$714/oz Silver?!

Today, silver finished trading in Shanghai, China, at $131.31 per ounce.

This is $16 above the U.S. market price.

During this upward trend, China has been at the forefront. As mentioned yesterday, most of the silver demand originates there.

Silver remains largely an industrial metal. Known as the best electrical conductor, it’s vital in electric vehicles, solar energy systems, and advanced military technology.

We’ve already explored the solar aspect extensively, so let’s briefly examine how electric vehicles are rapidly increasing their share of global silver consumption.

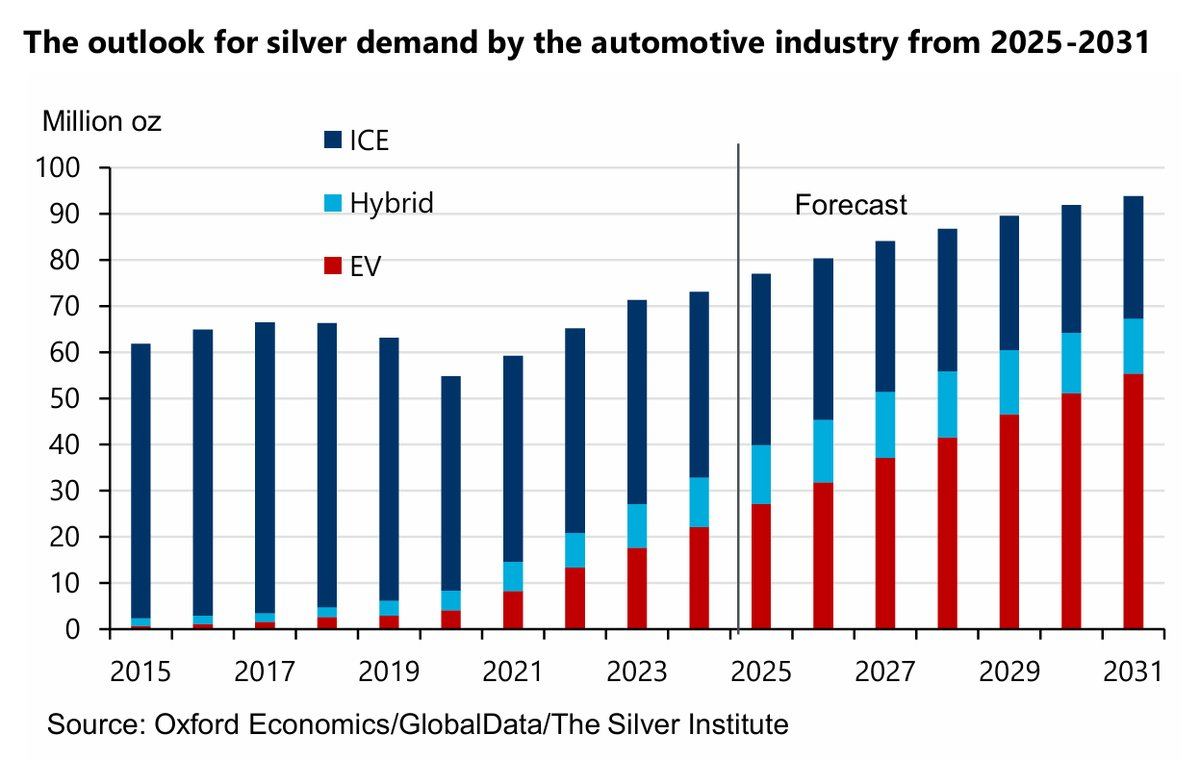

Below is a graph illustrating yearly silver demand from the automotive sector, categorized by vehicle type (ICE = internal combustion engine, EV = electric vehicle, hybrid = combination).

The chart highlights the surging silver demand within auto manufacturing. With EVs and hybrids expanding rapidly, silver use is expected to climb steadily.

A major upcoming demand driver involves South Korea’s Samsung, which has created a solid-state EV battery containing 1 kilogram of pure silver per battery.

Samsung’s innovation reportedly enables a vehicle to travel 600 miles and recharge to 80% capacity in only 9 minutes. Despite silver’s substantial cost, this performance gain could justify the higher metal price.

This represents a significant future increase in silver demand.

Currently, China dominates EV production, battery manufacturing, and solar panel output, holding a large share in these markets. For over a decade, China has been accumulating silver reserves, which are now becoming scarce.

It’s logical that silver prices are climbing first in China before following suit internationally.

Investors Ignite the Fireworks

Over the past year, we’ve highlighted silver’s role in industrial expansion. That story alone proved compelling.

We predicted investors would soon join the buying wave. That moment has arrived.

The market’s tight supply, driven by surging industrial consumption, meant only a small boost from investors was enough to push prices beyond $50/oz and leap past $100.

Following such a sharp rise, a pullback seems likely.

You might know that Jim Rickards has publicly stated silver could reach $200 this year (when it hovered around $65). Over the coming years, the metal’s price could climb even further.

How high could silver’s price soar? Let’s explore some figures…

Gold-to-Silver Ratio

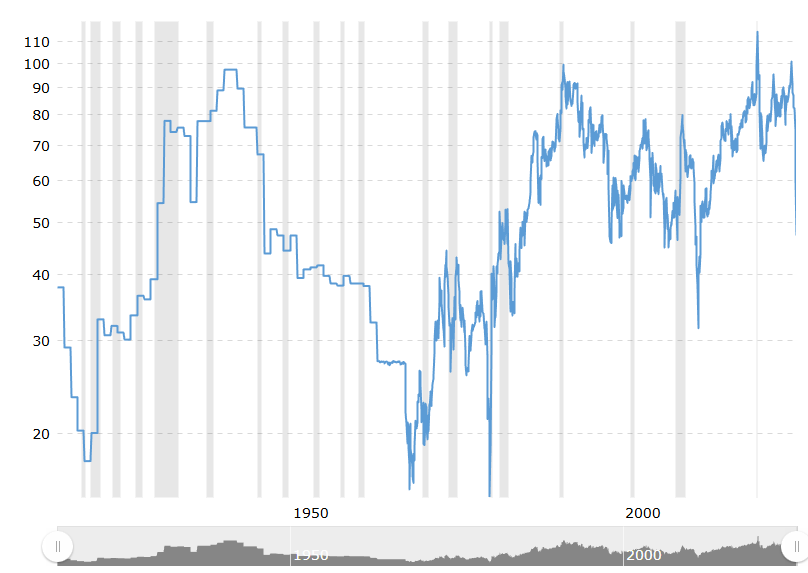

The following chart presents a century-long perspective of the gold-to-silver ratio. Currently, it’s near 47, meaning gold’s value is 47 times that of silver.

Source: Macrotrends

Back in April 2025, the gold/silver ratio exceeded 100! What an opportunity that presented. Yet, I still anticipate silver outperforming in the years ahead.

The ratio dipped to about 32 in 2011. If it returned to that level now, silver would be priced at $165/oz (using a current gold price of $5,300 divided by 32).

However, the chart shows that over the last 100 years, silver has often traded at a ratio noticeably lower than 32.

In 1919, the gold-to-silver ratio was approximately 17, which today would value silver at $311 per ounce.

In 1968, the ratio was roughly 14, translating to $378 silver in today’s terms.

These calculations assume gold remains at $5,300. Should it rise to $10,000 as Jim Rickards predicts, a gold-to-silver ratio of 14 implies silver hitting $714 per ounce.

That figure might sound extreme—even to me—but it’s within the realm of possibility.

Industrial silver demand is soaring and shows no signs of slowing. The metal plays a crucial role in advanced technology.

Meanwhile, growing awareness is emerging that silver is also an excellent store of value. For tens of thousands of years, silver functioned as money. Only in the last 60 years has that link been broken.

Furthermore, I believe nations will start stockpiling silver again (similar to how they once did!). Silver is not only vital for consumer electronics but is also essential in missiles, radars, and critical military equipment.

It’s almost negligent for countries not to maintain silver reserves. Currently, Russia is the only country known to do so.

The phrase “perfect storm” is often overused, yet it truly applies here.

To clarify, I’m not suggesting silver will immediately surge to $200+. The path will have volatility, with dips and sideways movement. Ultimately, inflation or stagflation will return strongly, and at that point, precious metals will be highly sought after.

Gold, silver, and other commodities will become a valuable refuge amid challenging economic conditions.