The Labubu Omen

Do you recall the Beanie Babies craze? They were wildly popular in the late 1990s.

These small stuffed animals, costing less than a dollar to produce, were once sold for thousands at the height of their demand.

The Princess Diana memorial bear once commanded prices over $500, but now trades near $5. Peanut the Royal Blue Elephant reached $5,000 in 1999, whereas a mint-condition piece today might only bring around $50.

The Beanie Baby phenomenon began in 1997, coinciding with the rapid ascent of the dotcom bull market. At its peak, Beanie Babies accounted for about 10% of all listings on eBay.

This timing was far from accidental. Speculation tends to spread quickly once it grips a culture, triggering all sorts of unusual market behavior.

The Beanie Baby Bubble (BBB) burst in mid-1999, just months before the dotcom bubble peaked in March 2000.

Labubus Gone Wild

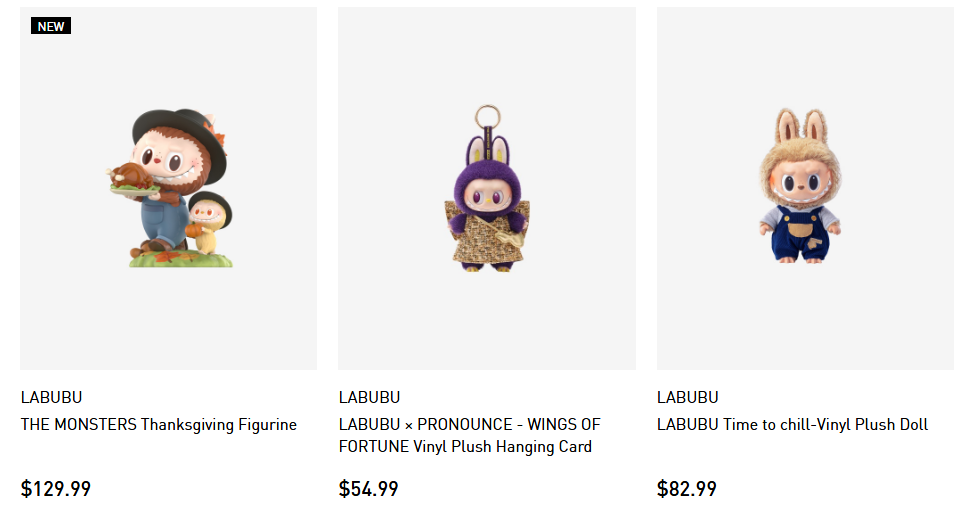

Recently, a fresh trend of plush toys called Labubus has captured public attention. These small, devilish creatures are created by a Chinese company named Pop Mart:

Source: Pop Mart

What sets these toys apart is their initial sale format through “blind boxes,” where buyers don’t know which figure they will receive. It could be a rare, highly valuable doll or a more common one. This element of chance fueled the craze, causing them to sell out almost instantly whenever new inventory arrived.

Earlier this year, a rare Vans Old Skool Vinyl Plush Doll Labubu sold for $10,585:

Forbes published a feature on that sale mid-year, even suggesting Labubus could be “good investments.”

In June, a 4-foot tall Labubu fetched an astonishing $170,000 at auction in China as reported.

However, enthusiasm has since waned. Less than three months later, that same Forbes editor revised her Labubu assessment.

Is The Labubu Craze Ending? Prices Are Down And Inventory Is Up As Eyes Turn To A New Toy

On eBay, where sellers once earned over $10,000 from exclusive Labubus, most dolls now list under $2,000, and none of the 60 priciest listings have received any bids.

Earlier this year, the Labubu craze caused the toys to sell out instantly after restocks on Pop Mart’s website, with resellers profiting hundreds to thousands of dollars on each quirky, toothy figure.

The combination of soaring prices and scarce supply led to a surge in counterfeit Labubus, and stores carrying the dolls were overwhelmed by customers jostling and shouting to secure their purchase.

A recent look at eBay reveals that the most expensive Labubus remain bid-less. Sellers continue to seek peak values, but buyers aren’t biting.

It appears the demand for Labubus has stalled.

Anecdotally, my middle schooler confirms that Labubus are no longer seen as exciting as before.

Is Speculative Mania Peaking?

The Labubu phenomenon reflects broader market conditions. Just as Beanie Babies symbolized the dotcom bubble, these trends reveal the current zeitgeist.

I don’t want to overstate it, but there’s little doubt we’re in the midst of a bubble that might be nearing its summit.

Cryptocurrencies have surrendered much of their earlier gains. Momentum stocks seem to have plateaued for now. Even large tech companies are facing turbulence since the selloff in April.

When this bubble bursts, the Federal Reserve will almost certainly respond with much lower interest rates and aggressive quantitative easing. Yet, considering the scale of this bubble, it might take a decade or longer for overheated stocks to fully rebound, even with substantial monetary stimulus.

Though I can’t predict the exact timing of the collapse—it could be tomorrow or next year—I am avoiding hot tech stocks (besides my retirement target date fund holdings), favoring my great rotation strategy. Investments in undervalued emerging markets, natural resources, and gold/silver/mining stocks are yielding solid returns. Speculating on overpriced momentum stocks isn’t appealing right now.

This approach allows me to rest easy without fearing another dotcom-like 70% downturn.