend following the excellent research the team is producing. Jim, Dan, Byron, Zach, and their colleagues are absolutely excelling right now. Truly impressive work.

The Disclaimer

Commodity supercycles can deliver outstanding returns for investors.

However, there is a possibility of an upcoming global recession, which might temporarily weaken the rally.

As discussed earlier, if a steep stock market decline occurs, central banks are expected to respond by printing money and lowering interest rates. Governments would likely issue stimulus checks and increase spending on infrastructure projects, which would support commodity prices.

For those with a long-term outlook, natural resources hold promising prospects. I mention these risks simply to remind readers that the path ahead may be volatile.

Still, it could also prove highly lucrative.