Don’t Fall in the China Trap

Is China’s economy on the verge of collapse? Or could it be just the precursor to an even more severe crisis? In brief, the situation might signal something far worse than an economic downturn. China could be entangled in a broader failure of the global monetary system.

We start by examining China’s most recent official economic reports. These numbers reveal some of the weakest economic activity since the pandemic-driven downturn in 2020.

Things Aren’t Looking Good

Industrial output growth slowed to 4.9% year-over-year in October, down from 6.5% previously. This represents the lowest figure since August 2024. While some sectors backed by the state—such as autos, computers, shipbuilding, and telecommunications—performed above average, overall manufacturing activity decelerated significantly, and mining production dropped as well.

Retail sales were also weak in October. Despite a modest overall growth of 2.9%, several categories experienced sharp declines: household appliances fell by 14.9%, building materials by 8.3%, and automobiles by 6.6%.

On the other hand, certain segments showed resilience, including jewelry (+37.6%, partly reflecting gold purchases disguised as jewelry) and cosmetics (+9.6%). Nonetheless, this marked the slowest retail sales increase in years, particularly concerning as October typically ushers in a seasonal spending boost.

The most alarming figure emerged from fixed-asset investment (FAI), which recorded a 1.7% year-to-date drop—the most significant since 2020’s pandemic crash.

Your editor on the Chinese high-speed train that runs from Shanghai to Beijing at over 300 kph. China has produced major technological advances, but it has done so in non-sustainable ways, including excessive debt and theft of intellectual property.

Property investment plunged by 14.7%, and infrastructure spending—a backbone of Chinese economic expansion—contracted slightly by 0.1%. Manufacturing investment grew by 2.7%, yet this pace is half of what it was earlier this year.

In summary, all key investment drivers—fixed assets, property, and manufacturing—are simultaneously decelerating. Since investment underpins much of China’s growth (with roughly 45% of GDP linked to it, compared to around 25% in developed markets), a collapse in investment portends a far broader economic downturn.

Real Estate Is Crashing Too

These results build on a prolonged decline in property values that has wiped out equity for many homeowners. Given that this lost equity often represents the lifetime savings of ordinary Chinese families, the effect on consumer spending and their willingness to invest in real estate is highly damaging.

The real estate crash has also triggered the downfall of major developers and property investment firms such as Evergrande Group ($19 billion in losses), Country Garden ($11 billion lost), Fantasia Holdings (recent $1 billion operating loss), and Sunac, which declared bankruptcy in 2023.

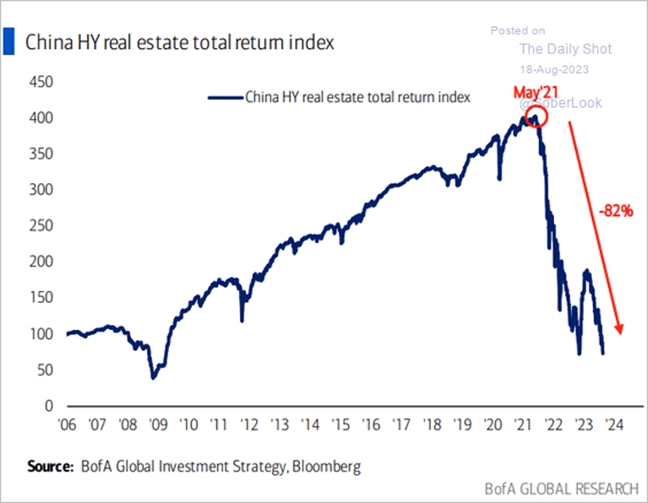

The financial collapses of China Evergrande, Country Garden, and Sunac all come against the background of a broader crash in real estate debt and real estate-backed wealth management products. This chart shows that a major Chinese high-yield real estate index collapsed 82% in recent years and has never recovered.

This real estate crisis coincided with several unsuccessful attempts to revive the Chinese economy post-COVID, along with a series of stimulus measures. The major reopening announced in 2022 failed to deliver growth after lockdowns were lifted. Subsequent “bazooka” stimulus efforts—including interest rate cuts, reductions in bank reserve requirements, and industry-specific subsidies—also faltered in 2024 and 2025. Similar to the U.S., falling interest rates in China signal recession rather than stimulus.

Negative Growth?

It is crucial to interpret Chinese economic figures with Goodhart’s Law in mind, which asserts that when a metric becomes a target for policy, it ceases to be a reliable indicator.

This concept applies strongly to China’s GDP data. The annual GDP growth rate has dropped from 10.0% in the early 2000s to 5.0% in 2024. The third quarter of 2025 saw a reported growth of 4.8%. Since China aims for a 5.0% target, this suggests the real growth rate is likely lower, possibly masked by data manipulation or outright false reporting.

As previously mentioned, investment makes up about 45% of China’s GDP. However, much of this goes into “ghost cities,” unproductive projects, and overbuilt infrastructure with no chance of profitable return. Adjusting for this wasted capital (per GAAP standards) could reduce reported growth from 4.8% to approximately 2.5%. When factoring in potential data distortions and Goodhart’s Law, it’s plausible that China’s GDP growth is currently negative—a reality that would surprise many bullish Wall Street investors.

Caught in the Middle-Income Trap

More broadly, China remains stuck in the middle-income trap. Countries can generally advance from low income (roughly $5,000 annual per capita GDP) to middle income (approximately $15,000) through urbanization, infrastructure development, and standardized manufacturing.

However, crossing into high-income status (around $25,000 or higher per capita GDP) demands innovation, proprietary technology, and high-value manufacturing. Only a handful of nations—Singapore, Taiwan, South Korea, and Hong Kong—have achieved this leap post-World War II. While China excels at appropriating technology, it struggles to develop original innovations or successfully integrate them into its manufacturing sector, presenting another significant barrier to growth.

Other Headwinds to Growth

Beyond the issues already mentioned, China faces other major challenges. It is experiencing the initial phases of the largest demographic decline recorded in history, surpassing even the devastation caused by the 14th-century Black Death.

Currently inhabited by about 1.4 billion people, China’s population is projected to shrink by half over the next fifty years, a loss of approximately 700 million individuals. This demographic collapse stems from the one-child policy instituted in 1980, extensive sex-selective abortions and infanticide that eliminated some twenty million girls, and a decline in birth rates linked to education, urban living, and gender equality in employment.

Economic growth can be simply calculated as the product of workforce size and productivity. Globally, productivity growth has slowed for reasons not fully understood by economists. When combined with a massive reduction in China’s labor pool, the nation’s economic output is likely to drop by half or more. This decline won’t be a distant event in 2080; it is already underway and will intensify over time.

China’s growth will also be constrained by its staggering debt-to-GDP ratio, estimated near 300%—more than double that of the U.S. at 123%. Research shows any ratio above 90% hinders economic expansion. Escaping this debt trap by borrowing more is impossible. The only paths forward are default, hyperinflation, or cutting government spending—each damaging growth and capital differently. Unless there’s a collapse in asset and debt values wiping out trillions in wealth, low growth appears inevitable for many years.

Investors: Stay Away from China

Layered on top of these economic disasters is political instability. Current reports indicate that Chinese President Xi Jinping has effectively been subdued by a soft military coup, placing him under the authority of the People’s Liberation Army leadership. Most of Xi’s supporters have been eliminated, leaving future leadership uncertain and foreign investors wary.

China’s problems mirror broader global economic weakness, alongside negative growth in Japan and the UK and only marginal gains in the EU. Rising unemployment, shrinking trade volumes, and tighter lending standards among banks recovering from unexpected credit losses all contribute to the slowdown.

Ignore optimistic claims from Wall Street praising China as an AI superpower and tech giant. The reality is quite different. China remains trapped in the middle-income limbo amid an economic freefall, ongoing trade conflicts, demographic collapse, soaring debt, political upheaval, lack of legal protections, and capital flight—all occurring in a stagnant global economic environment. Investors should avoid exposure to China altogether.