2026: A Monetary Tsunami

Fudai is a tranquil fishing village situated along Japan’s coastline.

When the catastrophic tsunami struck in 2011, Fudai stood as the sole settlement in the region to remain undamaged.

This outcome wasn’t by chance. It was the result of careful foresight.

Back in the 1970s, Fudai’s mayor, Kotoku Wamura, championed the construction of a floodgate designed to shield the town from tsunamis. Many dismissed him as irrational, branding the idea a needless expense.

Yet Mayor Wamura recalled the devastating 1933 tsunami that claimed over 400 lives in Fudai.

Determined, he persisted and ultimately saw the floodgate erected, sealing off a vital valley. Standing 51 feet tall, the sturdy structure was engineered to withstand destructive waves — and it succeeded.

Fudai floodgate, Iwate province – Source: Wikipedia

Kotoku Wamura, whose vision made the floodgate possible, did not live to witness how many lives it ultimately saved. Without its protection, the toll on March 11, 2011, would have been far greater.

Constructing Financial Floodgates

For decades, gold and silver were dismissed as outdated relics — irrelevant shiny stones from a bygone age.

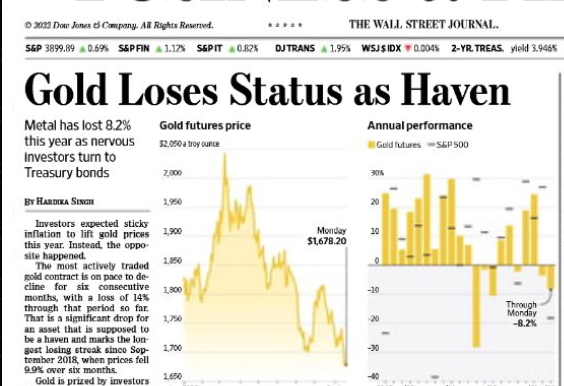

The mainstream media portrayed precious metals as worthless “pet rocks.” Even recently, in September 2022, the Wall Street Journal published a headline stating “Gold Loses Status as Safe Haven,” authored by Hardika Singh:

Since that publication, gold has climbed roughly $2,800 per ounce. Consider this a reminder to be skeptical of mainstream financial reporting.

Investors in gold have generally fared well over the past quarter-century. In 2000, the metal traded near $265 per ounce. However, the path has been uneven; gold peaked around $1,800 in 2011 and hovered near that level a decade later.

Currently, gold shines bright, exceeding $4,400 as I write. I don’t foresee this momentum fading anytime soon, likely continuing over the next five to ten years.

Silver is also beginning to enjoy renewed attention, now trading above $69 per ounce. Yet it still has progress to make, sitting only about $20 above its 1980 peak.

The valuation of gold and silver miners remains low, as if this precious metals rally were a fleeting craze. If you share our belief in the market’s persistence, these mining companies should perform exceptionally well ahead. They have transformed into formidable cash generators, with strong prospects.

I’ve held onto all my positions—miners, ETFs, and physical holdings alike. These serve as a personal financial safeguard. When the time comes, you’ll truly appreciate having them.

The trajectory we’re on makes a financial tsunami unavoidable, taking shape through unprecedented money printing and inflation on a global scale.

We are nearing an extraordinary financial and monetary crisis. Over the coming decade, multiple sovereign debt breakdowns will likely surface, including a near-certain one in the United States.

We will survive, though it won’t be easy or pleasant.

Those with resources should prepare by investing in gold, silver, and related miners for a minimum of five years. If holding precious metals isn’t feasible for you, focus on cultivating practical skills. Acquire or refine a trade, start gardening, and hone those abilities. Such expertise can be as valuable as precious metals during times of crisis.

Hold Strong

The temptation to cash out after such gains is understandable. But the bull market of the 1970s reminds us just how rewarding these cycles can be.

This bull run was sparked by the U.S. abandoning the gold standard in 1971.

Though significant corrections occurred, metals and miners surged, shielding informed investors from inflation’s harsh effects.

We are poised for a comparable shift, as the supposed “miracle” of fiat currency unravels.

As noted previously, debt burdens in the 1970s were far lighter — debt-to-GDP hovered around 35%, compared to today’s over 120%. Demographics also favored the economy, with baby boomers in their peak earning years. Now, as that generation retires, they contribute less to workforce income and tax revenues.

If you’ve held precious metals in your portfolio for some time, well done. But don’t celebrate just yet. The bullish phase is far from its peak.

The greatest challenge lies ahead: an overwhelming surge of inflation and relentless money creation. Don’t abandon your financial defenses because minor setbacks have occurred.