Metal Beats Paper

In today’s discussion, we’ll review last Friday’s performance of gold, silver, metals, and mining stocks, and outline how to proceed from this point. (As I finalize this article Tuesday morning, both silver and gold prices are rising sharply.)

First, a quick mention—yesterday was Groundhog Day. Surely you’re familiar with the Bill Murray film of the same name? It’s a quintessential piece of Americana.

Punxsutawney, PA celebrates its most famous weather forecaster. Courtesy PCNTV.

Groundhog Day stems from an 1880s tradition rooted in the dense hardwood forests of northwest Pennsylvania. A hibernating marmot named Punxsutawney Phil is awoken, forcibly removed from his shelter, and asked whether he sees his shadow. If he does, it reportedly signals six more weeks of winter. Naturally, this event is steeped in mystery and secrecy, with details controlled by Phil’s caretakers and communicators.

Alternatively, you could simply add 42 days to February 2nd and arrive at March 16th, just days shy of March 21st, when winter officially ends.

Nevertheless, Pennsylvania often experiences snow in April and occasionally May. Punxsutawney Phil serves as a weather-related superstition, a playful bet on extended cold. The annual Groundhog Day festivity functions as a longstanding local promotion, featuring Phil as the star attraction, all in good humor.

What was decidedly not amusing, however, was last Friday’s sharp decline in metals and mining stocks. No actual metal was lost, but many “paper” wealth claims vanished.

Similar to the mystique around Gold and Groundhog Day, esoteric explanations abound. For me, it makes sense to focus on the tangible metal fundamentals. So, let’s examine the facts.

The Great Metal Meltdown

I won’t dwell on the details of Friday, January 30th. Prices for silver, gold, platinum, copper, and other metals dropped steeply, as did mining stocks overall, taking a nosedive.

First and foremost, especially for newcomers unfamiliar with metals, mining, and market dynamics: don’t panic. Avoid selling in a frenzy and locking in losses. There’s a path forward.

Despite the bruising day, there is some silver lining to the downturn, no matter how painful it may seem.

If you recently began investing in metals and mining shares—perhaps in the last month or two—you likely bought near peaks and suffered losses last Friday. That’s understandable; we’ve all been there at Paradigm Press.

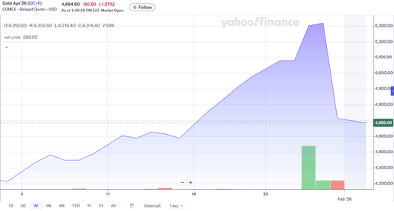

However, take a wider view. January’s closing prices for gold and silver still marked monthly highs, including many mining shares. Here is the January gold price chart, which climbed from roughly $4,300 early in the month to over $4,600 at month-end:

Gold price, January 2026. Courtesy Yahoo Finance.

Despite Friday’s sharp price drop during trading, gold still posted a monthly high. Looking back to early November, gold hovered around $4,000 per ounce, so over three months your position gained about 15%. (This morning, gold is above $4,900.)

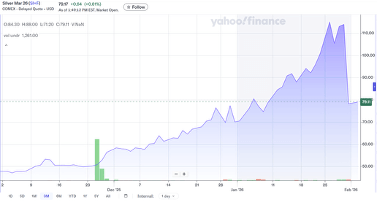

Turning to silver, this three-month chart shows a rise from about $48 per ounce in early November to $78 at January’s close—a roughly 60% increase. Even with Friday’s sell-off, the monthly close remains a record high. (Today, silver is trading near $87.)

Silver price, Nov-Dec-Jan. Courtesy Yahoo Finance.

Granted, gold peaked above $5,300—touching nearly $5,500—and silver once traded near $115 just a week ago. Those elevated prices plummeted dramatically on Friday (more on the timing below).

Put simply, Friday reversed much of the gains amassed over the prior three months—a volatile shift.

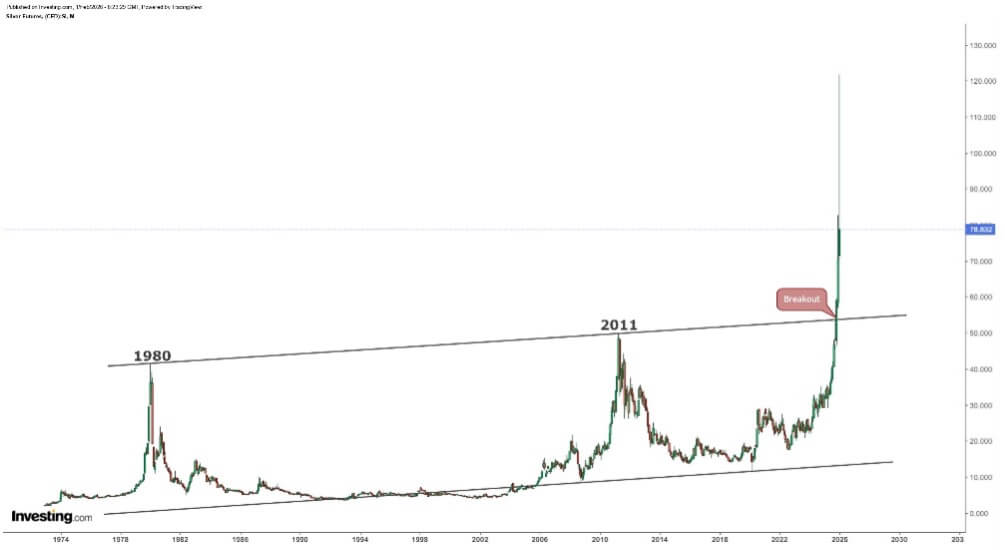

To many, Friday’s collapse felt sudden, but was it truly unexpected? Perhaps not, since price charts had been nearly vertical, especially silver, resembling an F-22 in afterburner—far from typical behavior. Consider silver’s long-term chart stretching back to the early 1970s:

Silver price chart since 1972. Courtesy Investing.com.

What stands out? In 1980, silver surged when the Hunt Brothers attempted to corner the market but were ultimately blocked by the U.S. government. The Department of Justice prosecuted them, while the Treasury Department released large quantities from strategic reserves to increase supply, such as this 10-ounce silver ingot:

10-ounce silver ingot from U.S. strategic stockpile. BWK collection.

In 2011, silver experienced a financial surge followed by a steep drop. Various factors played a role, but the surge was unsustainable and the market corrected.

More recently, as shown in the above chart, silver’s price surged dramatically in a historic breakout.

Support for this rise came from real factors: global demand for silver in industries such as electronics, solar, electric vehicles, data centers, and defense is increasing steadily, while mining output remains constrained. This structural deficit in supply is not quickly fixable without new discoveries, mine construction, and refinery upgrades.

On top of these fundamentals, a diverse group of speculators—from major banks like JP Morgan to retail traders—jumped on the trend, often driven by FOMO rather than a deep understanding of silver’s rally.

Always remember the adage, “Nobody rings a bell at the top.” The weeks leading up to last Friday felt like the ideal moment to lock in profits and step aside.

For instance, on January 22, my colleagues Jim Rickards and Dan Amoss advised subscribers of Strategic Intelligence to sell Hecla Mining (HL) at around $31 per share. This secured gains close to 480% since coverage began in early June 2025, just six months prior—a solid call.

After last Friday, HL shares now trade near $22, down approximately 28% from that recommended sell price. In other words, “Whew… Dodged that bullet.”

Yet there were many similar opportunities saved from last week’s turmoil. The metals markets resembled “intersecting fields of fire,” borrowing a phrase I once heard from a Marine Corps drill instructor.

Here’s What to Do Now…

Recall the earlier reference to Punxsutawney Phil? It’s a well-orchestrated event, albeit in a friendly way, designed to draw people to a Pennsylvanian winter celebration.

Last week’s silver and metal movement was another kind of orchestrated event—but not as congenial as the groundhog tradition. Let’s break down what truly happened (and what didn’t), then determine where to go from here.

First off, don’t fall for the mainstream media’s story that precious metals dropped because President Trump nominated Kevin Warsh to lead the Federal Reserve after Powell, and that Warsh will be the next Paul Volcker. As my colleague Jim Rickards emphasized in emails yesterday, Warsh might have acted as “a catalyst” in the sell-off, but Warsh alone was not the cause.

Warsh won’t—and cannot—raise interest rates enough to crush speculation, defeat inflation, and fully restore confidence in the dollar. That’s fantasy, akin to a talking groundhog spotting its shadow.

To elaborate, in 1980 the U.S. debt-to-GDP ratio was roughly 30%, and America managed to endure 20% interest rates, despite the painful economic toll (I was there—it was awful). Those high rates wreaked havoc, accelerating the collapse of much of the U.S. industrial base, especially the Rust Belt. So yes, Volcker defeated inflation, but at a significant cost—an outcome with mixed blessings.

Currently, the U.S. debt-to-GDP ratio is 125% and climbing. The federal government adds about $1 trillion in new debt every quarter. Interest payments exceed $1 trillion per year and are poised to become the largest single federal expenditure.

So no, Warsh cannot hike rates aggressively without triggering Treasury insolvency. In fact, he will likely need to ease rates, which benefits precious metals and hard assets like base metals and energy.

Meanwhile, last Friday saw silver and gold receive a severe one-day price collapse, akin to a “body slam” in wrestling parlance. This event saw Western metal markets plunge roughly 35% with no corresponding change in supply from mines or refineries, nor any reduced demand from industry, central banks, or other key buyers.

Does this make sense? No, it does not.

While paper silver in London and New York dropped to $78, physical silver in Shanghai still traded above $120. This indicates that genuine metal held a strong price, while the paper contracts were discarded like rubbish.

Put differently, last Friday—at month’s end, when many important metrics are tallied—the markets were maneuvered by those who know how to pull the strings.

In other words, large holders of paper silver forced out recent speculative buyers (those driven by FOMO) and crushed the price. This drastic sell-off also rescued several well-placed players who had naked short positions in a surging market. They cleared their books as best they could. Sauve qui peut, indeed.

Remember, physical metal reveals truth without deception.

Today (Tuesday), Shanghai silver remains above $100 while Western paper silver trades near $87. This highlights the gap between real and artificial prices. Since China consumes a majority of the world’s silver for electronics, solar panels, chemicals, and more, their industry demands actual metal rather than mere paper contracts. Our Chinese counterparts want real silver, not silver “settlements.”

Currently, as events unfold, Western silver vaults are being emptied as holders of paper silver “stand for delivery”—requiring the delivery of physical metal.

However, there simply isn’t enough silver for all these claims. According to some estimates, the silver market carries up to 350 paper contracts per ounce of real silver. Essentially, it’s a game of musical chairs with only one seat available in a huge gymnasium. Paper contracts face an imminent collapse.

If you possess physical silver—coins, ingots, or bars—hold firm and weather the storm. Don’t worry about purchasing silver at $110 last week, only to see it at $80 yesterday and $87 today. At least you have actual metal; be patient and watch developments unfold.

Regarding mining stocks, every company requires individual assessment. I spent the weekend reviewing each holding in my portfolio, asking why I own it, whether I want to keep it, what the underlying asset is, how management is performing, future prospects, and if the company is profitable.

Remember, investing hinges on earnings. Many mining operations are already profitable at today’s prices. They gained at $2,500 and $3,500 gold prices and will continue to thrive at $4,500. Similarly, they were profitable at $25 and $35 silver and can do well at $65, $75, or even $87.

A longstanding favorite of mine is the Sprott Physical Silver Trust (PSLV), which buys and stores physical silver—actual metal. And metal represents reality.

Exercise caution, yes. But also recognize this sell-off presents a buying opportunity: quality companies and assets are now available at discounted prices. Let the market settle, examine fundamentals and management, monitor charts closely, seize market dips with limit orders, and avoid chasing momentum.

Wrap-Up

Think your situation is difficult? Last week, the U.S. Mint announced delays in producing its precious metal products, with prices “to be determined.” The Mint is struggling, just like everyone else.

Up north in Canada, rumors swirl that the Royal Canadian Mint may invoke force majeure, canceling many delivery contracts. In other words, high premium spreads are driving “good silver” (i.e., .999 or .9999 purity) out of North America and into Asia.

To address a frequent reader question: scrap silver is tough to sell currently because refineries prioritize servicing large industrial customers over processing items like old candlesticks. It could be many months before the scrap silver market realigns to these new conditions.

Once again, don’t panic. Await market stabilization. Physical silver and gold remain scarce and valuable, though prices have been distorted by paper markets. Ultimately, “real” metal outperforms paper—and this reality will shape the market’s future.

That’s all for now. Thank you for subscribing and reading.