How to Play the Nuclear Boom

On October 31, 2025, the U.S. government committed to facilitating $80 billion in financing for Westinghouse Electric’s upcoming nuclear reactors. This major development is particularly significant for Westinghouse’s parent companies, the uranium giant Cameco (NYSE: CCJ) and Brookfield Renewable Partners (NYSE: BEP).

The announcement caused Cameco’s stock to surge, as demonstrated here:

According to the deal with Westinghouse Electric, the U.S. government will not only arrange financing but also assist in securing permits for new reactors. In exchange, it will receive 20% of future earnings after Westinghouse recoups $17.5 billion in profits.

The government could convert that profit share into an equity stake of up to 20%. Furthermore, the terms mandate an initial public offering for Westinghouse by 2029 if its valuation exceeds $30 billion.

Japan also committed up to $332 billion in additional backing for U.S. reactor projects. This support covers the construction of Westinghouse AP1000 reactors and small modular reactors. Reuters reports that Japanese companies such as Mitsubishi Heavy Industries, Toshiba, and IHI might build Westinghouse reactors valued at nearly $100 billion.

Simply put, those bullish on AI are inherently bullish on electric power. For AI to operate without drastically increasing consumer electricity costs, the expansion of power generation is essential. While all forms of power generation are valuable, nuclear energy stands out by delivering more output with less fuel.

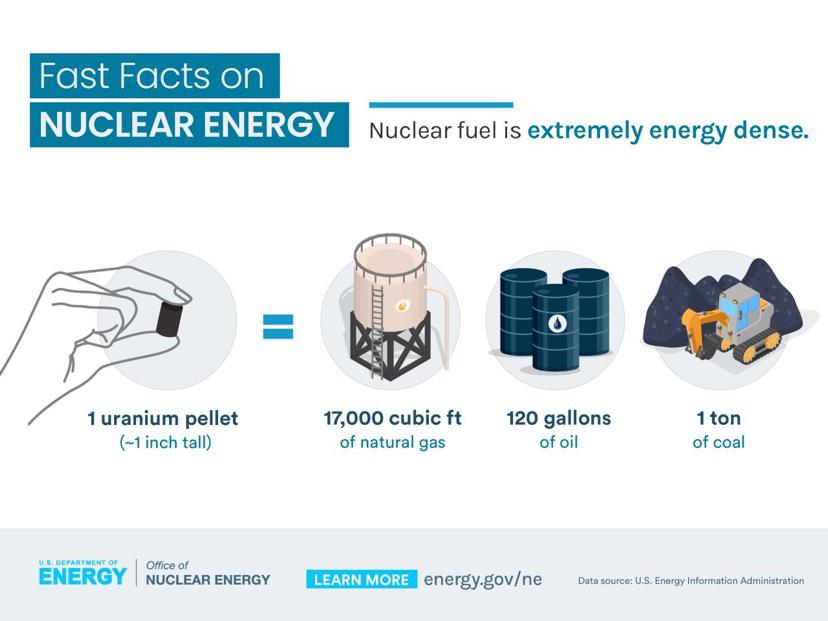

A uranium pellet roughly the size of a 10-gram gummy bear holds energy equivalent to:

- 1 ton of coal

- 17,000 cubic feet of natural gas

- 120 gallons of oil

This remarkable efficiency contributes to nuclear power’s appeal today. However, the agreement extends beyond promoting the expansion of nuclear plants in the U.S.; it also expedites the permitting process.

This is a game changer.

Permitting represents the most significant obstacle to new nuclear development in the United States. Historically, obtaining approval for new nuclear plants took between eight and twelve years. The most recent nuclear units authorized in the U.S. were Vogtle Units 3 and 4 in Georgia, with permits granted by the NRC in February 2012.

Vogtle Unit 3 began commercial operation in July 2023, becoming the first new U.S. reactor to come online in over three decades. Unit 4 followed in April 2024.

Following this timeline, any reactors proposed now wouldn’t become operational until after 2050, factoring in 12 years each for permitting and construction—an unappealing prospect for investors.

However, the new U.S. agreement promises to streamline the permitting phase for Westinghouse reactors. This shortens the timeline and lowers associated risks, which is highly beneficial for investors by reducing uncertainty and accelerating construction.

While Cameco gains from this arrangement, Brookfield Renewable Partners (NYSE: BEP) stands to benefit even more. Their business encompasses electricity generation from a diverse portfolio, and this deal enables them to expand their holdings with reduced risk and cheaper capital. As highlighted in their investor day presentation, 95% of their energy projects are located in the top fifty data center markets.

Investors should closely consider Brookfield. With worldwide demand for nuclear reactors rising, Westinghouse’s profitability will increase. The U.S. government’s role in mitigating permitting risks should help the company expand its nuclear plant fleet faster and at a lower cost than competitors. Given the accelerating need for new electricity, this stock represents a compelling long-term investment opportunity.