Speculation 2.0: The Rise of Prediction Markets

Prediction markets are quickly becoming a major phenomenon.

These are digital platforms where you can wager on a vast array of events.

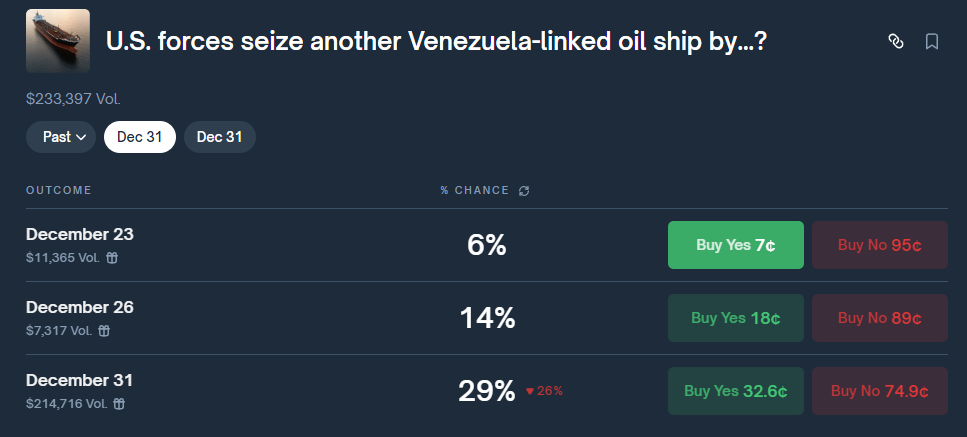

Take, for instance, the question: will the U.S. seize another Venezuelan oil tanker by December 31st? Currently, speculators on Polymarket assign a 29% probability to this event.

Source: Polymarket

Here’s the mechanism: if you believe the U.S. will seize another Venezuelan tanker before year-end, you purchase a “yes” contract priced around $.32 (note that a spread exists due to limited volume on certain contracts). Should the event occur, you will receive $1 per “yes” contract owned.

At present, Polymarket stands out as the leading platform, although it operates primarily using crypto and stablecoins and is not yet fully accessible to U.S. residents—but that is expected to change.

Meanwhile, Kalshi represents the primary licensed U.S. prediction market and holds the domestic lead.

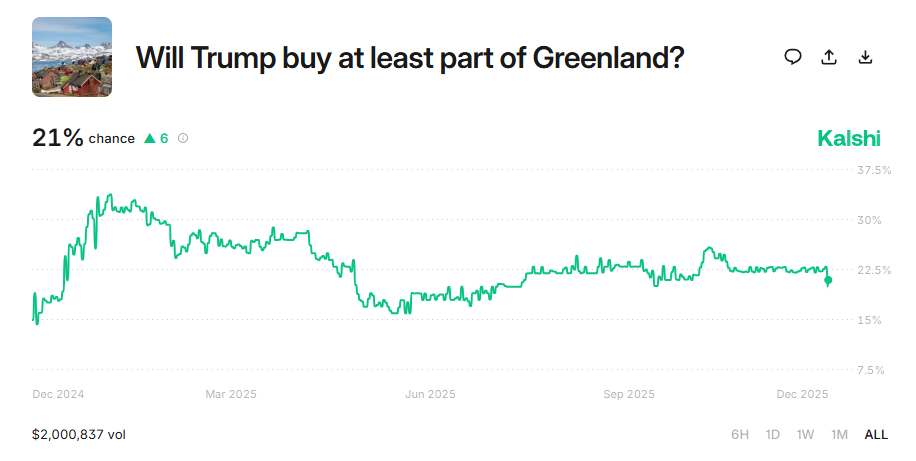

On Kalshi, you can wager on whether President Trump will acquire any portion of Greenland by January 20th, 2029. Presently, this market places a 21% likelihood on that outcome.

Source: Kalshi

Over $2 million has already been wagered on this particular contract. Determination will come via the New York Times; if they report that Trump purchased part of Greenland, those holding yes contracts will win.

Kalshi also offers markets on various topics, including who Trump might select as Fed Chair, or the number of plague cases in the U.S. this year. Sports results and many other subjects are now open to betting.

Truly remarkable.

A Flood of New Markets

In 2025, it is estimated that $45 billion was wagered through prediction markets, and this trend is just beginning to accelerate.

A surge of fresh prediction market platforms is reaching U.S. investors. Major names from the crypto space, online trading, and sports betting are all jumping in:

- Robinhood

- Coinbase

- Gemini

- Fanduel

- Draftkings

Each company is launching its own variation of prediction markets, and 2026 promises even more entrants. It’s hard to imagine any large brokerage missing the chance to join this booming sector. Almost everyone will want their own platform—soon.

Insider Trading Concerns

Due to the novelty of prediction markets, regulations regarding insider trading remain unclear.

For example, a Trump administration insider with advance knowledge that the U.S. plans to buy Greenland could profit substantially by purchasing the yes contract via Kalshi.

Although such activity is likely illegal, existing laws are still ambiguous on this new market’s specifics.

This situation introduces complex challenges. Properly regulating this emerging market would require virtually complete monitoring of all participants, which is unrealistic (and hopefully inadvisable).

For instance, Kalshi includes markets tied to particular companies—like betting on Tesla’s quarterly car sales figures. For insiders, this could present an easy avenue to exploit confidential information.

Speculation Nation

The rapid expansion of prediction markets reflects our culture’s fascination with speculation and wagering.

Now, betting on nearly anything is possible around the clock. It’s notable that the surge in these markets may have contributed to the recent downturn in crypto prices, as prediction markets have captured attention as a fresh, shiny alternative.

These markets are here for the long haul, but caution is warranted. Before placing your bets, remember the opposing side may hold privileged information.

Despite these risks, I find these new platforms captivating and intend to explore them further in 2026.

I plan to create an account soon to test one of these services and will share discoveries with readers.

Merry Christmas to all my readers. Wishing you a joyful holiday season.