Google Drops a Nuke in the AI Wars

Since its debut in late 2022, I’ve relied on OpenAI’s ChatGPT nearly every day.

It has served as an invaluable tool for research and even helped generate the images that appear atop these letters.

Now, ChatGPT faces formidable rivalry. Google has unveiled its latest offering, Gemini 3.

Gemini 3 has surged ahead in AI benchmarks, which evaluate model capabilities through rigorous testing.

Additionally, Google’s new image-generating AI, Nano Banana Pro (Google is still horrible at naming products), shows remarkable results.

Consider the image below: the user submitted the photo on the left and asked the AI to solve the math problem in the same handwriting style. The output is shown on the right.

Source: @MinChoi on X

Truly impressive.

Look Ma – No NVIDIA GPUs

It’s hardly unexpected that Google is closing the gap in AI development. After all, they pioneered the transformer technology that underpins today’s AI systems (we discussed this in Google is No Kodak some time ago).

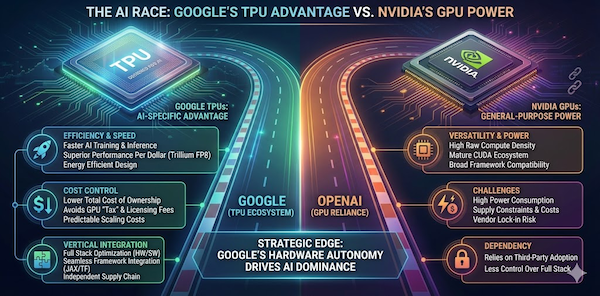

What’s remarkable is their use of in-house AI hardware—no reliance on costly NVIDIA GPUs.

Google manufactures its own AI chips called TPUs, which are more affordable, energy-saving, and tailored specifically for AI workloads.

I asked Nano Banana Pro to generate an infographic outlining Google’s hardware benefits compared to OpenAI:

Source: Gemini (click the link for a larger image and to see the prompt)

Utilizing proprietary chips gives Google a crucial edge in the AI competition—they avoid paying the so-called “NVIDIA tax” that others face.

Reports suggest Google may eventually lease or sell TPUs to other data centers, posing a potential challenge for NVIDIA. However, GPU demand still appears robust for now.

OpenAI Excitement Fades

OpenAI was the pioneer in releasing groundbreaking AI models to the public and continues to lead among paying consumers.

Yet, their latest major version, ChatGPT-5, disappointed many by seeming like a step back from their previous o3 model. Expectations for a significant leap with GPT-5 fell flat.

Anthropic’s Claude models have overtaken OpenAI in enterprise and business sectors.

Meanwhile, Gemini 3 from Google threatens to capture a large share of both consumer and enterprise customers, leveraging Google’s vast reach through search, video, and productivity platforms.

Since OpenAI is privately held, its valuation isn’t publicly traded, but it reportedly soared from $14 billion in 2021 to $500 billion recently in a secondary sale.

If OpenAI were publicly listed, its stock would likely have declined sharply over the last month due to intensifying rivalry.

The closest indicator to OpenAI’s market performance is Softbank, the Japanese investment powerhouse, which has pumped about $30 billion into OpenAI. Notably, Softbank recently sold its $5.4 billion NVIDIA stake to double down on OpenAI.

Softbank’s shares have dropped 30% during the past month.

Softbank founder Masayoshi Son with OpenAI CEO Sam Altman, Source: Bloomberg

I admire Softbank’s Masa, though he has a reputation as a risk-taker. Investing huge sums into OpenAI at this stage and at sky-high valuations (rumored $300 billion in April) raises some doubts. Softbank also invested billions into WeWork near its peak.

Only three weeks ago, rumors swirled of OpenAI pursuing an IPO priced at $1 trillion valuation—but things have shifted rapidly since then.

I’m not ruling OpenAI out yet, but the competitive landscape got significantly tougher. Challenging a giant like Google, which generated over $75 billion in cash flow last year, will be daunting.

Alphabet’s (Google) shares rose 5.5% around midday as investors absorbed this major shift in AI dynamics.

It’s remarkable that, at least for now, Google holds the crown for both the most advanced AI model and highly specialized proprietary hardware.

If I were to place a bet on any American AI company, Google (Alphabet) would be it. I held a sizable GOOGL position for fifteen years, from 2006 to 2021, though I sold too soon in hindsight.

Buying back in seems premature now, and I anticipate opportunities to acquire big tech stocks at notably lower prices within the next couple of years.

While I’m bullish on Google’s AI stance, I can’t recommend purchasing shares at a $3.6 trillion valuation—it’s just too pricey.

The AI race will force major players to pump in massive investments and compete by offering services at minimal or even negative profit margins. This is fantastic for consumers but might negatively affect companies’ short-term earnings.

However, in the event of a tech market downturn, Google will be atop my list to buy.