Tech Wreck

Last spring, I believed the tech/AI boom was collapsing.

That turned out to be premature—or just early, really.

I recommended increasing investments in precious metals and emerging markets.

So far, that strategy has paid off handsomely. Hard assets and EMs have notably outpaced other sectors.

However, a tech downturn might be looming again, with potential to pull broader markets down along with it, at least temporarily.

Let’s explore why software shares are facing challenges and consider whether this could spark a wider market correction.

AI Threatens Silicon Valley

In an ironic twist, new advances in AI are now causing major troubles for software stocks.

For years, the AI surge lifted the entire tech sector, but now the situation is reversing.

Like Frankenstein’s monster, AI seems to be turning against its own makers.

Anthropic, the company behind the advanced Claude AI models, recently introduced tools that shook the tech world, especially impacting software-as-a-service (SaaS) firms.

These innovations enable Claude AI agents—autonomous models—to handle tasks in legal, compliance, sales, marketing, and more, fields that have traditionally been lucrative for software companies.

This shift caused Legalzoom (LZ) to plunge 20% yesterday and Factset Research to drop by 10%.

Salesforce (CRM), a leader in cloud software, is now trading 44% below its 52-week peak.

Once high-flying SaaS stocks like The Trade Desk (TTD) have plunged 80% from their record levels.

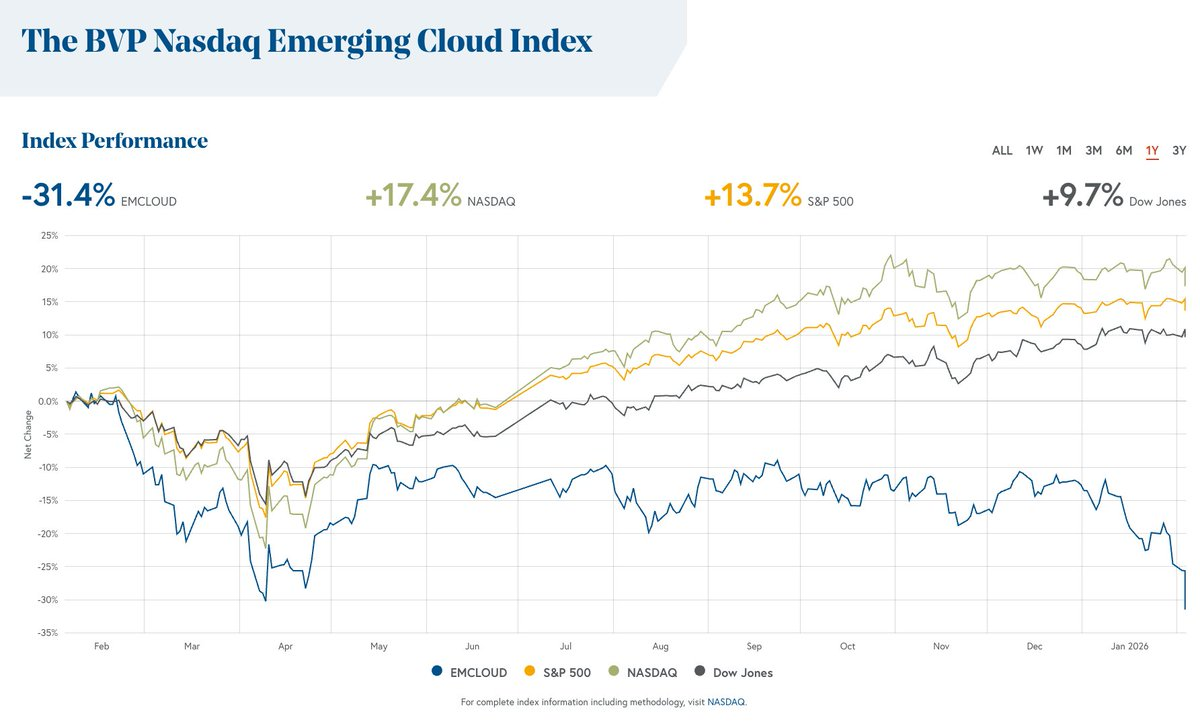

The chart below illustrates how the BVP Nasdaq Emerging Cloud Index (SaaS stocks) has lagged behind the general market.

The blue line near the bottom represents cloud software stocks. Oof.

More than $285 billion in market value was erased across the software sector just yesterday.

Software: Still Not Cheap?!

What’s striking is that software shares remain pricey. Salesforce, for instance, trades at 26 times earnings—among the more affordable SaaS stocks—and yet it still isn’t truly cheap.

Smaller, fast-growing tech companies continue to burn through capital, while investors grow weary of backing unprofitable newcomers.

The sector’s lofty valuations have made it prone to sharp declines. Still, I’m not ready to buy the dip. Eventually, there will be a chance to rotate out of hard assets into growth stocks, but that moment isn’t near. I’d estimate we’re at least five years away.

Markets often move far beyond logical limits, both on the rise and the fall.

Private Equity Has a Mini-Crash

Yesterday, amid the tumble in software, another notable event occurred.

Private equity and credit firms saw steep drops. Apollo declined roughly 7%, Blackrock lost 5%, and smaller firms such as Ares and Blue Owl fell over 10%.

The culprit? Their significant exposure to software businesses, as lenders and investors.

Apprehensions about AI’s disruptive impact on tech firms are growing.

Are these just the initial dominoes? Investors are starting to grasp the vast scale of AI disruption across industries. Software is the first sign, but eventually, this will ripple through many sectors. Entry-level white-collar jobs face particular risk.

A Cascading Sell-Off is Possible

The heavy selling in software has begun spilling into other tech areas. Even prominent stocks like Nvidia have fallen significantly from their peaks.

There’s a danger that a prolonged tech meltdown could spread into other domains, including our hard asset holdings—albeit temporarily.

Serious corrections in sectors like tech often trigger panicked selling across unrelated investments, driven by margin calls or profit-taking.

If the market pulls back broadly, it might momentarily stall the gains in precious metals and emerging markets. Since a correction was overdue, heightened market anxiety could dampen our preferred sectors for a while.

Still, I view sharp declines in precious metals, miners, and Brazil as buying opportunities. For those well-positioned, like myself, they represent moments to hold.

The market’s volatility makes frequent trading impractical for me. For now, my strategy is to remain steady, avoid overanalyzing every move.

Should a full-scale crash materialize, the safest havens will be cash, gold and silver, natural resources, and affordable emerging markets.

While these may drop initially alongside other assets, they historically rebound earliest and outperform over the long term. This was true after the dotcom crash—an analogous scenario to today.

Down the line, it may make sense to short the market substantially or at least hedge with a sizable number of put options.

We will monitor developments closely to gauge if this situation escalates further.