Oil Stocks and OPEC Lies

At the close of November, the Organization of Petroleum Exporting Countries (OPEC) revealed it plans to maintain current oil production levels throughout the first quarter of 2026. This decision is uncommon for the cartel, which typically announces output reductions when oil prices drop. Here’s the present situation:

Despite forecasts predicting a surplus in 2026, OPEC chose not to warn of any production cuts. This is quite noteworthy.

The influence of OPEC has diminished over time. The cartel once held the power to destabilize the West by controlling oil supplies. Nowadays, their economies rely heavily on oil revenues to fund social programs, making them beholden to oil price fluctuations instead.

OPEC’s announcements generally fall into two categories: production increases or reductions. When they declare increases, they are usually accurate. Conversely, claims of production cuts are seldom genuine.

Interestingly, markets frequently fall for these claims, resulting in a short-lived spike in oil prices.

OPEC nations rarely admit to true production cuts because their budgets depend heavily on oil income. This is similar to U.S. politicians who promise tax reductions and spending cuts but rarely deliver.

In countries within OPEC, oil revenues constitute a significant portion of their GDP:

The importance of oil income to these nations is clear. OPEC’s statements about cutting production aim to push prices higher. Although lower production causes short-term challenges, it’s meant to be offset by increased prices down the line. Still, many of these governments cannot endure hardship in the near term.

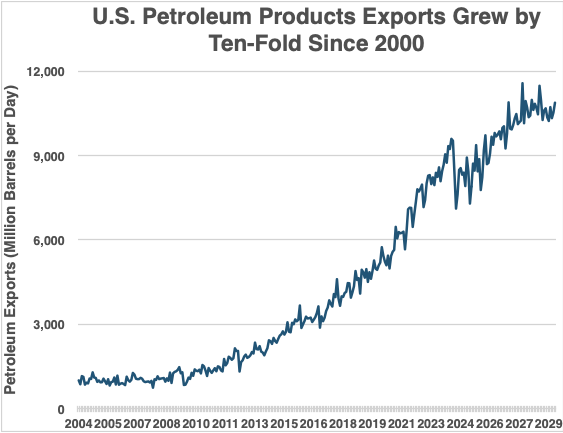

Back when OPEC held tighter control over output, their announcements were taken seriously. However, since the shale boom began in the mid-2000s, such statements mostly serve as strategic messaging. U.S. petroleum exports have skyrocketed, expanding 1,000% since 2000.

This transformation accelerated over the past 17 years. In 2008, OPEC controlled more than 40% of the global oil market, with the U.S. accounting for only 5%. Today, OPEC’s share has decreased to 35%, while the U.S. has increased to 17%.

This industry will remain under close observation in 2026. Eventually, oil company stocks should become appealing investments. Since commodity prices typically dictate stock valuations, we are holding back for the right moment.

My plan is to buy shares of Schlumberger (NYSE: SLB), the leading oil service firm, at a discount. I anticipate this chance will arise early in 2026. Schlumberger tends to respond quickly to rising oil prices. During downturns, these companies delay maintenance to cut costs, but when prices climb again, they get production back on track.

Schlumberger handles all the essential work involved in drilling new wells, making it an excellent entry point for those interested in oil stocks. Oil remains one of my preferred sectors; however, timing plays a crucial role in energy stock investments. We expect a more favorable entry point next year. Stay tuned.