Silver FAQs

I’ve been receiving messages from friends (and even one adversary) about silver.

Given that silver recently reached $92/oz in the U.S. and surpassed $105 in Shanghai, interest isn’t fading anytime soon.

“Is it too late to buy silver?”

“Should I sell?”

“Are miners a buy here?”

I’m sure many of you have similar questions.

So today, let’s address these points.

Is it Too Late to Buy?

This is one of the most difficult questions to answer.

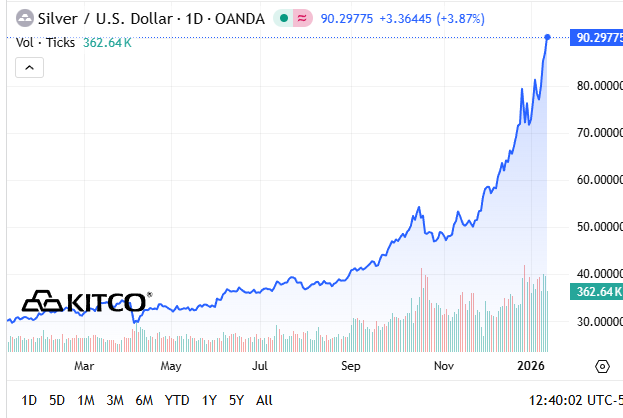

Take a look at the silver price chart over the last year.

Quite the dramatic spike… a classic parabolic surge.

When folks ask if buying silver now is too late, my response is usually probably—at least for short-term investing. I know that’s not a thrilling answer, but it’s what the data suggests.

That said, long-term, I remain one of silver’s biggest advocates. This metal stands out because it serves both industrial uses and monetary purposes, with demand growing strongly on both fronts.

Still, this rapid price jump feels excessive for the moment.

So, I wouldn’t recommend jumping in at these levels. I anticipate a more favorable entry point for silver within the next five months.

That said, if you’re trading with strict stop-loss orders or gradually accumulating silver (dollar-cost-averaging), continuing your purchases is reasonable. Building a position slowly smooths out your average cost. Just don’t go all-in here.

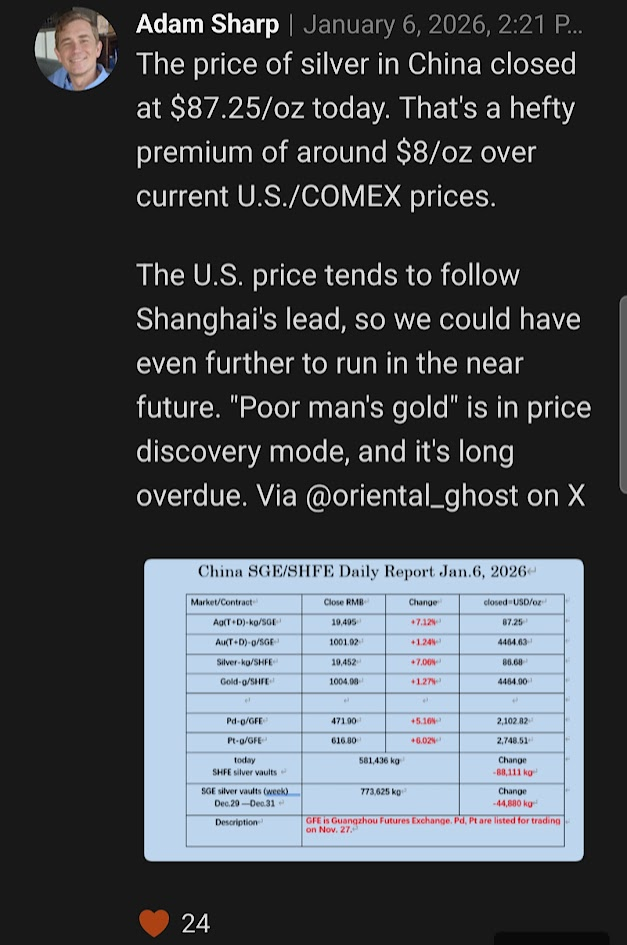

Of course, there’s a chance I’m wrong, and prices shoot straight up to $150. In China, silver’s premium over the U.S. price has swelled to an astonishing $13, with its price already reaching $105. We may have entered a speculative frenzy—or perhaps the paper silver issue is more serious than anticipated.

I first called attention to this “Shanghai premium” on January 6th via the Paradigm App’s Daily Feed, when silver traded near $79 in the U.S. and $87 in China:

(As a side note – Download the Paradigm Press App Here – it’s free. I use it daily and post regularly in the Daily Feed, alongside Jim Rickards, Sean Ring, and our editorial team.)

Is it possible U.S. prices will mirror China’s rise past $100? Absolutely. However, a notable pullback seems likely. That’s the challenge with volatile markets like silver.

When to Sell?

To be clear, I’m not selling any silver or miner shares myself. My plan is to hold for the next 3-5 years.

Still, after such a surge, some holders may feel the urge to liquidate.

Whether selling is appropriate depends on your personal objectives. I explored this topic thoroughly last September in The ‘When to Take Profits’ Problem.

The key factors to consider include:

- Your investment timeframe—how long do you intend to keep the asset?

- Available alternatives—what would you purchase if you sell?

- Tax implications—are your gains short-term or long-term?

If you’re wrestling with this dilemma, I highly recommend revisiting that article. Although silver was at about $46/oz then, the guidance remains relevant.

You’re already familiar with my strategy: hold through the upcoming waves of inflation and monetary expansion for at least 3-5 years. Of course, your plan might vary.

Alternatively, some prefer to lock in partial profits while retaining a stake. That compromise works well for many.

Are Silver Miners a Buy Here?

In the short term, I believe miners offer more upside than silver bullion itself. As we discussed in Silver Miners Are Printing Money, the cash flows to be reported are set to be enormous.

Back in early 2024, many miners operated with a margin of roughly $6/oz. At today’s silver prices, their margins could exceed $70 per ounce.

The leverage to silver’s price is tremendous. Plus, miners also extract a considerable amount of gold, which tends to stabilize their share prices when silver prices dip sharply.

Recently, miner stocks have underperformed the metal itself, suggesting some investors doubt these price levels will last.

However, if silver holds above $70/oz this quarter, miners will reap huge profits. Staying near $90 would be even more remarkable.

Interestingly, I see miners as a potentially safer, higher-reward investment than bullion right now. Our preferred silver miner ETF is SILJ—an easy way to gain broad exposure to this sector.

That said, both silver and miners have surged dramatically in the past year. So exercise caution. I want to avoid anyone getting caught off guard if silver suddenly drops 25% in a single week—always a risk after such a rapid run-up.

Long term, I’m more optimistic than ever about silver’s prospects, but the current price action does make me slightly uneasy.

We’ll continue monitoring silver closely and update readers when attractive buying chances emerge.