PACO vs. TACO

Let’s begin by clarifying what these acronyms stand for.

PACO means Powell Always Chickens Out, a fresh twist derived from TACO.

TACO stands for Trump Always Chickens Out, a cliché frequently used by mainstream media.

The critical question remains: who will concede first? President Trump or Fed Chair Powell?

This standoff has been ongoing throughout Trump’s entire second term.

Last year, President Trump gave Federal Reserve Chair Jerome Powell a nickname inspired by Native American culture. “Too late.”

It referred to Powell’s delayed action on cutting interest rates. Trump also threatened to fire Powell and take legal action against him for “gross incompetence.”

A federal criminal probe involving Powell has now been launched. This inquiry centers around the Fed’s extravagant $2.5 billion headquarters makeover and Powell’s congressional testimony concerning it.

Trump denied any involvement, telling NBC News he had no knowledge of the probe, adding, “I wouldn’t even think of doing it that way. What should pressure him is the fact that rates are far too high. That’s the only pressure he’s got.”

A grand jury investigation and a subpoena directed at the Fed Chair is unprecedented.

CNBC reports that analysts at JPMorgan currently believe the Fed will resist Trump’s pressure and maintain current interest rates. “We now expect the Fed to stay on hold throughout 2026.”

Chair Powell made an unusually rare response to the investigation on Sunday. The Fed issued a video statement through their X/Twitter account.

Powell appeared exhausted, yet he asserted that the probe reflects Trump’s ambitions to seize control over the Fed:

“This is about whether the Fed will be able to continue to set interest rates based on evidence and economic conditions, or whether instead monetary policy will be directed by political pressure or intimidation.”

Root Causes

During fiscal year 2025, the federal government’s expenditure reached $7 trillion. Tax revenues accounted for $5.2 trillion, resulting in a $1.8 trillion deficit that had to be financed through fresh borrowing.

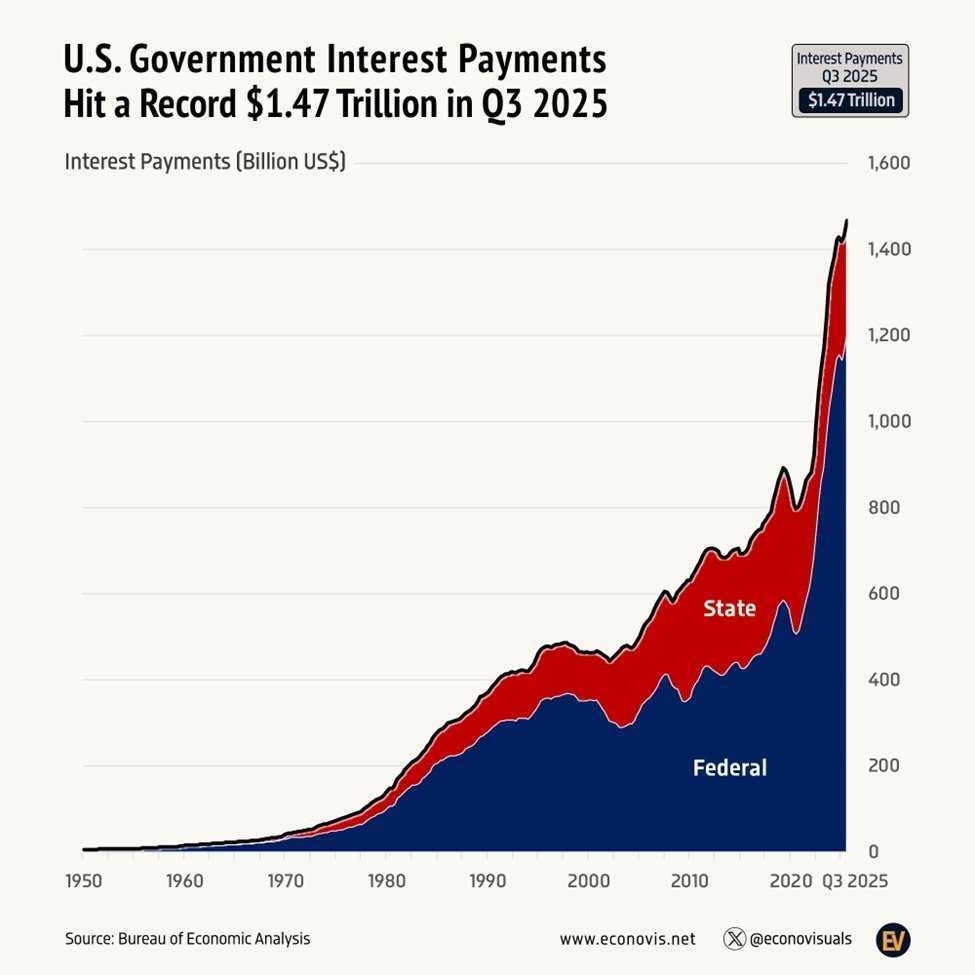

Out of this deficit, $1.2 trillion was solely spent on servicing the interest on the national debt. See the chart below.

Source: Econovis.net

Notice the sharp upward curve in recent years, driven by pandemic-related spending and substantially higher interest rates.

Now, the cost of interest payments has become a significant burden on the economy.

The only viable method to reduce these interest expenses is for the Federal Reserve to cut rates dramatically. The alternative, paying down the principal debt, is unrealistic.

The President cannot directly say, “Hey Jerome, we need you to lower rates so that we don’t spiral into debt during my second term.”

Instead, Trump frames rate cuts as a means to bolster the economy, stock market, and homebuyers. This might hold true temporarily, but long-term solutions to the debt dilemma remain elusive.

In my view, the urgent need to reduce rates stems primarily from the goal of slashing interest costs. Without it, debt and deficits will escalate more rapidly.

We are at a stage where debt levels and associated interest charges are so large that lowering interest rates becomes necessary on those grounds alone. President Trump and Treasury Secretary Scott Bessent are undoubtedly aware of this reality.

Financial Repression Approaches

We are now entering an era marked by financial repression: soaring deficits and public debt, artificially suppressed interest rates, monetary expansion, welfare programs, and inflationary pressures.

Savers relying on cash and bonds are likely to suffer most. Investing in hard assets presents a better refuge.

This debt crisis has been gradually unfolding since the 1980s but is now approaching its final phase.

There are no simple escape routes. The available options include:

- Inflationary – Printing money, lowering interest rates, and attempting to reduce debt burden through inflation

- Deflationary – Suffering a collapse in the economy and financial markets

Historically, governments have overwhelmingly favored inflationary policies. It’s easier and preserves the existing order for a period.

Essentially, pursuing inflationary tactics means deferring the problem down the line—a choice almost always preferred by authorities.

Who Breaks First?

So, who will give in first—Trump or Powell? I suspect it will be Powell.

However, the specific answer is somewhat irrelevant.

Powell is well aware of the growing interest payment issues but strives to preserve the Federal Reserve’s image as an independent and responsible institution.

Therefore, he is likely holding out until a severe crisis, such as a stock market crash, compels him to sharply lower rates to near zero and increase quantitative easing.

Regardless, money printing is already underway. The Fed began purchasing $40 billion in Treasury securities last month.

Meanwhile, President Trump has initiated a QE-style program by instructing government-supported mortgage entities Fannie Mae and Freddie Mac to acquire $200 billion in mortgage bonds aiming to reduce borrowing costs.

So whether or not Trump replaces Powell, significant monetary expansion is inevitable soon. The issue is mainly about control and maintaining appearances.

Powell aims to safeguard the Fed’s reputation and maintain the illusion of prudent currency management. Yet, the reality is quite different.